- Developer

- Perpay Inc.

- Version

- 3.5.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.2

Perpay - Shop and Build Credit: A Fresh Approach to Credit Management

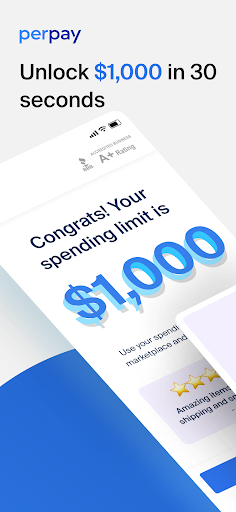

Perpay is a thoughtfully designed financial app that blends credit-building tools with everyday shopping, aiming to empower users to improve their credit scores while making routine purchases. Developed by the innovative team at Perpay Inc., this platform uniquely merges credit education, responsible spending, and security—offering a more holistic financial experience for users eager to take control of their financial future. Its primary strengths include flexible payment options, credit score enhancement features, and a user-centric interface tailored for those new to credit management or seeking a supportive environment to grow their credit health.

Introducing Perpay: Your Friendly Guide in Credit Building

Imagine a financial companion that's as friendly as a trusted friend but as smart as a seasoned financial advisor—that's what Perpay aims to be. Whether you're a first-time credit builder or someone looking to tighten up your financial habits, this app stands out by making credit management approachable and integrated into your daily shopping routines. It's like having a personal coach guiding you through the sometimes murky waters of credit, helping you paddle along with confidence and clarity.

Core Functionality: Where Perpay Truly Shines

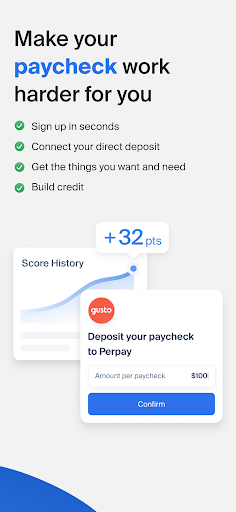

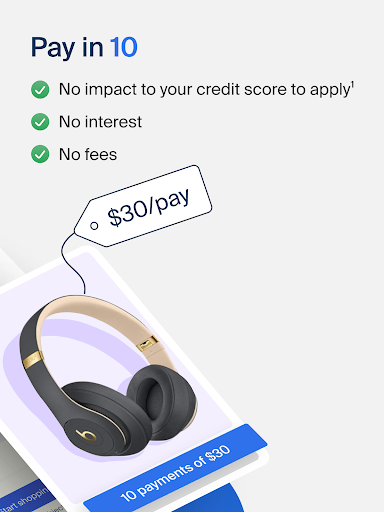

1. Flexible, Transparent Credit Building

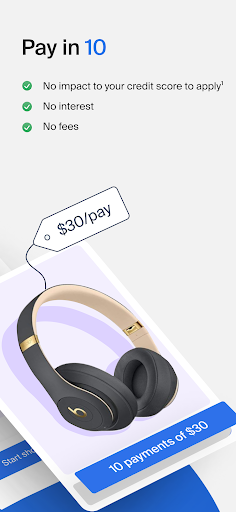

One of Perpay's most striking features is its ability to turn everyday shopping into a credit-building activity. Users can purchase a variety of items—from electronics to apparel—and pay over time through manageable installments. This system not only provides a flexible payment schedule that fits into various budgets but also reports the timely payments directly to credit bureaus. This means you're gradually boosting your credit score without the pressure of high-interest loans or complicated credit cards. It's akin to planting seeds with each purchase, gradually cultivating a healthier credit profile with every responsible payment.

2. Seamless and Secure Transaction Experience

Perpay's transaction workflow is as smooth as silk. The app's interface is clean, intuitive, and visually engaging, guiding users effortlessly from browsing to checkout. Payments are processed securely, with strong encryption methods ensuring that your financial data remains protected. Unlike some finance apps that bombard you with confusing menus or lengthy procedures, Perpay simplifies the entire process, almost like having a concierge manage your shopping and payments in the background. This focus on security and ease of use reassures users, especially those wary of online financial risks.

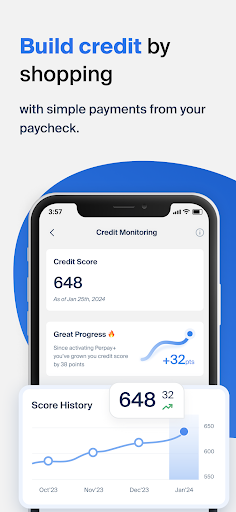

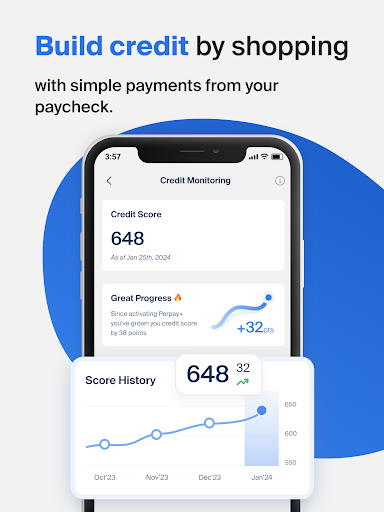

3. Educational and Credit Monitoring Tools

Beyond just shopping, Perpay doubles as a personal financial coach. It provides insights into your credit health, showing how your payments influence your score over time. Visual dashboards break down your credit progress into simple, digestible graphics, demystifying credit scoring for users. The app also offers tips and reminders, turning “building credit” from a daunting task into an engaging, empowering journey. This distinctive combination of functionality and education makes Perpay not just a transactional platform but a holistic aid to financial literacy.

User Experience: Friendly and Intuitive, Yet Sophisticated

From the moment you open Perpay, you're greeted with a palette of inviting colors and straightforward navigation—much like entering a well-organized, friendly workspace. The interface design prioritizes simplicity, reducing potential anxiety for those unfamiliar with complex finance apps. The entire operation feels fluid; swipes and taps respond instantly, creating a seamless experience akin to flipping through a favorite magazine rather than wrestling with a complicated machine. The learning curve is gentle, with onboarding tips that allow even beginners to quickly grasp the app's core concepts without feeling overwhelmed. Compared to traditional credit management apps that often feel tech-heavy or intimidating, Perpay's approachable design is a significant advantage, especially for novice users.

Highlighting Unique Strengths in a Crowded Market

What sets Perpay apart from other financial apps? Its dual focus on *real-world shopping and credit improvement* is a core differentiator. Unlike typical credit-building apps that are purely informational or require dedicated credit cards, Perpay integrates these goals directly into daily spending habits. Additionally, the platform's commitment to security—through bank-level encryption and continuous monitoring—ensures that users' data remains protected at every step. It's akin to having a fortified vault for your financial information, giving users peace of mind.

Final Thoughts and Recommendations

Overall, Perpay offers a compelling, user-friendly alternative for those seeking to enhance their credit profile without the stress associated with traditional credit-building methods. Its standout features—the seamless integration of shopping and credit, combined with transparent, secure processes—make it especially suitable for beginners or those who prefer a gentle, supportive approach to financial growth. For anyone looking to start a credit journey that's both practical and educational, Perpay deserves serious consideration. While it may not replace complex financial tools for advanced users, its emphasis on simplicity, security, and education makes it a trustworthy companion for many—like a helpful friend guiding you step-by-step toward better credit health.

Pros

- Builds credit history with flexible payment options

- Easy-to-use interface for seamless shopping and credit management

- Offers educational resources to help users understand credit building

- No traditional credit check required to get started

- Wide range of products available for purchase and installment plans

Cons

- Limited credit reporting agencies currently supported (impact: medium)

- Potential for late fees if payments are missed (impact: high)

- Interest rates can be higher compared to traditional credit options (impact: medium)

- Limited availability of customer service channels (impact: low)

- Some users may find the installment plans restrictive (impact: low)

Frequently Asked Questions

How do I get started with Perpay and set up my account?

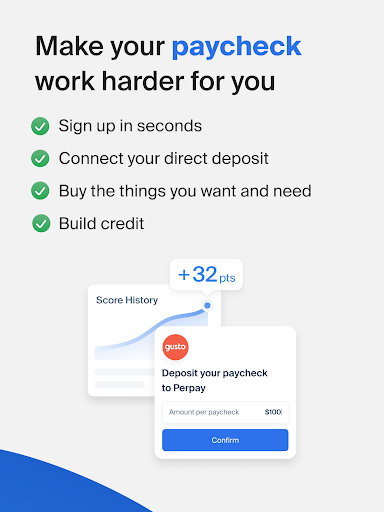

Download the app, sign up with your email or phone, and follow the onboarding steps. No hard credit check is required, and you can connect your paycheck for automatic deductions.

Can I shop for items without impacting my credit score?

Yes, you can shop using Perpay without a hard credit check during sign-up. Payments made through Perpay+. Reporting to credit bureaus helps build your credit over time.

How does the Perpay+ credit reporting work?

Enable Perpay+ in Settings > Credit Building. Your on-time payments will be reported to all three credit bureaus to help improve your credit history.

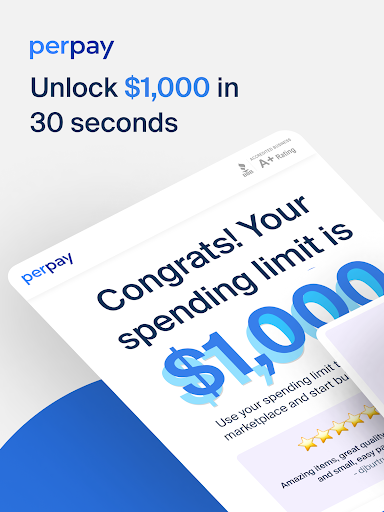

What types of products can I purchase on the Perpay marketplace?

You can shop for electronics, home goods, apparel, and more. The marketplace offers top brands with flexible payment plans up to $1,000.

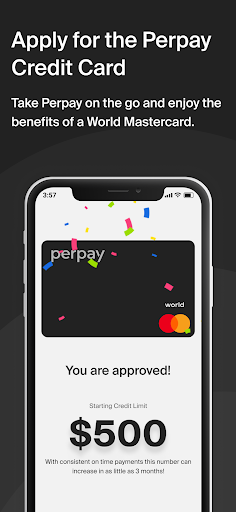

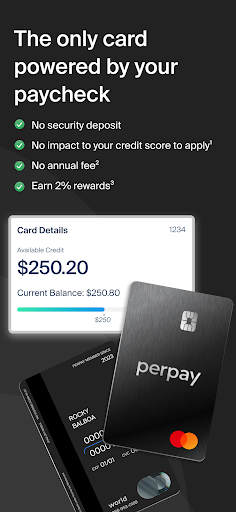

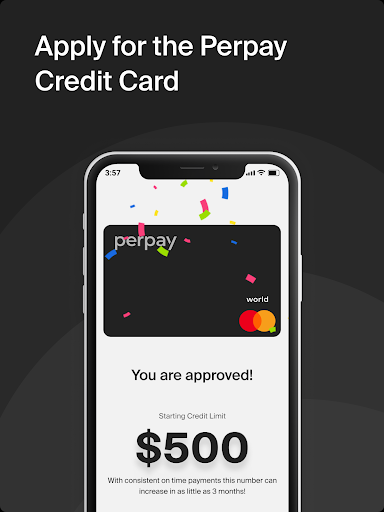

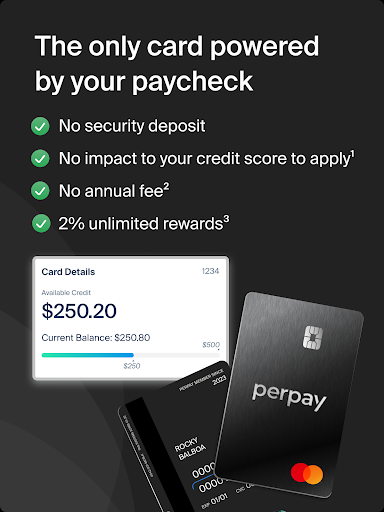

How can I apply for the Perpay Credit Card and what are the benefits?

Apply in the app via 'Get the Credit Card' option, available in Accounts. The card offers a $1,000 limit, 2% rewards, no security deposit, and no impact on your credit score.

Are there any fees or interest charges for shopping on Perpay?

No, Perpay offers interest-free payments with no fees for marketplace purchases. There's a monthly $9 servicing fee for the credit card, but no additional interest or hidden charges.

How do I make payments and track my purchases on Perpay?

Payments are deducted automatically from your paycheck if linked. You can also view and manage purchases and payments within the app under 'My Orders' or 'Payment History.'

What should I do if I experience technical issues with the app?

Try restarting the app, check for updates, or reinstall. For further support, contact Perpay customer service via the app's Help section or visit the support website.

Can I change my payment plan or payment date after making a purchase?

Yes, you can modify your payment plan or due date in Settings > Payment Settings. Note that changes may take some time to process.

Is there a limit to how much I can shop or build my credit with Perpay?

Yes, shopping is limited to $1,000 per purchase or overall limit, and the credit card also has a $1,000 credit line. Limits help manage your financial risk and growth.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4