- Developer

- ONE Finance, Inc.

- Version

- 10.110.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.8

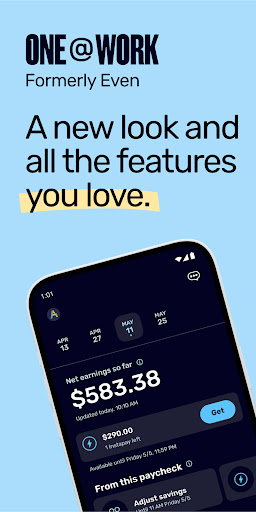

ONE@Work: Elevating Personal Finance Management with Seamless Security and Intuitive Design

In a digital world flooded with finance apps, ONE@Work (formerly Even) stands out as a thoughtfully crafted tool that combines robust security with user-friendly features, helping users stay on top of their financial goals effortlessly. Developed by a dedicated team committed to transparency and user empowerment, this app aims to demystify personal finance through intelligent automation and an elegant interface. Whether you're a busy professional, a student managing a tight budget, or simply someone who wants a clearer picture of their finances, ONE@Work promises a tailored experience that adapts to your needs.

Core Features That Make a Difference

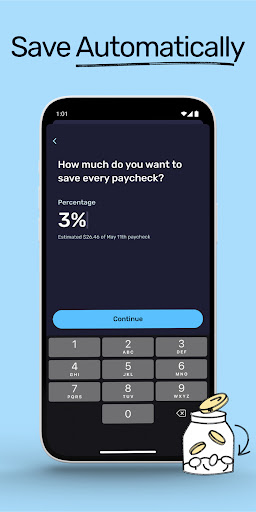

Automated Savings and Budgeting

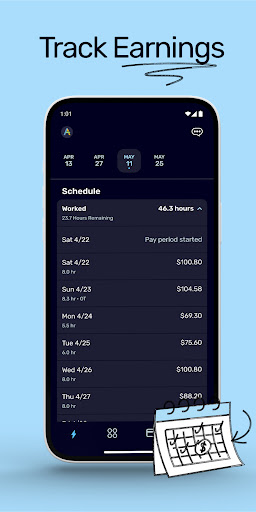

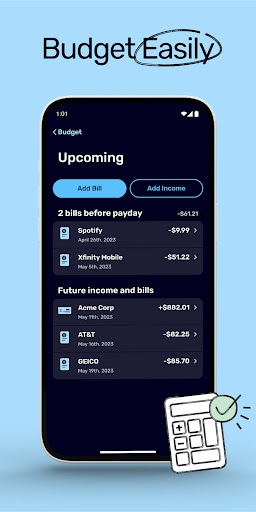

Imagine having a financial assistant that silently watches over your income and expenses, nudging your savings up without requiring constant oversight. ONE@Work's automated savings feature cleverly analyzes your spending patterns and automatically transfers small, manageable amounts into your savings account. This subtle yet effective approach helps users develop a savings habit without feeling overwhelmed. The app also offers customizable budgets, enabling users to allocate funds to various categories with ease, providing a clear roadmap of their financial journey.

Enhanced Account and Fund Security

Security is often the Achilles' heel for finance apps, but ONE@Work raises the bar through multi-layered protection measures. Utilizing bank-grade encryption, biometric authentication, and real-time fraud detection, it ensures that your financial data stays private and protected. What stands out is its proactive security alerts system, which notifies users immediately of suspicious activities or unauthorized access attempts—like having a vigilant guardian watching over your wallet.

Smooth Transaction Experience with Smart Categorization

Picture your transactions being automatically sorted into intuitive categories, turning a jumble of receipts into a neat, insightful dashboard. ONE@Work's smart categorization uses AI to analyze your spending habits and classify transactions accurately, making budgeting and expense tracking significantly less labor-intensive. Plus, the app supports quick transfers between accounts and integrates with your existing financial institutions seamlessly, offering a frictionless transaction experience reminiscent of gliding through an ice rink rather than slogging through mud.

User Experience: Interface and Usability

The visual design of ONE@Work feels like a breath of fresh air—clean, modern, and thoughtfully arranged. The color palette and iconography are calming yet engaging, making navigation a breeze even for first-time users. The app operates with remarkable smoothness; transitions are swift, and responses are instantaneous, providing a feeling of reliability and responsiveness akin to conversing with a trusted friend rather than wrestling with clunky software.

For newcomers, the learning curve is gentle. The onboarding process is guided but unobtrusive, allowing users to familiarize themselves with core features without feeling overwhelmed. Returning users find quick access to key functions from a customizable dashboard, empowering them to manage their finances at any moment. The app's intuitive design minimizes cognitive load, making finance management feel less like a chore and more like a daily habit.

What Sets ONE@Work Apart?

While many finance apps focus solely on tracking expenses or investments, ONE@Work shines with its dual focus on deep security and effortless automation. Its proactive security measures set it apart from competitors that may rely solely on passcodes or basic encryption, offering peace of mind that your data is under vigilant protection. Additionally, its intelligent automation—particularly the automatic savings and smart categorization—reduces manual entry and decision fatigue, making complex financial planning accessible to everyone, regardless of financial literacy level.

Moreover, the app's design supports a more personalized experience. It adapts to your habits, making recommendations based on your spending behavior and goals. This personalized touch, combined with a user interface that feels both sophisticated and approachable, positions ONE@Work as a thoughtful companion in everyday money management, rather than just another generic finance tool.

Recommendation and Use Cases

Based on its security features, ease of use, and innovative automation, I would confidently recommend ONE@Work to users seeking a reliable, comprehensive personal finance app. Its best fit is for individuals who want a tool that simplifies financial tracking without sacrificing security or control. For those tired of manually budgeting or worried about data breaches, this app provides a compelling blend of automation and protection. It's particularly suited for users who prefer an elegant, straightforward interface but still wish to harness the power of smart categorization and automatic savings.

For new users, I suggest starting with the onboarding tutorial to explore its core features and setting realistic financial goals. Experienced users can leverage its automation to streamline everyday transactions and maintain a clear overview of their financial health, making ONE@Work not just a tool but a financial partner you can trust and enjoy working with.

Pros

- Intuitive and user-friendly interface

- Effective task management features

- Strong collaboration tools

- Cross-platform compatibility

- Personal productivity analytics

Cons

- Limited offline functionality (impact: Medium)

- Occasional synchronization delays (impact: Low)

- Basic free version features (impact: Medium)

- Limited customization options (impact: Low)

- Occasional app crashes on older devices (impact: Low)

Frequently Asked Questions

How do I sign up and get started with ONE@Work?

Download the app, follow the on-screen instructions to create an account, and connect your employer to access features like early wage access and savings tools.

Is my personal and financial data secure on ONE@Work?

Yes, the app is powered by FDIC-insured banks like Cross River Bank, uses encryption, and follows strict security protocols to protect your information.

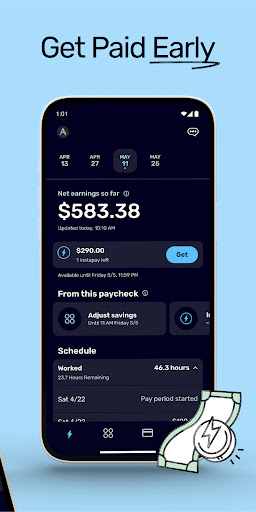

How can I access my earnings early using ONE@Work?

Enable the Instapay feature in the app under ' Wage Access,' then you can request early payment of your earned wages without hidden fees.

Can I set up automatic savings with this app?

Yes, go to 'Savings,' select 'Automatic Savings,' set a percentage or amount, and it will automatically transfer from your paycheck to your savings.

How does the budgeting feature work in ONE@Work?

Navigate to 'Budget,' connect your bank account, and the app will analyze your spending to provide personalized budgets and expense insights.

Are there any fees for using early wage access or savings features?

Most users can enjoy these features without fees; however, specific conditions may apply. Check the app's details or your employer's policies for precise info.

What should I do if the app isn't syncing with my bank account properly?

Try reconnecting your bank in 'Settings > Accounts,' ensure your bank credentials are correct, or contact support if issues persist.

Can I change or cancel my savings or budget goals?

Yes, go to 'Savings' or 'Budget,' select your goal, and choose options to modify or cancel as needed.

Is there a subscription fee for using ONE@Work?

No, the app is provided as an employer benefit and is generally free for employees; check with your employer for any specific charges.

What should I do if I encounter technical issues or errors?

Try updating the app, restart your device, or contact customer support via 'Help > Support' in the app for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4