- Developer

- PayPal Mobile

- Version

- 8.97.1

- Content Rating

- Everyone

- Installs

- 0.10B

- Price

- Free

- Ratings

- 4.8

PayPal - Pay, Send, Save: A Seamless Digital Wallet for Every Financial Need

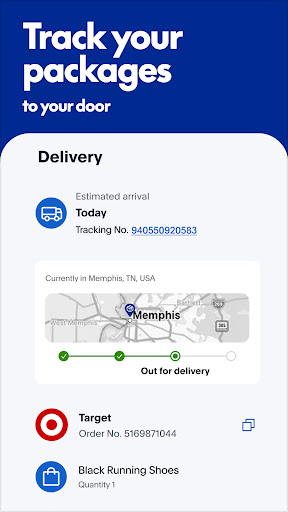

In the rapidly evolving world of digital payments, PayPal consistently aims to simplify users' financial lives through innovative features and a user-friendly interface. The PayPal - Pay, Send, Save app stands out as a comprehensive mobile solution designed to facilitate transactions, manage funds, and promote savings—all within a single, secure platform.

Developed by a Trusted Leader in Fintech

The app is developed by PayPal Holdings, Inc., a global leader in digital payments with decades of experience in creating secure, reliable financial solutions for individuals and businesses alike. Their commitment to innovation and customer trust underpins this app's robust security and seamless operation.

Key Features That Make It Shine

- All-in-One Financial Hub: Combining payment sending, receiving, and savings management in one app, reducing the need for multiple financial tools.

- Enhanced Security Protocols: Advanced encryption, biometric authentication, and fraud detection to safeguard users' funds and personal data.

- International Transactions Made Easy: Support for multiple currencies and quick cross-border payments simplify global financial interactions.

- Innovative Saving Tools: Features like automatic rounding-up and savings goals help users cultivate better financial habits effortlessly.

Engaging and Intuitive User Experience

Imagine holding your finances in the palm of your hand—PayPal's app aims to make this a smooth, engaging experience. While it maintains a straightforward layout, it offers enough customization and visual cues to keep even tech novices comfortable. The interface design employs calming tones and clear icons reminiscent of familiar banking apps, which eases navigation and reduces cognitive load.

The app responds swiftly to user inputs, with minimal lag during transactions or setting up savings. The learning curve is gentle; most users can quickly grasp features such as sending money or setting savings goals. The onboarding process offers concise tutorials, guiding users through essential functions without feeling overwhelming.

Core Functionality Deep Dive

Seamless Sending and Receiving Money

One of the standout features of PayPal - Pay, Send, Save is its streamlined transaction experience. Sending money feels like a casual chat, with options to select contacts directly from your device or email addresses, streamlining peer-to-peer payments. The process is as effortless as passing a note to a friend—remove friction for both sender and recipient. The app also supports scheduled payments and split bills, making it perfect for social groups or small businesses.

Security and Fund Management

Security isn't just an afterthought here; it's foundational. Using multi-layered encryption and biometric verification, the app creates a fortress around your funds. Users can link multiple bank accounts and credit/debit cards, with each transaction thoroughly protected. Unlike some competitors, PayPal's escrow-like capabilities ensure that transactions—especially large or international ones—are safe, reducing the risk of fraud. The ability to instantly freeze or lock accounts adds an extra layer of peace of mind.

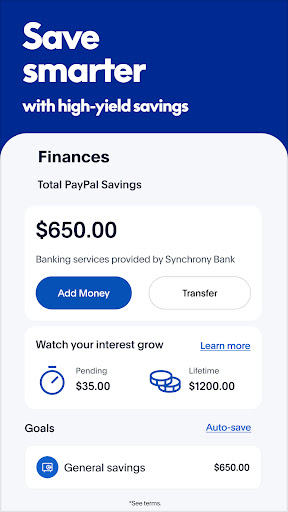

Savings and Financial Growth Tools

What truly distinguishes PayPal - Pay, Send, Save is its proactive approach to savings—transforming a utility app into a personal financial coach. Automated rounding-up features allocate spare change from purchases into a dedicated savings account. Users can set up tailored savings goals, track progress visually, and receive personalized insights. This promotes a habit of saving without feeling like a chore, turning everyday spending into an investment in future ambitions.

Comparison and Final Recommendations

Compared to similar finance apps like Venmo, Cash App, or traditional banking apps, PayPal emphasizes a blend of security, international usability, and integrated savings. Its reputation for trustworthy fund handling and top-tier security protocols create a significant advantage, especially for users engaging in cross-border transactions. The app's interface is clean yet feature-rich, balancing advanced options with intuitive design—a crucial factor for broad user adoption.

For users seeking a reliable, all-in-one digital wallet that bridges international payments, security, and financial growth tools, PayPal - Pay, Send, Save is a compelling choice. Its most distinctive features—robust security measures and the automated savings function—stand out as practical tools that can genuinely enhance everyday financial management.

While beginners may take a little time to explore all features, the app's ease of use and clear guidance make it accessible for most. I recommend it for anyone who values security, convenience, and a holistic approach to personal finance—whether for casual payments, small business needs, or cultivating savings habits.

Pros

- User-friendly interface

- Secure transactions

- Wide acceptance

- Multiple funding options

- Additional features

Cons

- Limited international transfer support (impact: medium)

- Occasional app crashes during large transactions (impact: low)

- Fee structure not fully transparent (impact: medium)

- Limited customer support options (impact: low)

- In-app navigation could be optimized (impact: low)

Frequently Asked Questions

How can I get started with using PayPal for the first time?

Download the app, create a free account, link your bank or card, and verify your identity to start sending, receiving, and managing funds easily.

Is it safe to link my bank account or credit card to PayPal?

Yes, PayPal uses encryption and security measures to protect your financial information. Always enable two-factor authentication for added security in Settings > Security.

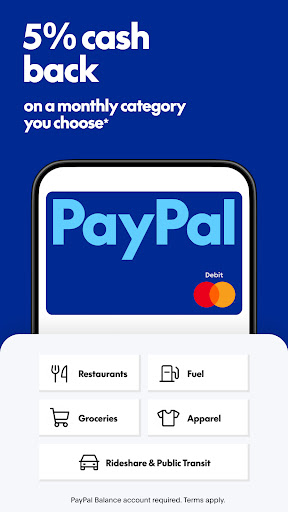

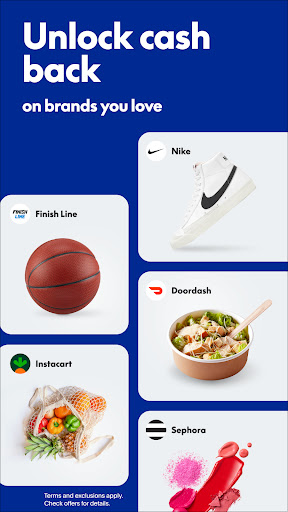

How do I find and use cashback offers in the app?

Open the app, go to the 'Offers' tab, browse available deals, and activate offers before shopping. Cashback will be automatically applied at checkout where applicable.

How can I send money to friends or family via PayPal?

Tap 'Send & Request', enter the recipient's email or phone, amount, then confirm. Sending is free when using an linked bank account or PayPal balance within the US.

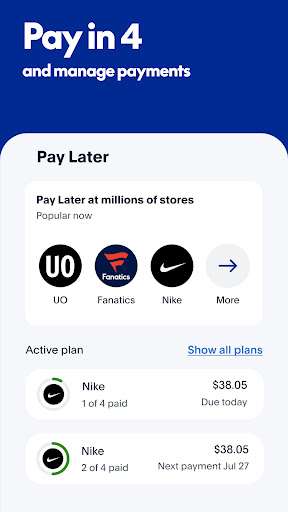

What is Pay in 4 and how do I use it?

Select 'Pay in 4' during checkout at participating stores, and the purchase amount will be split into cuatro interest-free payments. Manage your plans within the app.

How do I apply for a PayPal Debit Mastercard?

In the app, go to 'Cards', select 'Request Card', and follow instructions. No credit check is required, and you can start using your card immediately after approval.

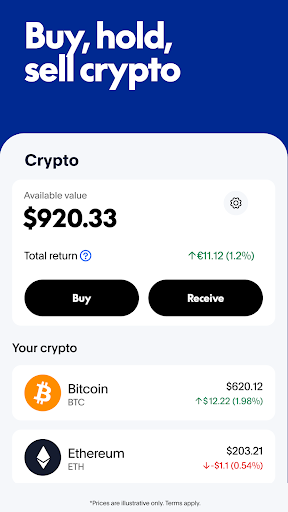

Can I buy and sell cryptocurrencies on this app?

Yes, you can buy, sell, and hold cryptocurrencies like Bitcoin and Ethereum through the 'Crypto' section. Be aware of risks involved and consult financial advice if needed.

How do I set up and manage PayPal Savings within the app?

Navigate to 'Savings', then 'Set Up Savings', and transfer funds from your PayPal balance. Track your savings goals and earned interest directly in the app.

What should I do if I experience transaction issues or errors?

Check your internet connection, verify linked bank accounts, and ensure correct details. Contact PayPal support via the app or website if issues persist.

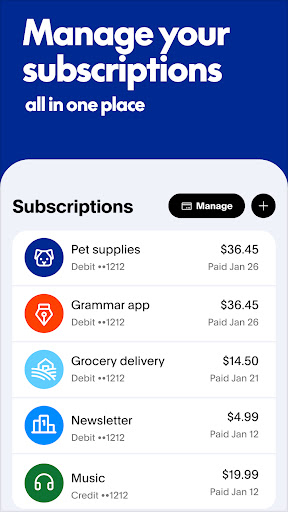

Are there any subscription fees or charges for using PayPal features?

Most basic services like sending money and managing accounts are free. Fees may apply for currency conversions or certain merchant transactions, check the fee section in the app.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4