- Developer

- On-demand pay and beyond

- Version

- 2.2.5

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

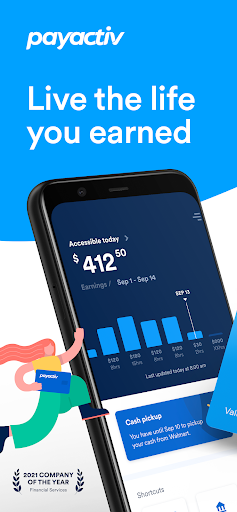

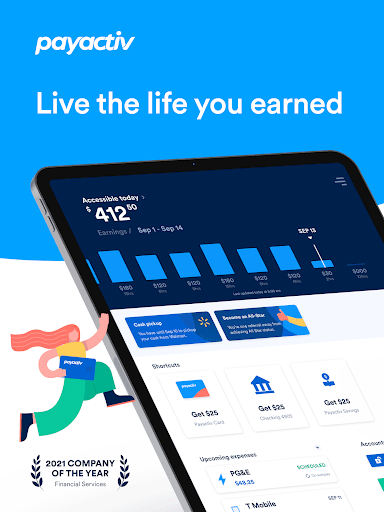

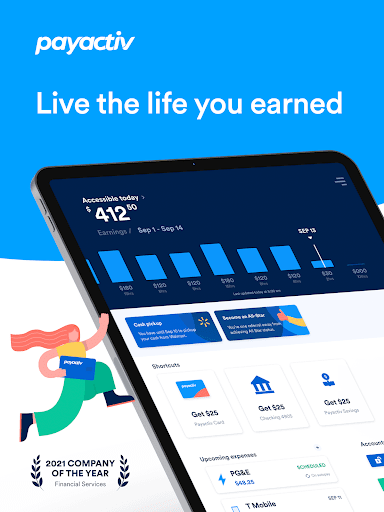

Payactiv: Empowering Employees with Instant Access to Earned Wages

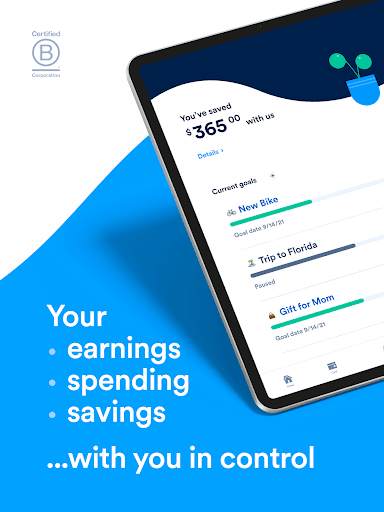

Payactiv is an innovative financial app designed to bridge the gap between paycheck cycles, offering employees quick access to their earned wages and fostering healthier financial habits through comprehensive tools.

Developers and Core Highlights

Developed by Payactiv Inc., a company focused on workplace financial wellness solutions, this app stands out with its user-centric approach and secure infrastructure. Its main features include real-time wage access, financial education tools, and expense monitoring. Designed primarily for hourly and salaried employees seeking financial flexibility, Payactiv aims to reduce payday loan dependency and promote financial literacy among workers.

A Fresh Take on Accessing Your Hard-Earned Money

Imagine this: it's been a tough week, and your rent is due tomorrow — what if your paycheck felt more like a rolling river rather than a static pond? Payactiv steps in much like a financial lifeline, allowing users to tap into their earned wages anytime, without waiting for the traditional pay cycle. This flexibility can be a game-changer for managing unexpected expenses, reducing reliance on costly payday loans, and building a more resilient financial future. The app's straightforward design and seamless experience make this process feel like borrowing from a trusted friend rather than navigating a complicated maze.

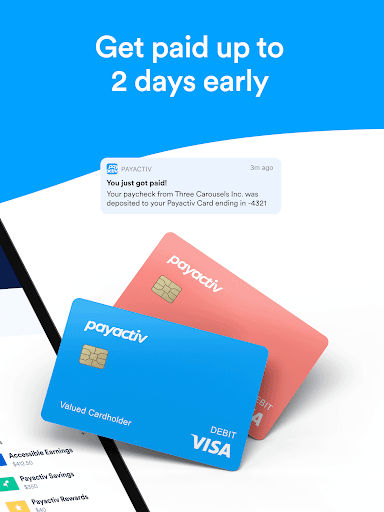

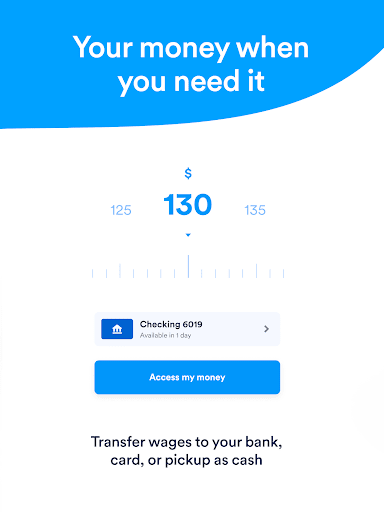

Real-time Wage Access: Your Financial Safety Net

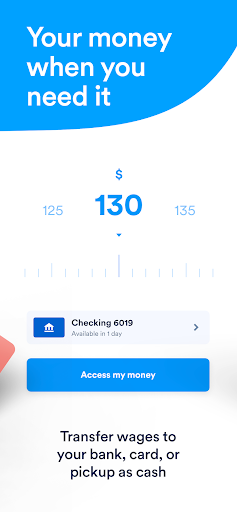

The core feature that sets Payactiv apart is its real-time wage access. Unlike traditional payroll systems that only settle once a month or bi-weekly, Payactiv enables employees to view and access their earned wages on-demand. Picture it as having your paycheck in your pocket, ready for when life throws a curveball. This feature is particularly beneficial for workers facing periodic financial tight spots, providing immediate liquidity without the high costs tied to payday loans or overdraft fees. The process is simple: after linking your employer account, you can request a payout anytime through the app, with funds transferred quickly and securely.

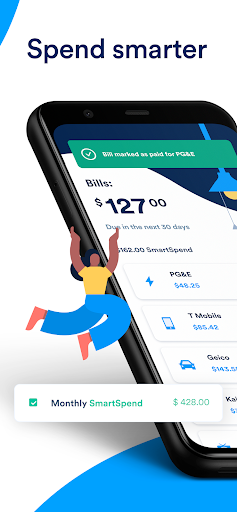

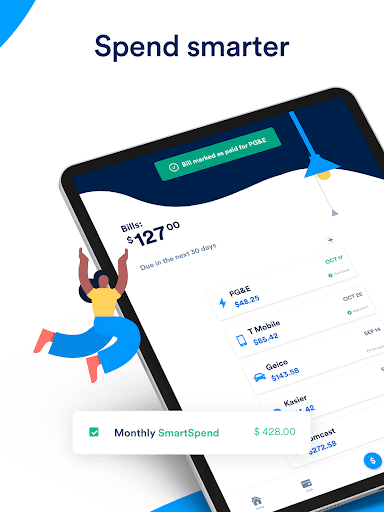

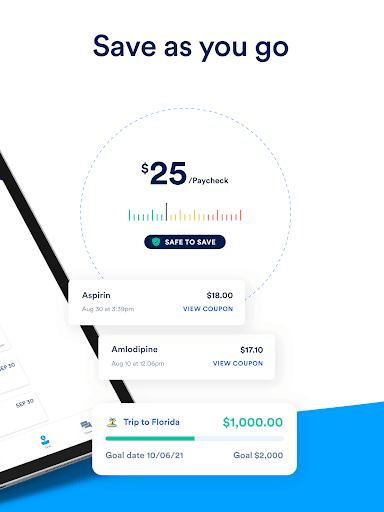

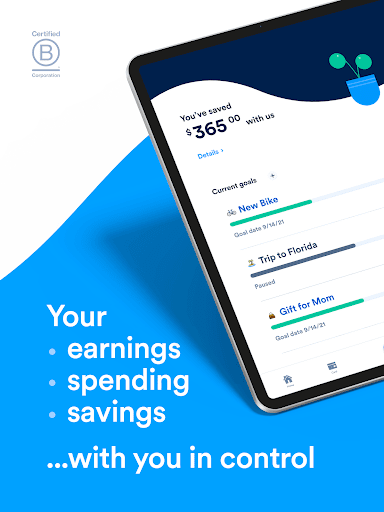

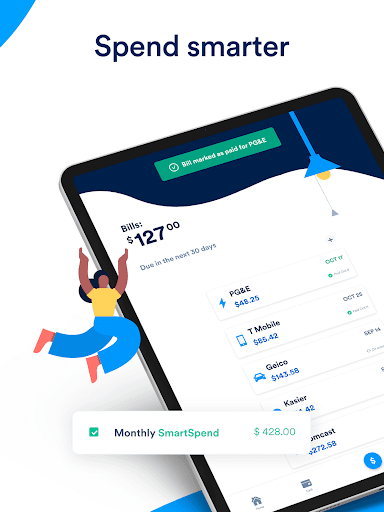

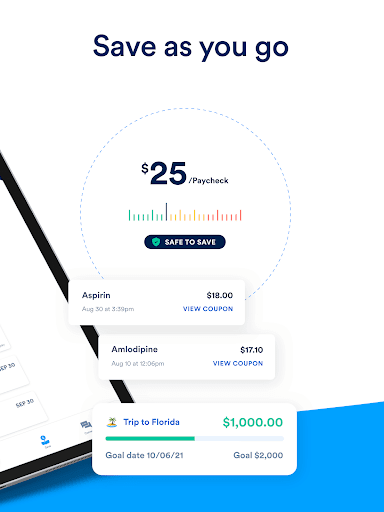

Financial Wellness Tools and Budgeting Made Easy

Beyond wage access, Payactiv offers a suite of financial education tools aimed at empowering users to make smarter decisions. This includes expense tracking, goal setting, and personalized alerts for bill payments. Think of it as a personal financial coach sitting in your pocket, guiding you through budgeting and spending wisely. The interface is clean and intuitive, allowing users to navigate effortlessly, whether they're checking their balance or planning their next financial move. The learning curve is gentle, even for those not tech-savvy, making financial literacy accessible and engaging.

Security and User Experience: Trustworthy and Smooth

When it comes to handling sensitive financial data, security is paramount. Payactiv invests heavily in safeguarding user information through encryption, secure login methods, and compliance with financial regulations. Users report that the app's interface feels familiar, slick, and responsive, akin to flipping through a well-organized booklet. Tasks such as requesting wages, viewing statements, or setting alerts happen seamlessly, with minimal loading times or glitches. Compared to other financial apps, Payactiv's focus on simplicity and reliability ensures a smooth user journey, even during busy hours or on older devices.

What Sets Payactiv Apart? Security and Flexibility as the Cornerstones

While many financial apps offer similar features, Payactiv's pioneering emphasis on transaction experience and account security distinguishes it. Its real-time wage access function is not only convenient but also built with rigorous security protocols, providing peace of mind. Furthermore, its integration with employer payroll systems ensures data accuracy and swift transactions, minimizing errors and delays. This robust security and seamless real-time access create a distinctive edge—users don't just feel safe; they feel empowered, with control over their money when they need it most.

Final Verdict & Recommendations

Overall, Payactiv is a thoughtfully designed app that offers tangible benefits for workers seeking financial flexibility. Its standout feature—instant wage access—is particularly valuable in today's fast-paced economy, providing immediate relief without the high costs typically associated with other quick cash options. The user experience is smooth, with an approachable interface and strong security measures. I would recommend Payactiv to employees who want more control over their finances and are looking for an affordable way to manage unexpected expenses. While it's not a replacement for comprehensive financial planning, it's a practical addition to any worker's financial toolkit.

In sum, Payactiv isn't just another app; it's a reliable partner in managing your earnings smarter, safer, and more flexibly. For anyone tired of waiting for payday, this offers a real, user-friendly solution worth exploring.

Pros

- Early wage access reduces financial stress

- User-friendly interface simplifies transactions

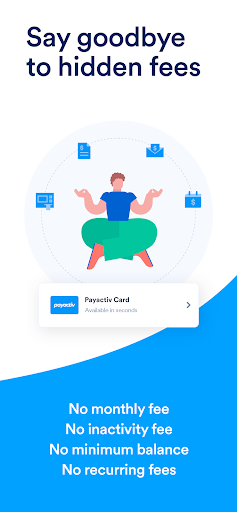

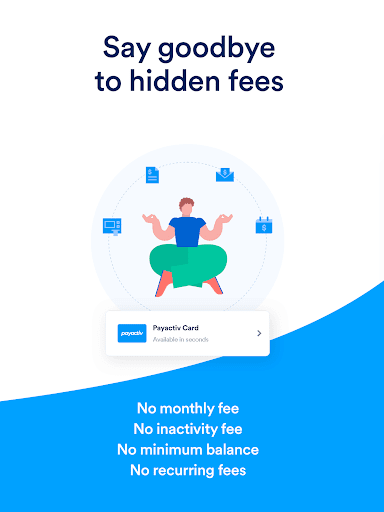

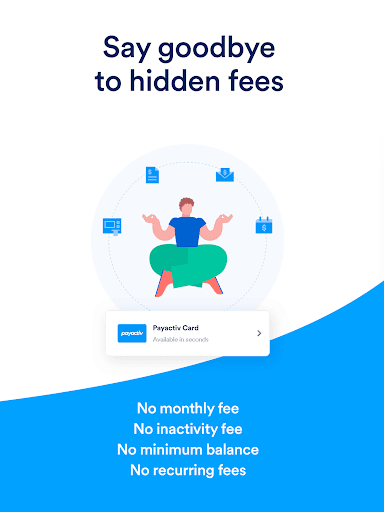

- No interest or hidden fees for basic services

- Integration with payroll systems streamlines operations

- Financial wellness features promote better money management

Cons

- Limited availability of advanced financial products (impact: low)

- Potential delays in transaction processing during high demand (impact: medium)

- Limited cash withdrawal options in certain regions (impact: low)

- Learning curve for new users unfamiliar with digital financial tools (impact: low)

- Some features may incur fees for premium services (impact: medium)

Frequently Asked Questions

How do I start using Payactiv with my employer?

Ask your employer if they participate in Payactiv; then download the app, sign up, and connect your employment details to access features.

Is there a fee to download or register for Payactiv?

No, Payactiv is free to download and register; however, some features like the prepaid card may have associated transaction fees—check app details.

How can I view my available wages or benefits on Payactiv?

Open the app, login, and go to the 'Wages' or 'Balance' section to see your early-available earnings and benefits summary.

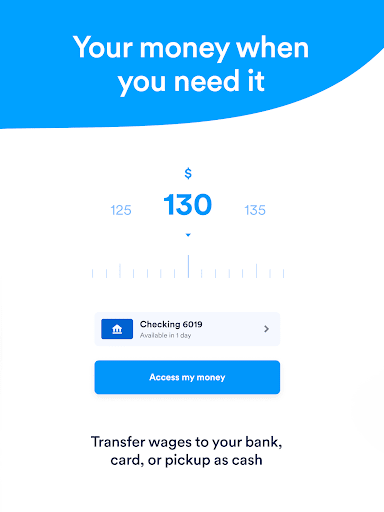

How do I transfer money from Payactiv to my bank account?

Navigate to 'Transfer' or 'Send Funds' in the app, enter your bank info, and confirm the transfer—typically instant or within one business day.

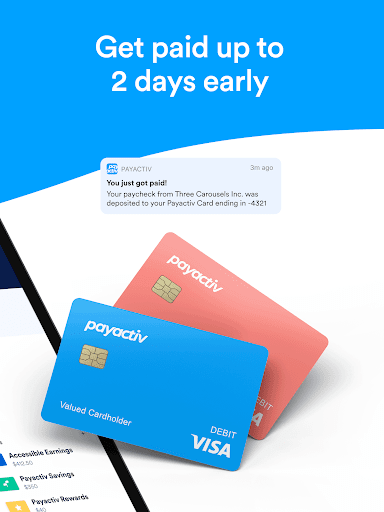

Can I use the Payactiv Visa® Card for shopping and ATM withdrawals?

Yes, activate your card in the app, then use it for contactless payments, online shopping, or surcharge-free ATM cash withdrawals at MoneyPass® ATMs.

How do I set up automatic transfers to savings within the app?

Go to 'Savings' or 'Transfers' in the app, select 'Auto-Transfer,' set your amount and frequency, then confirm to start saving automatically.

Are there any subscription fees or monthly charges for using Payactiv?

No, there are no monthly or hidden subscription fees; most features like wage access and peer transfers are free or low-cost. Check your plan for specifics.

What should I do if my Payactiv card is lost or stolen?

Immediately lock or report your card through the app's 'Card Management' section, then request a replacement to prevent misuse.

Does using Payactiv require a credit check or impact my credit score?

No, Payactiv does not perform a credit check; using the app's features does not affect your credit score—it's a secure financial tool.

Who can I contact if I encounter issues with the app or my account?

Use the in-app 'Help' or 'Support' feature for 24/7 assistance, available in English and Spanish, or call customer service for help.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4