- Developer

- RecargaPay

- Version

- 5.8.20

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.8

RecargaPay: Pix Cartão e Conta - A Comprehensive Review of Brazil's Versatile Payment App

RecargaPay: Pix Cartão e Conta is a dynamic mobile application designed to streamline digital payments and financial management for Brazilian users, combining convenience, security, and innovative features in one seamless platform.

What Is RecargaPay? A Quick Snapshot

Developed by RecargaPay, a leading fintech company based in Brazil, this app positions itself as a comprehensive digital wallet solution tailored to meet the diverse needs of everyday financial transactions. Its core strengths lie in enabling instant money transfers via Pix, managing prepaid cards, and offering a variety of bill payment services—all within an intuitive interface.

- Developed by: RecargaPay

- Main Features:

- Seamless Pix transfers for instant, contactless payments

- Prepaid Visa/MasterCard options linked to user accounts

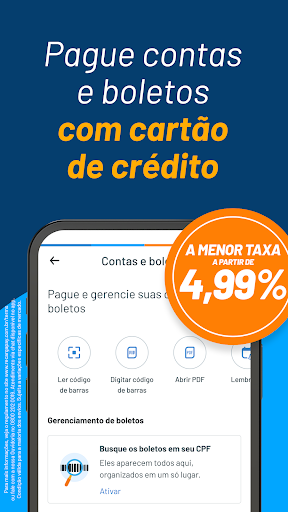

- Easy bill payments and recharge services

- Advanced security measures for user data and transactions

- Target Audience: Tech-savvy individuals seeking quick, reliable financial solutions; small business owners needing easy payment mechanisms; younger users embracing digital wallets over traditional banking.

Engaging and User-Friendly Interface: The First Impression

Imagine opening a digital wallet that feels as friendly as a trusted companion—intuitive, colorful, and clutter-free. RecargaPay strikes a harmonious balance between functionality and friendly design, making even hesitant newcomers feel at home within minutes. The onboarding process is straightforward, guiding users through setting up accounts, linking cards, and exploring features smoothly.

The layout showcases clearly labeled sections—Pix transfers, card management, bill payments—allowing users to navigate intuitively. The app's aesthetic employs vibrant, approachable visuals that evoke a sense of security and ease, much like a neatly organized workspace that invites you to settle in comfortably.

Performance and Ease of Use

Speed is a key highlight; transactions like Pix transfers are almost instantaneous, mimicking the effortless convenience of passing notes in a classroom. The interface responds swiftly, with minimal lag, ensuring users aren't left waiting or frustrated. The learning curve is gentle; even first-time users find the app manageable thanks to straightforward tutorials and clear icons. Regular users will appreciate quick access to frequently used features, making daily transactions feel like a smooth dance—every step natural and unforced.

Security and Transaction Experience: Standing Out from the Crowd

One of RecargaPay's standout features is its robust approach to security, critical in today's digital economy. The app employs multi-layered protection, including encryption, biometric authentication, and real-time fraud monitoring—much like a high-security vault protecting your valuables. Compared to other finance apps, RecargaPay emphasizes account and fund security, ensuring users' money and personal data remain shielded against cyber threats.

Furthermore, its transaction experience is tailored for reliability. With Pix transfers, users can send and receive money instantly, regardless of time or day, making it comparable to having a personal assistant standing by 24/7. The app also boasts a smooth fund loading process, with various methods such as bank transfers or cash loading at partner locations, blending traditional convenience with modern speed.

Recommendations and Final Thoughts

On the whole, RecargaPay offers a compelling package for those seeking a versatile, secure, and user-friendly financial app. Its emphasis on Pix transfers—Brazil's instant payment system—and security measures positions it as a trustworthy tool in the crowded fintech landscape. Whether you're managing daily expenses, paying utility bills, or simply exploring digital wallets, RecargaPay provides a reliable and engaging experience.

For users comfortable with digital tools and looking for a comprehensive app that combines innovative features with practical security, RecargaPay deserves a strong recommendation. Beginners will appreciate its straightforward onboarding, while experienced users will find its speed and security features meet their high standards.

In essence, if you desire an app that feels more like a helpful financial assistant rather than just another tool, RecargaPay stands out—offering not just convenience but peace of mind in your everyday financial dealings.

Pros

- User-Friendly Interface

- Multiple Payment Options

- Secure Transactions

- Instant Notifications

- Integration with Local Banks

Cons

- Limited Language Support (impact: medium)

- Occasional App Glitches (impact: medium)

- Incomplete User Guides (impact: low)

- Limited Customer Support Hours (impact: low)

- Some Transaction Fees (impact: low)

Frequently Asked Questions

How do I create my account on RecargaPay?

Download the app, open it, and follow the registration prompts by entering your details or connecting with your social media accounts.

How can I link my Pix key for quick payments?

Go to 'Settings' > 'Pix Keys' and add your preferred Pix key to simplify sending and receiving money within the app.

What is the main way to make payments with RecargaPay?

Use the 'Payments' feature to scan QR codes, choose bill payments, or pay with your registered credit card or Pix for quick transactions.

How do I top up my wallet using Pix or bank transfer?

Navigate to 'Wallet' > 'Top Up' and select Pix, bank slip, or transfer options; follow the prompts to complete your deposit with no fees.

How does the cashback system work for phone recharges?

Recharge your phone via the 'Top Up' feature; you'll earn up to 10% cashback credited directly to your wallet afterward.

Can I split payments into installments?

Yes, when paying with a credit card or Pix, select the option to split the payment into up to 12 installments on the payment screen.

Is there a subscription fee for using RecargaPay's premium features?

Most features, including the basic wallet, bill payments, and top-ups, are free. Check 'Settings' > 'Subscriptions' for any premium plans.

What are the costs associated with credit card payments?

Paying with a credit card via Pix costs a 4.99% fee, and installments may incur additional interest depending on the Pay-in options.

How do I resolve a failed transaction?

First, check your internet connection and payment details. If still issues, contact RecargaPay support via the Help Center for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4