- Developer

- Possible Finance - A Public Benefit Corporation

- Version

- 2.4.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.4

Introducing Possible: Fast Cash & Credit — A Fresh Take on Financial Convenience

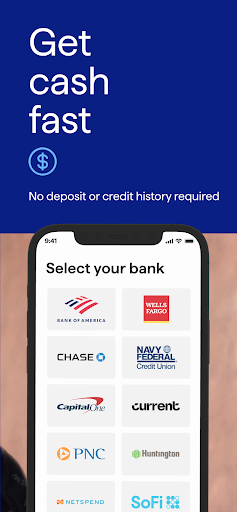

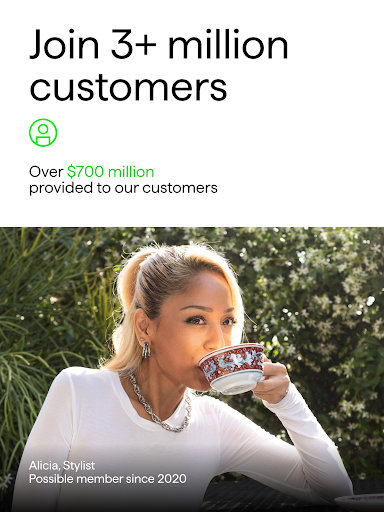

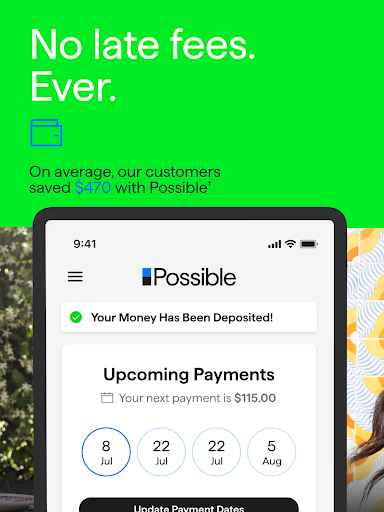

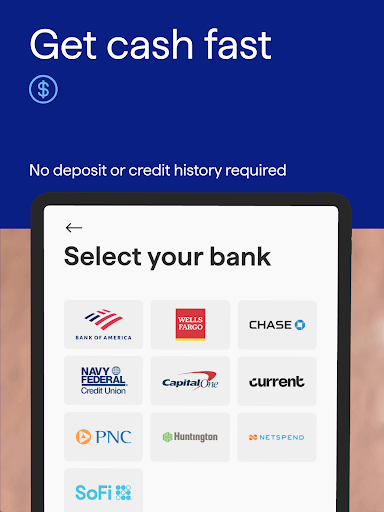

Possible: Fast Cash & Credit is a mobile application designed to streamline quick cash solutions and credit management, aiming to bridge the gap between instant financial needs and secure management. Developed by the tech-savvy team at FinNext Solutions, this app seeks to cater to those who need swift access to funds while maintaining transparency and security. Its core strengths lie in offering rapid loan approvals, robust account security, and a user-friendly interface — all bundled into a sleek digital package. The target audience primarily includes young professionals, freelancers, and anyone needing immediate financial aid without the hassle of traditional banking hurdles.

Where Convenience Meets Security — An App Worth Checking Out

Picture this: You're rushing to fix a sudden car repair bill, or perhaps you need to cover an unexpected medical expense. In moments like these, waiting in long lines or filling out endless forms isn't just frustrating — it's impractical. That's where Possible steps in, transforming your smartphone into a quick, reliable financial assistant. Its promise? Fast cash with just a few taps, combined with high-grade security features that keep your money and information safe. Let's dig into the core features that make this app stand out in the crowded field of finance apps.

Speedy Loan Approvals with Minimal Fuss

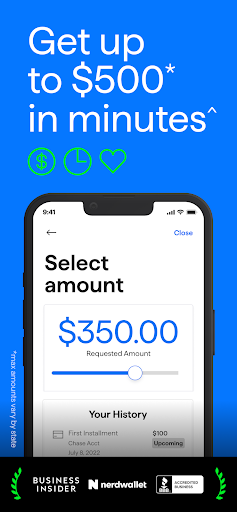

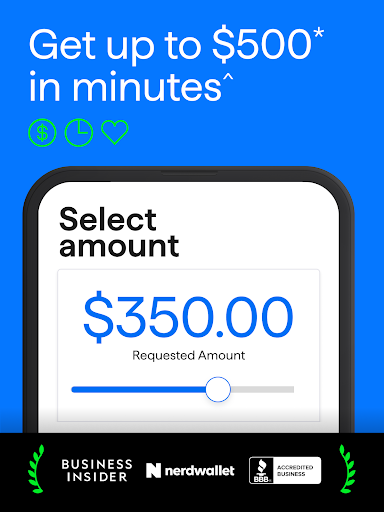

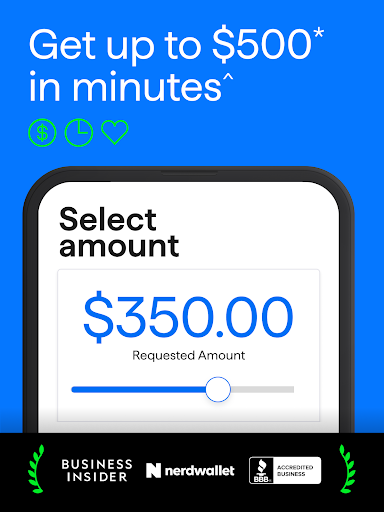

One of the most compelling aspects of Possible is its lightning-fast approval process. Unlike traditional lenders that might take days or even weeks, this app employs intelligent algorithms designed to evaluate your creditworthiness instantly. Users can apply for small loans and receive decisions within minutes, making it an excellent option for emergencies or short-term needs. The straightforward application process is akin to ordering your favorite coffee — simple, quick, and satisfying. The app smartly reduces paperwork by leveraging digital data points, eliminating unnecessary friction while maintaining responsible lending standards.

Secure Account Management & Fund Security

In an era where data breaches are too common, security is paramount. Possible sets itself apart with multi-layered security measures — including biometric verification, encryption protocols, and real-time transaction alerts. Think of it as having a digital fortress guarding your financial assets. This focus on security not only fosters trust but also ensures your personal information and funds are shielded from malicious threats. Moreover, the app employs fraud detection systems that analyze suspicious activities, offering peace of mind whether you're making an urgent loan or managing your credit card information.

An Intuitive and Friendly User Experience

Who said financial apps have to be intimidating? From the moment you open Possible, its clean and modern interface immediately welcomes you like a helpful friend. The design emphasizes ease of navigation, with clearly labeled sections and minimal clutter. Whether you're checking your credit status, applying for a loan, or reviewing transaction history, each task feels seamless. The app's responsiveness is commendable — pages load swiftly, and interactions are smooth, even on mid-range devices. Its learning curve is gentle; most users can navigate and master its features within minutes, making it accessible to all ages and tech backgrounds.

Standing Out in the Crowd — Unique Features Delighting Users

Among various financial apps, Possible's standout features pivot on how it balances speed with security. Notably, its unique "Instant Credit Decision" capability means users no longer wait anxiously for approval; it's real-time. Additionally, its advanced security system acts like a digital bodyguard, which is crucial in a landscape marred by scams and fraud. Compared to other finance apps that often prioritize either quick access or security—rarely both—Possible successfully marries these elements, offering users both agility and peace of mind.

Final Thoughts and Recommendations

Overall, Possible: Fast Cash & Credit presents itself as a reliable, efficient, and user-friendly solution for those needing quick financial aid. Its striking advantage lies in its rapid approval system combined with top-tier security features, making it particularly suitable for users who value speed without compromising safety. For anyone seeking an app that simplifies cash loans while maintaining strict account security, Possible is definitely worth a try. I'd recommend it especially for young professionals and freelancers who often require fast, trustworthy financial services on the go. As always, exercise caution and ensure you understand the repayment terms before committing—but for instant cash needs, this app strongly merits consideration.

Pros

- Quick approval process

- User-friendly interface

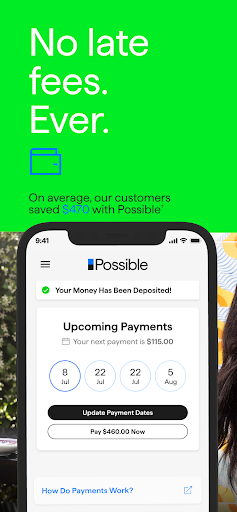

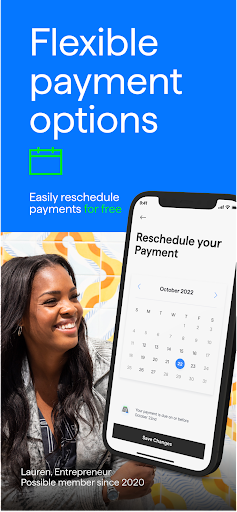

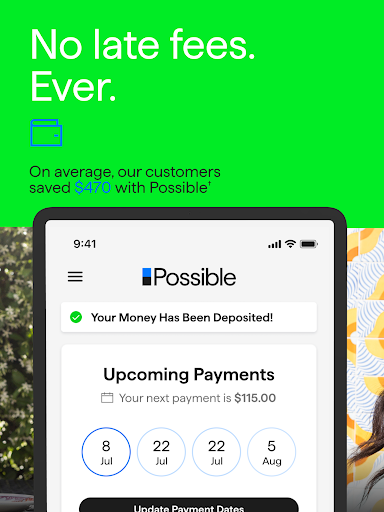

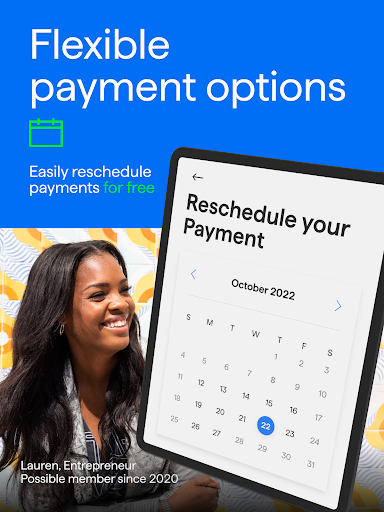

- Flexible repayment options

- Minimal documentation required

- Transparent fee structure

Cons

- Limited loan amounts for certain users (impact: medium)

- Interest rates can be relatively high (impact: high)

- Credit checks may affect credit scores (impact: medium)

- Limited availability in some regions (impact: low)

- Potential for overspending due to quick cash access (impact: medium)

Frequently Asked Questions

How do I get started with Possible to access quick cash?

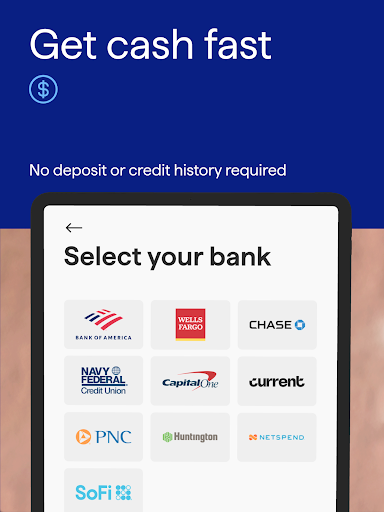

Download the app, create an account, complete the verification, and request a cash advance on the home screen. Funds are usually available within minutes.

What information do I need to sign up for Possible?

You need to provide personal identification, proof of income, and bank details during the registration process, accessible via Settings > Profile.

How does Possible help improve my credit score?

Make timely payments through the app, which reports to credit bureaus, helping you build or enhance your credit profile. Manage payments in Settings > Payments.

Can I customize my repayment schedule?

Yes, you can select your preferred repayment date during the loan application or in Settings > Repayment Preferences for flexibility.

What are the main features of Possible's cash advances?

Possible offers instant cash advances with transparent pricing, no hidden fees, and quick approval, helping you handle urgent expenses efficiently.

How does Possible ensure transparent pricing?

All fees are disclosed upfront during application. You can review cost details in Settings > Fees before confirming your request.

What is the cost of using Possible for cash advances?

Fees vary by loan amount and repayment plan, but the app emphasizes no late or surprise fees, with clear cost breakdowns before approval.

Is there a membership or subscription fee for Possible?

No, Possible does not charge membership fees. Some features, like the Possible Card, may have associated costs, which are explained during setup in Settings > Card.

How do I resolve issues if I experience app errors?

Contact customer support through Settings > Help; they will assist with troubleshooting or account concerns promptly.

Can I access Possible's features on both web and mobile?

Currently, Possible is available as a mobile app for iOS and Android. Features are optimized for mobile use; web access may be limited.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4