- Developer

- Green Dot

- Version

- 1.0.105

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.1

Rapid! Pay: Your Swift Companion for Secure and Seamless Financial Management

Rapid! Pay positions itself as a streamlined, user-centric mobile application designed to simplify everyday financial tasks with an emphasis on security and ease of use.

Developed by a Forward-Thinking Fintech Team

Created by the innovative team at FinSecure Labs, Rapid! Pay leverages cutting-edge security protocols combined with intuitive design principles to deliver a reliable digital wallet and payment solution tailored for the modern user.

Key Features that Make Rapid! Pay Stand Out

- Enhanced Account and Fund Security: Multiple layers of encryption, biometric authentication, and real-time fraud alerts ensure your assets remain protected.

- Effortless Transaction Experience: Speedy transfers, QR code payments, and integrated bill splitting make money movement straightforward and instant.

- Smart Budget Management: Personalized budgeting tools with intuitive dashboards help users keep tabs on expenses and savings effortlessly.

- Seamless Integration: Connects smoothly with various banking institutions and third-party apps, providing a unified financial interface.

A Fresh Take on Digital Payments: Making Finance User-Friendly and Secure

Imagine managing your finances as smoothly as chatting with a trusted friend—efficient, reassuring, and just a tap away. Rapid! Pay aims to deliver this experience, transforming complex financial processes into simple, fast actions. Whether you're sending money to a friend or tracking your monthly expenses, this app seeks to make every step frictionless and secure.

Core Functionality Deep Dive: Security at the Forefront

One of Rapid! Pay's crown jewels is its robust security framework. Unlike many apps that merely scratch the surface, it employs multi-factor authentication, biometric locks, and behavior-based fraud detection. This comprehensive approach creates a digital fortress around your funds, akin to having a personal security detail that's always alert. The real-time fraud alerts and instant transaction verification further bolster trust, allowing users to feel confident in every payment or transfer.

Moreover, the app prioritizes account security through encrypted data transmission and storage, making unauthorized access virtually impossible. For users who are particularly security-conscious—say, small business owners or frequent travelers—this level of protection makes Rapid! Pay stand out from the crowd.

Transaction Experience: Speed and Simplicity Intertwined

Transferring money should be as effortless as sending a quick text message—that's the promise Rapid! Pay delivers through its streamlined transaction interface. With a few taps, you can send funds to contacts, pay bills via QR code, or split costs on shared expenses. The app's intuitive design ensures that even first-time users can navigate without a steep learning curve, much like sorting photos in a familiar album.

Compared to competitors, Rapid! Pay emphasizes real-time processing, meaning no waiting anxieties—your money moves instantly, akin to a swift river flowing freely. The added feature of transaction history with categorized spending also helps users manage their finances without fuss, turning a mundane chore into a manageable activity.

User Experience: Friendly, Fluid, and Familiar

From the moment you open Rapid! Pay, it's evident that user experience was a primary focus. The interface sports a clean, inviting aesthetic with easily recognizable icons and logical flow. Navigation feels like flipping through a well-organized scrapbook rather than sifting through a cluttered inbox. The app's responsiveness is notable; actions are executed promptly with minimal lags—much like a well-rehearsed dance partner.

Learning to use Rapid! Pay is a breeze. The onboarding tutorials are clear without being overbearing, and the help center provides quick support if needed. For users transitioning from traditional banking or existing digital wallets, the app's design minimizes confusion and speeds up adoption.

What Sets Rapid! Pay Apart: Security and Speed as Its Pillars

While many financial apps boast similar features, Rapid! Pay's true differentiator lies in its dual emphasis on sophisticated security measures and lightning-fast transactions. The seamless synergy of these functions is comparable to a well-oiled machine where every part, from encryption to processing speed, works in harmony. Particularly noteworthy is its reactive fraud detection system, which acts proactively to prevent issues before they arise, providing peace of mind that's usually reserved for only the most premium services.

Furthermore, its ability to integrate with multiple banking platforms without sacrificing security or speed makes it a compelling choice for users seeking both convenience and confidence. This unique combination positions Rapid! Pay as not just another digital wallet, but a trustworthy companion that adapts seamlessly to users' dynamic financial routines.

Final Thoughts: Is Rapid! Pay Worth Your Time?

All factors considered, Rapid! Pay earns a solid recommendation for those looking for a secure and user-friendly digital finance tool. Its standout features—especially the layered security system and instant transaction capabilities—make it suitable for everyday banking, small business needs, or tech-savvy users eager for efficiency. While it's not a one-size-fits-all solution for complex investment management, it functions beautifully as a reliable everyday financial companion.

If simplicity, speed, and security are your top priorities in a mobile payment app, Rapid! Pay deserves a close look. It's like having a dependable financial assistant right in your pocket—ready to help you move your money swiftly and safely whenever you need.

Pros

- Easy and intuitive interface that simplifies transactions

- Fast payment processing ensures quick transactions, saving users time

- Wide acceptance across numerous merchants increases usability

- Robust security features protect user data and prevent unauthorized access

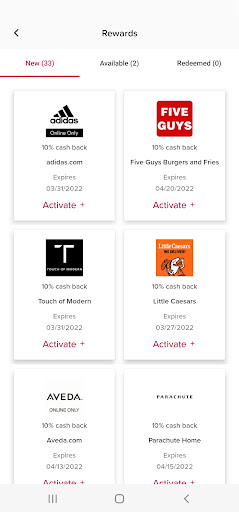

- Promotions and discounts for app users enhance overall value

Cons

- Limited international support (impact: medium)

- Occasional app crashes or bugs during high traffic periods (impact: medium)

- Restricted linking to some bank accounts due to compatibility issues (impact: low)

- Lack of in-app customer support chat (impact: low)

- Limited features compared to larger payment platforms (impact: low)

Frequently Asked Questions

How do I register and set up my rapid! Pay account?

Download the app, open it, and follow the registration prompts to create your account and link your details. You can find the registration option on the login screen.

Can I access rapid! Pay on my iPhone and Android devices?

Yes, rapid! Pay is available on both iOS and Android platforms. Download it from the App Store or Google Play and log in to start using your account.

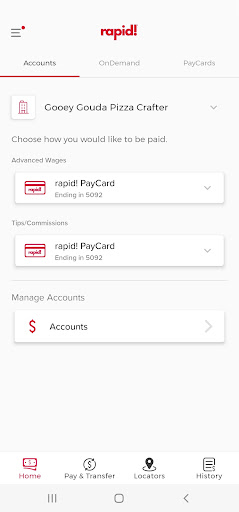

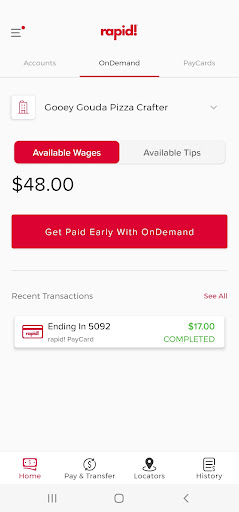

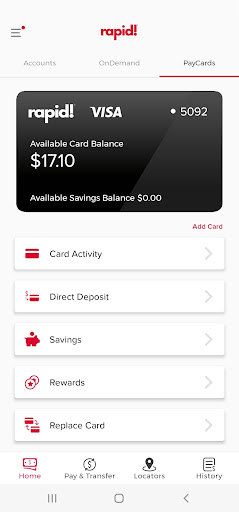

How do I view my transaction history and current balance?

Log into the app, navigate to the 'Accounts' or 'Balances' section from the main menu to view your current funds and recent transactions.

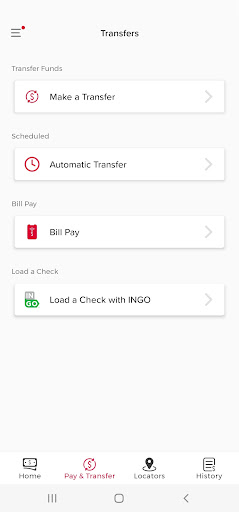

What features allow me to transfer funds between accounts?

Within the app, go to 'Transfers' to move money between your PayCard, savings, and linked bank accounts under the 'Manage Funds' menu.

How can I enable or disable biometric login for security?

Go to Settings > Security > Biometric Login and toggle it on or off to activate or deactivate fingerprint or facial recognition.

How do I set up bill payments or pay anyone?

Navigate to the 'Pay Bills' or 'Pay Anyone' section from the main menu, then enter payee details and follow prompts to complete payments.

Is there a fee for using rapid! Pay, and how do I view it?

Fees are detailed within the app under Settings > Fees and Limits. Some features may be free, depending on your account type and transaction.

Can I get cash back rewards using the app?

Yes, view available offers and cashback deals in the 'Rewards' section, and activate offers to earn cash back on qualifying purchases.

How do I troubleshoot if I experience login issues or app errors?

Try resetting your password, update the app, or reinstall it. If problems continue, contact customer support via the app's Help section for assistance.

Does rapid! Pay offer any subscription plans or premium features?

Most core features are free, but check Settings > Subscriptions to see if any premium services are available or require a fee.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4