- Developer

- Remitly

- Version

- 6.55

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.9

Empowering Global Remittances: An In-Depth Look at Remitly: Send Money & Transfer

Remitly is a dedicated money transfer app aimed at simplifying cross-border transactions through innovative features, robust security, and user-friendly design. Whether you're supporting family overseas or managing international payments, Remitly positions itself as a reliable companion for your financial journeys.

Who's Behind the Curtain?

Developed by Remitly Inc., a well-established fintech company with a focus on remittance services, the app benefits from a team of financial technology experts committed to making international money transfers fast, affordable, and secure. Their experience in cross-border payments and customer-centric approach underpin the app's thoughtful feature set.

Key Features That Make a Difference

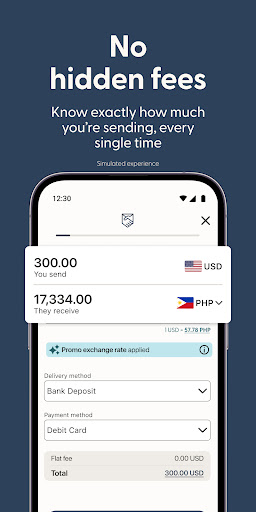

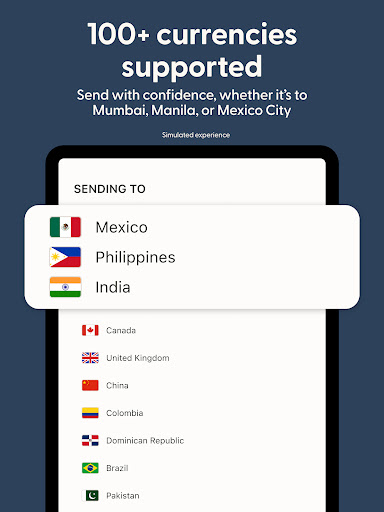

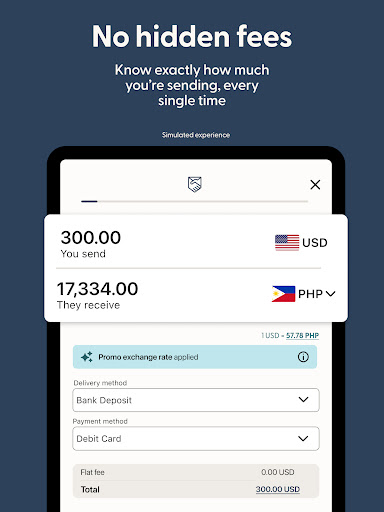

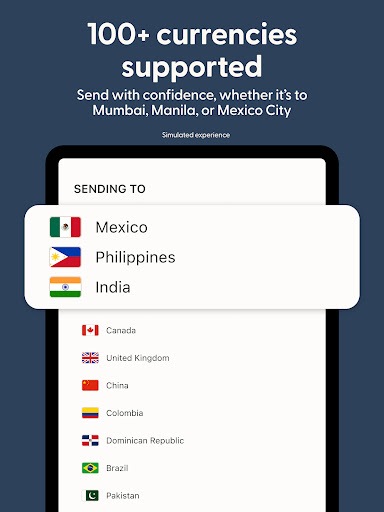

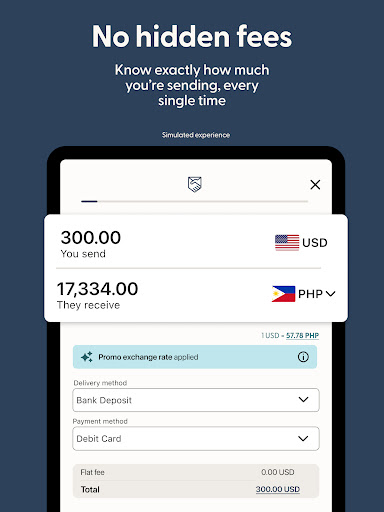

- Competitive Exchange Rates & Transparent Fees: Remitly offers real-time exchange rates with no hidden charges, ensuring you know exactly what you're paying.

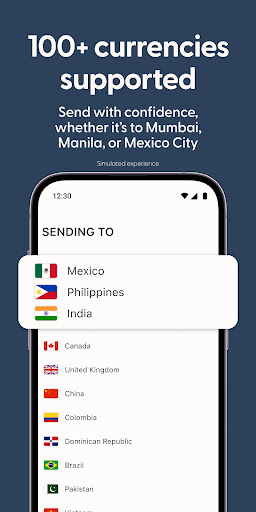

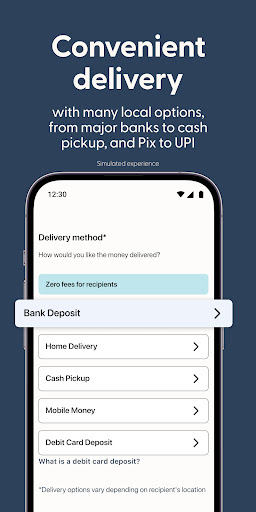

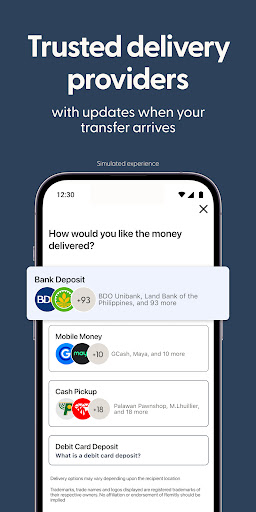

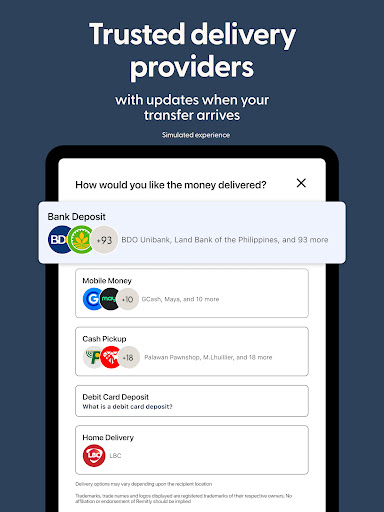

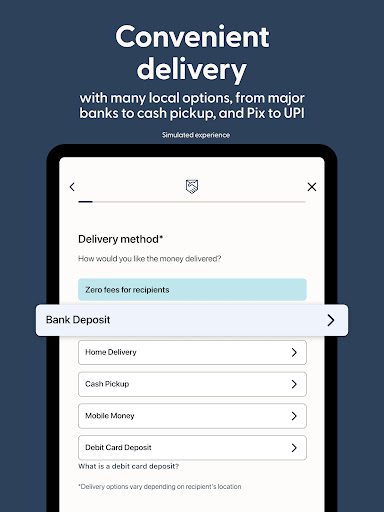

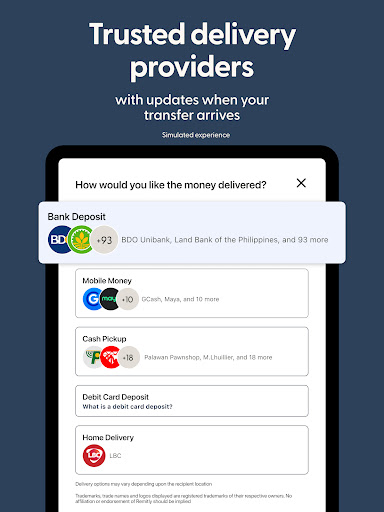

- Multiple Delivery Options: Users can choose to have funds delivered via bank deposit, cash pickup, mobile money, or home delivery, covering diverse recipient needs.

- Express & Economy Transfer Modes: The app balances speed and cost, allowing users to opt for faster transfers at a premium or more economical options if time permits.

- Robust Security Measures: End-to-end encryption, identity verification, and fraud monitoring ensure your money and data are protected at every step.

Making the Complex Simple: User Experience and Interface

Imagine entering a virtual financial marketplace where every transaction feels like a smooth, well-orchestrated dance — that's the user experience Remitly aims for. Its interface is sleek, intuitive, and designed for a seamless flow, whether you're a first-time user or a seasoned remitter.

Visual Design & Ease of Navigation

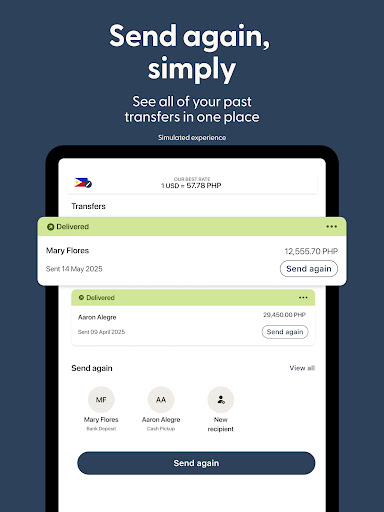

The app boasts a clean, modern aesthetic with straightforward menus and clearly labeled sections. The main dashboard highlights your recent transactions and quick access to transfer options, much like a well-organized control panel that invites you to dive in without confusion.

Operation Flow & Learning Curve

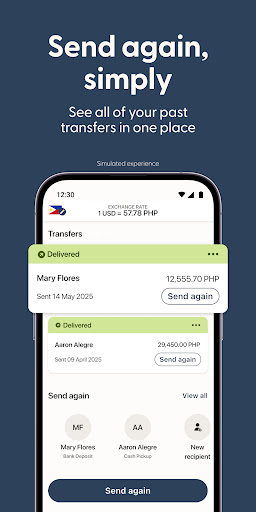

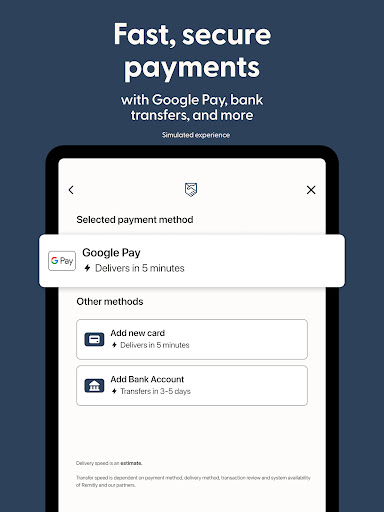

Initiating a transfer involves just a few taps: select the destination country, enter recipient details, choose an amount, and pick your preferred transfer mode. The steps are logically ordered, with helpful prompts and real-time rate updates that prevent surprises. For new users, it's straightforward to get started, with minimal onboarding required — think of it as sliding into a familiar groove quickly.

What Sets Remitly Apart from Its Peers?

While many apps dabble in international transfers, Remitly distinguishes itself through its unwavering focus on security and transaction experience. The combination of account and fund security measures with streamlined transfer processes creates a trustworthy environment akin to a secure vault with an open door.

Account & Fund Security

Unlike some competitors that rely solely on basic encryption, Remitly emphasizes multi-layered security protocols, including biometric login options and rigorous identity verification safeguards. This means you can send money confidently, knowing your funds are guarded by industry-leading practices.

Transaction Experience & Flexibility

The app's unique ability to offer both rapid transfers and budget-friendly options caters to diverse user needs, from urgent support to routine remittances. Its real-time rate tracking ensures transparency, and the multiple delivery options make it adaptable to local contexts, whether a recipient prefers cash pickup or bank deposit.

Final Verdict: Should You Give It a Try?

If you're seeking a remittance app that combines security, ease of use, and multiple transfer options without the typical hassle, Remitly comes highly recommended. It's particularly suitable for those who value transparency and reliable service over flashy marketing. For users regularly sending funds abroad, it's a trustworthy tool that simplifies a traditionally complex process.

In summary, Remitly: Send Money & Transfer exemplifies a well-crafted financial app that prioritizes user experience and security. Its two standout features — transparent rates paired with a variety of delivery methods — make it a compelling choice in the crowded remittance space. Give it a shot if you want your international transfers to be as straightforward as a chat with a trusted friend, but with the professionalism of a seasoned financial service.

Pros

- Fast and reliable transfers

- User-friendly interface

- Multiple payout options

- Competitive exchange rates and low fees

- Excellent customer support

Cons

- Limited availability in some countries (impact: Medium)

- Higher fees for certain transfer speeds (impact: Low)

- Inconsistent app performance during high traffic (impact: Medium)

- Limited options for bill payments or additional services (impact: Low)

- Verification process may be lengthy in some cases (impact: Medium)

Frequently Asked Questions

How do I create an account and start using Remitly?

Download the app, tap 'Sign Up', enter your details, verify your identity, and you're ready to send or receive money through the app.

What documents do I need to verify my identity?

You may need to provide a government-issued ID, proof of address, or other personal verification documents during registration or transfer.

How do I send money internationally with Remitly?

Open the app, select 'Send Money,' choose your recipient, input the amount, select payment and delivery options, and confirm your transfer.

What are the main features of Remitly's transfer service?

Features include multiple delivery options (bank deposit, cash pickup, digital wallets), real-time updates, competitive exchange rates, and secure transactions.

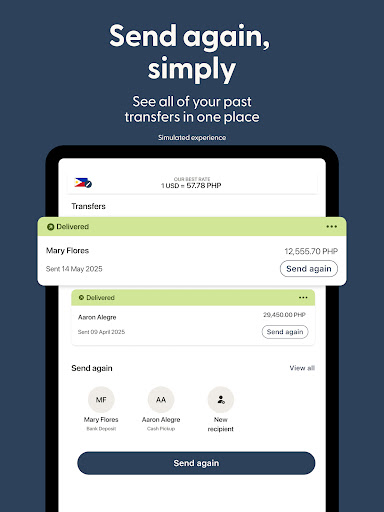

How can I check the transfer status and estimated delivery time?

Go to 'Transfer History' or 'My Transfers' in the app to view status updates and estimated delivery times for your transactions.

Are there any fees for the recipient when receiving money via Remitly?

No, recipients typically do not pay any fees. Senders may pay low transfer fees depending on the amount and method.

How do I manage or update my payment methods in the app?

Navigate to Settings > Payment Methods, then add, edit, or remove your bank cards or digital wallets as needed.

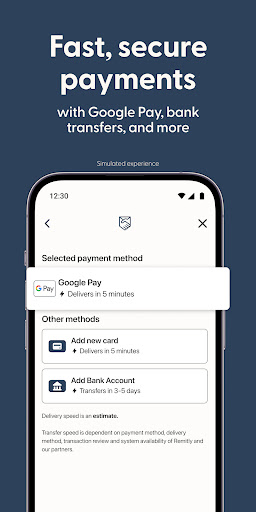

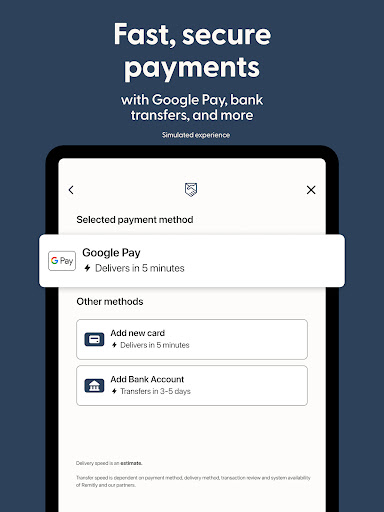

What payment methods does Remitly support?

Remitly supports bank transfers, credit/debit cards, and mobile money options like M-Pesa and MTN for flexible payments.

What should I do if my transfer isn't arriving on time?

Check the transfer status in the app, contact customer support via Help Center, or request a refund if applicable.

Are there any subscription plans or premium features in Remitly?

Remitly does not require subscriptions; payments are per transfer with transparent fees. Check Settings > Payments for details on fees.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4