- Developer

- ONE Finance, Inc.

- Version

- 5.54.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.8

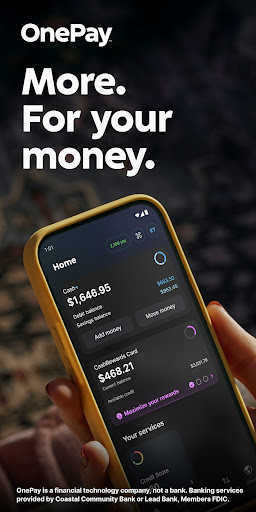

Introducing OnePay – Mobile Banking: Your Digital Wallet Companion

OnePay – Mobile Banking is a streamlined, secure, and user-friendly financial app designed to empower users to manage their banking needs effortlessly on their smartphones. Developed by a dedicated fintech team focused on innovative security and intuitive experience, this app brings banking closer to your fingertips. Its primary features include simplified transaction management, robust security protocols, and personalized financial insights. Targeted at busy professionals, tech-savvy young adults, and anyone seeking a reliable digital banking solution, OnePay aims to deliver seamless financial control anytime, anywhere.

An Engaging Start: Your Journey into Mobile Banking Made Easy

Imagine walking into your bank branch — the buzz of activity, paperwork in hand, waiting for your turn. Now, picture replacing that entire scene with a tap on your phone, where your financial life unfolds smoothly and securely. That's the promise of OnePay. Whether you're paying bills, transferring funds, or checking your account balances, this app turns what used to be tedious into a swift, enjoyable experience. Its thoughtful design and straightforward navigation make banking feel less like a chore and more like a conversation with a trusted friend—simple, familiar, yet impressively sophisticated.

Core Features: Powering Your Financial Flexibility

Intuitive Transaction Management

OnePay stands out with its streamlined transaction interface. Sending money, paying bills, or splitting expenses is as effortless as sending a text. The app employs a simple, step-by-step process that guides users through each action, reducing errors and confusion. Highlighted by instant transaction confirmation and real-time updates, users enjoy a feeling of control and transparency. Unique to OnePay is its ability to schedule recurring payments automatically, freeing you from manual reminders and potential late fees—an especially handy feature for routine expenses like rent or subscriptions.

Fortified Security with Innovative Measures

Security is a cornerstone of any banking app, and OnePay excels with its combination of cutting-edge safeguards. Multi-layer authentication, biometric login options, and real-time fraud detection make unauthorized access nearly impossible. What truly sets OnePay apart is its AI-driven anomaly detection system that proactively monitors transactions and alerts users immediately of suspicious activities. This rapid response mechanism creates a fortress around your funds, offering peace of mind that your money and data are protected with rigorous standards—an essential benefit in today's digital threat landscape.

Personalized Financial Insights and User Experience

Beyond basic banking, OnePay adds a personal touch by offering tailored financial insights based on your spending habits. Graphical representations of your expenses, saving suggestions, and goal tracking turn banking from a mere utility into an empowering financial coach. The user interface is sleek, with bright visuals and logical flow, making navigation intuitive for newcomers. The app's learning curve is gentle; even first-time users quickly become proficient thanks to in-app tutorials and responsive design. Whether you're checking your balance or exploring new financial products, everything feels fluid and responsive—like gliding on ice rather than trudging through mud.

Differentiating Factors: Why OnePay Stands Out

Many finance apps focus on basic functionalities, but OnePay's standout features are its cutting-edge security and transaction experience. Its advanced AI security layer not only protects but also actively monitors suspicious activity, offering a level of confidence unmatched by many peers. Additionally, its user-centric approach—embedding personalized insights and convenience—creates a more engaging and trustworthy banking experience. Compared to standard apps, OnePay's seamless integration of security and usability makes it a top contender for users who value safety without sacrificing speed and simplicity.

Recommendations and Usage Suggestions

If you're seeking a reliable, secure, and easy-to-use mobile banking app, OnePay deserves a serious look. Its strongest suit—the combination of advanced security features and straightforward transaction management—is ideal for those who prioritize safety and efficiency. For users new to mobile banking, the intuitive design minimizes the learning curve, making it accessible for all age groups. However, tech enthusiasts looking for highly customizable features or extensive investment tools might find it somewhat narrow in scope. Overall, I recommend OnePay for daily banking needs, especially for users wanting peace of mind with innovative security measures embedded and a smooth transaction experience. For those willing to explore further, it can be a trusted partner in managing everyday finances securely and effortlessly.

Pros

- User-Friendly Interface

- Secure Transactions

- Fast Fund Transfers

- Comprehensive Service Range

- Regular Updates and Support

Cons

- Occasional App Freezes (impact: Medium)

- Limited Offline Features (impact: Low)

- Intuitive Design Could Improve (impact: Low)

- Notification Delays (impact: Low)

- Limited Multi-Language Support (impact: Low)

Frequently Asked Questions

How do I sign up and create an account on OnePay Mobile Banking?

Download the app, open it, and follow the on-screen registration process. You'll need to verify your identity and link your banking partners during setup.

Is there a minimum balance requirement to start using OnePay?

No minimum balance is required to create an account. You can begin managing funds immediately after registration.

How do I transfer funds between my pockets or to external accounts?

Navigate to Transfers > Select source and destination, enter amount, and confirm. You can do this from the main dashboard or the transfers menu.

What are virtual pockets and how do I set them up?

Go to the Pockets tab, tap 'Create New', name your pocket, and allocate funds. This feature helps organize your savings for specific goals.

How do I enable real-time transaction notifications?

Settings > Notifications > Enable 'Real-Time Transaction Alerts' to receive instant updates on your account activities.

What rewards can I earn with OnePay Rewards and how are they redeemed?

Earn points for eligible transactions. To redeem, go to Rewards > Redeem Points, and choose to convert points into cash deposited into your account.

How do I set up a high-interest savings account on OnePay?

Navigate to Accounts > Savings, select the account, and ensure you meet deposit requirements like direct deposits of $500+ or balance over $5,000 to qualify for higher APY.

Are there any fees for using OnePay Mobile Banking?

OnePay clearly states applicable fees upfront. Most basic transactions are free, but check the fee details in Settings > Fees for specifics.

How do I report and resolve a transaction error or unauthorized activity?

Contact customer support via the Help section in the app or use the 'Report Issue' feature to report your concern and get assistance promptly.

What should I do if I forget my password or can't log in?

Use the 'Forgot Password' option on the login screen, follow verification steps, and reset your password to regain access.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4