- Developer

- oportun

- Version

- 4.153.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4

Oportun: Finances Made Simple – A Fresh Take on Budgeting and Financial Management

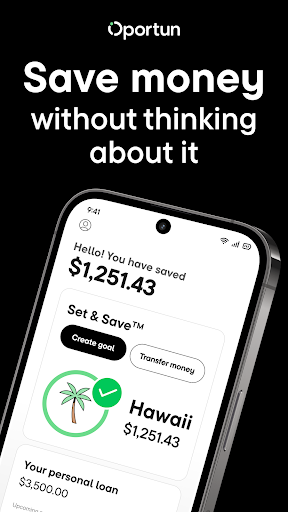

Oportun is a user-friendly financial app designed to streamline personal money management by offering intuitive tools that demystify budgeting, saving, and debt tracking. Built by a dedicated team committed to financial inclusion, it aims to empower everyday users with a clear and straightforward approach to handling their finances—whether they're just starting out or seeking to gain better control over their monetary health.

Key Features That Set Oportun Apart

Among its standout features, Oportun shines with its simplified interface that makes complex financial planning approachable. It also incorporates intelligent transaction categorization and real-time alerts that help users stay on top of their financial activities. Notably, its focus on security and privacy, coupled with an engaging user experience, makes it a compelling choice for those who want practical tools without the clutter.

Clear and Friendly Interface — Navigating Your Finances as a Breeze

From the moment you open Oportun, you'll notice its clean, minimalistic design that feels more like chatting with a trusted friend than grappling with a mountain of numbers. The app uses warm colors and simple icons, guiding users effortlessly through the various sections—be it setting budgets, viewing transactions, or monitoring savings goals. The layout minimizes cognitive load, making financial management feel less intimidating.

Core Functionalities: Simplicity Meets Power

At the heart of Oportun lies its core strength: making financial tasks straightforward. Its budget creation tool allows users to set monthly spending limits with just a few taps and provides visual progress meters that make tracking progress satisfying—think of it as a fitness tracker for your finances. Transaction categorization is semi-automated; the app learns your patterns over time and auto-sorts expenses into categories like groceries, entertainment, or bills. This intelligent automation reduces manual input and helps users better understand where their money goes.

Another notable feature is the real-time notifications system, which sends alerts before overspending or when bills are due—offering just enough nudging without being intrusive. Additionally, Oportun provides simplified debt overview charts, helping users visualize repayment progress and plan future payments effectively. These features collectively ensure users have a comprehensive yet digestible financial snapshot at their fingertips.

User Experience and Differentiators

Using Oportun feels akin to having a friendly financial mentor guiding you through your journey. The app's smooth operation results from optimized coding and a thoughtful user flow, making navigation seamless across devices. The learning curve is gentle; even users with little financial background find the features intuitive and accessible. From a security standpoint, Oportun employs bank-grade encryption and multi-factor authentication, ensuring that personal and financial data are well-guarded—a crucial point for peace of mind.

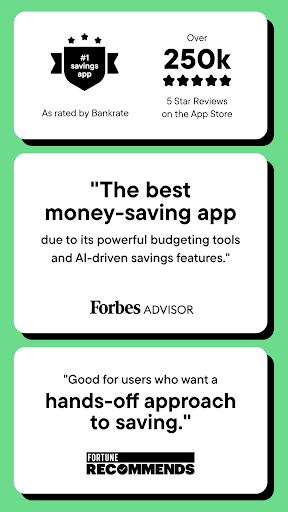

Compared to traditional finance apps that often focus heavily on investment or complex management tools, Oportun's unique advantage lies in its focus on everyday financial health. Its standout features—particularly the automated categorization and friendly budget tracking—differentiates it from competitors like Mint or PocketGuard, which often require more manual input or present data less approachable. Oportun's emphasis on privacy and simplicity, combined with core functionalities designed like a conversation rather than a ledger, makes it especially appealing for users seeking a no-fuss, secure way to manage their money.

Final Verdict and Recommendations

Oportun is a solid choice for individuals who want to gain clearer insight into their finances without wading through complex tools or overwhelming features. Its user-centric design and focus on security make it a trustworthy companion in everyday money management. I recommend it especially for budget-conscious users, beginners, or those prioritizing privacy. If you're looking for an app that feels like a helpful friend—simple, supportive, and secure—Oportun deserves a close look.

While it might not offer extensive investment tracking or advanced financial planning for seasoned professionals, its core strengths lie in making money management approachable and secure. For anyone wanting to get a grip on their finances and build good habits, Oportun is worth trying out—consider it a gentle yet effective step toward financial clarity.

Pros

- User-friendly interface

- Comprehensive financial overview

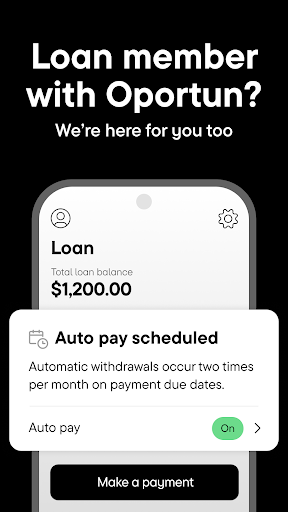

- Loan management and repayment tracking

- Educational financial tips

- Secure data encryption

Cons

- Limited credit-building features (impact: medium)

- Occasional app lag during data sync (impact: low)

- Basic budgeting tools (impact: medium)

- Limited integration with third-party services (impact: high)

- No offline access (impact: low)

Frequently Asked Questions

How do I get started with Oportun to manage my finances?

Download the app, create an account, connect your bank account, and set your savings goals. The app will start analyzing your finances automatically.

Is it free to use Oportun, and what are the costs involved?

Yes, the app offers a 30-day free trial. Afterward, it costs $5/month, which you can manage via Settings > Subscription & Payments.

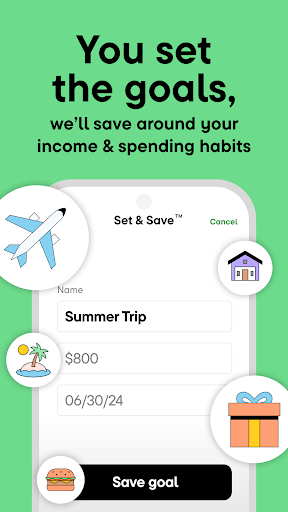

Can I customize my savings goals and plans within the app?

Absolutely. Go to Savings > Goals to set or adjust your goals, and the app will personalize your savings strategy accordingly.

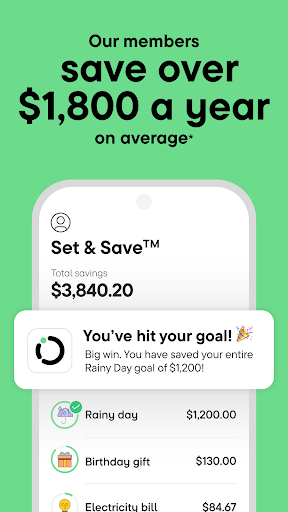

How does Oportun's Set & SaveTM feature automatically save money for me?

Set & SaveTM learns your spending habits and schedule, then transfers small amounts automatically at optimal times, based on your income and expenses.

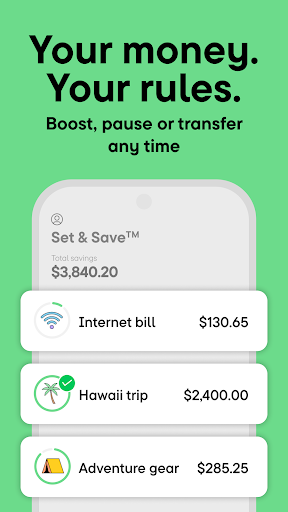

Can I pause or change my automatic savings if I need to?

Yes. Navigate to Savings > Set & SaveTM and toggle or adjust your savings plan as needed for better control.

How can I manage my existing Oportun loan through the app?

If you're an Oportun loan customer, go to Loan Management > My Loans to check balance, make payments, or set autopay, directly from the app.

Is my financial data safe with Oportun?

Yes, the app uses bank-level encryption, and your savings are FDIC insured up to $250,000 for security and peace of mind.

What should I do if the app isn't loading or encountering errors?

Try restarting your device or reinstalling the app. For further help, visit Settings > Help & Support for troubleshooting options.

How do I cancel my subscription if I no longer want to use Oportun?

Go to Settings > Subscription & Payments, select your plan, and follow the prompts to cancel at any time easily.

Are there any extra fees for using premium features or managing loans?

The basic automatic saving features are included in the $5/month fee; additional loan management services are included for members. No hidden charges.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4