- Developer

- OneMain Financial

- Version

- 10.19.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

Introducing OneMain Financial: Your Friendly Guide to Smarter Borrowing

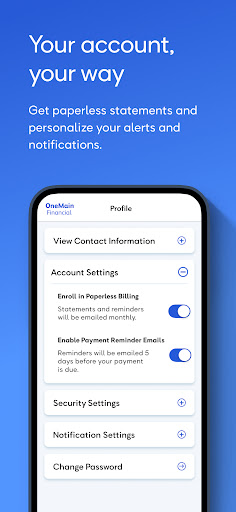

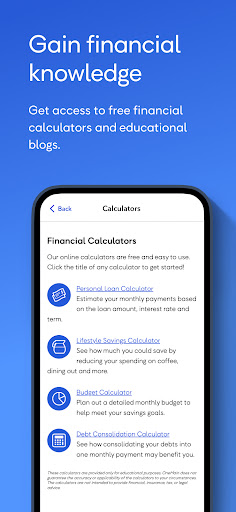

OneMain Financial is a user-friendly mobile application designed to streamline personal loan management and financial services, making borrowing and repayment processes more accessible and transparent for everyday users.

Developed by a Trusted Financial Team

Created by OneMain Financial Corporation, a well-established leader in the consumer finance industry, the app benefits from years of lending expertise, ensuring reliable service and secure handling of sensitive financial data.

Core Features That Stand Out

- Seamless Loan Application and Management: Allows users to apply for, track, and manage personal loans entirely via the app.

- Instant Pre-Qualification: Offers quick pre-qualification checks without affecting credit scores, enabling users to explore options easily.

- Secure Payment and Repayment Options: Facilitates convenient, real-time loan payments with advanced encryption for data security.

- Personalized Financial Guidance: Provides tailored advice and options based on user credit profiles and financial goals.

A Bright Perspective: A User Experience That Feels Like a Personal Banking Assistant

Imagine having a trusted financial companion right in your pocket—OneMain Financial app embodies this vision perfectly. Its intuitive design and friendly interface make managing loans feel less like navigating a maze and more like chatting with a knowledgeable friend. Whether you're making a quick payment or reviewing your loan status, the experience is smooth, straightforward, and surprisingly engaging.

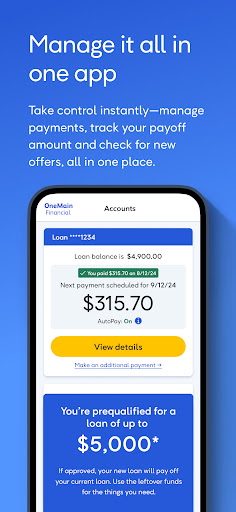

Loan Application and Management: Making Borrowing Feel Less Like a Chore

The app's core strength lies in its streamlined loan application process. Think of it as a streamlined express lane in a busy highway—quick, efficient, and hassle-free. Users can start by pre-qualifying without sinking their credit scores into a whirlpool of inquiries; this transparent process reassures users that they're exploring options within a safe space. Once approved, the dashboard presents all relevant details clearly, including repayment schedules, outstanding balances, and personalized offers. The internal notifications and updates feel like friendly nudges, keeping users informed without overwhelming them.

Enhanced Security and Transaction Experience: The Fort Knox of Personal Finance Apps

Security is paramount in any financial app, and OneMain Financial excels here with its multi-layered encryption and rigorous data protection measures. It's akin to having a high-tech safe—your financial data remains locked tight, accessible only to you. Additionally, the app's transaction process is straightforward yet robust. Real-time updates, instant payment confirmations, and easy-to-follow prompts make repaying loans as effortless as sending a quick message. Thanks to its dedicated security protocols, users can perform sensitive tasks confidently, knowing their information is shielded from risks—a crucial feature in today's digital age.

Unique Selling Points: Why Choose OneMain Financial?

Beyond just being another finance app, OneMain Financial differentiates itself through its personalized approach and emphasis on security. Its pre-qualification feature minimizes uncertainty, helping users understand their borrowing options upfront. The app's design emphasizes clarity and ease of use, focusing on reducing the mental load typically associated with financial management. Compared to competitors, it offers a more personable experience—think of a financial assistant who's always ready to help, rather than a faceless interface. This blend of secure, user-centric design and transparency makes it particularly suitable for individuals new to borrowing or those seeking straightforward financial tools.

Recommendations and Usage Tips

If you're looking for a reliable, easy-to-navigate app to handle personal loans with a focus on security and user comfort, OneMain Financial deserves a spot on your device. It's best suited for users who value transparency, quick application processes, and personalized support. To maximize its benefits, familiarize yourself with the pre-qualification process early on and keep an eye on the notifications for timely updates. However, those seeking complex investment features or multi-account management might find it somewhat limited and could consider supplementary apps for broader financial needs.

In conclusion, OneMain Financial isn't just about managing loans; it aims to demystify the borrowing journey with a friendly, secure, and efficient platform. For anyone looking to take control of their personal finances without the usual fuss, this app offers a trustworthy partnership—like having a financial advisor who's always just a tap away.

Pros

- User-Friendly Interface

- Quick Loan Application Process

- Clear Repayment Scheduling

- In-App Customer Support

- Security Features

Cons

- Limited Financial Tools (impact: Low)

- Geographic Restrictions (impact: Medium)

- Detailed Credit Information Missing (impact: Low)

- Occasional App Loading Delays (impact: Medium)

- Limited Customization Options (impact: Low)

Frequently Asked Questions

How do I log into my OneMain Financial account for the first time?

Download the app, open it, and select 'Sign In.' Enter your username and password, or choose 'Register' if you're a new user, then follow the prompts to complete setup.

What should I do if I forget my login credentials?

On the login page, click 'Forgot Password' or 'Recover Username' and follow the instructions to reset your credentials via email.

How can I view my current loan details in the app?

Sign in, go to the 'Loans' section from the dashboard, then select your loan to see details like balance, payment due date, and repayment schedule.

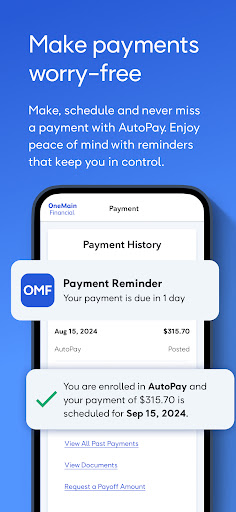

How do I make a loan payment using the app?

Navigate to 'Payments,' select your loan, then choose 'Make Payment.' Enter your payment amount, select the account, and confirm.

What is AutoPay and how do I set it up?

Go to 'Settings' > 'AutoPay,' select your loan, choose your payment date, and confirm your automatic payment setup for seamless monthly payments.

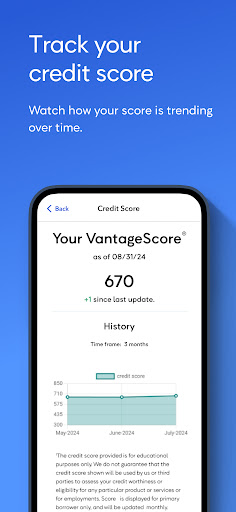

How does the app help me monitor my credit score?

Access the 'Credit Monitoring' feature from the dashboard to view your VantageScore, updated monthly, giving you insights into your credit health.

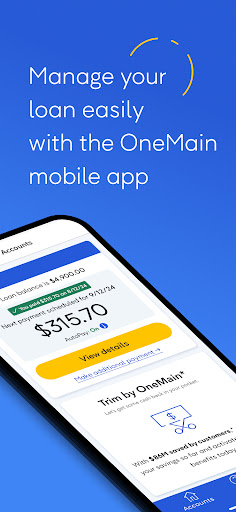

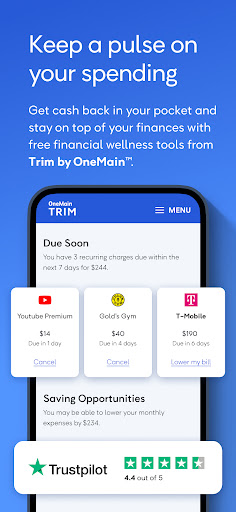

Can I use the app to track my spending and savings?

Yes, link 'Trim by OneMain' in the app under 'Financial Tools' to analyze your expenses and identify ways to save money efficiently.

Is there any cost to use the app or its features?

Most features like loan management and score monitoring are free; check 'Settings' > 'Subscriptions' for any premium services or additional offerings.

How do I update my payment information in the app?

Navigate to 'Settings' > 'Payment Methods,' select your account, then update your bank details or card information and save changes.

What should I do if I experience technical issues or the app crashes?

Try restarting your device, ensure your app is updated, and contact customer support via 'Help' > 'Contact Us' in the app for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4