- Developer

- Revolut Ltd

- Version

- 10.109

- Content Rating

- Everyone

- Installs

- 0.05B

- Price

- Free

- Ratings

- 4.7

Pros

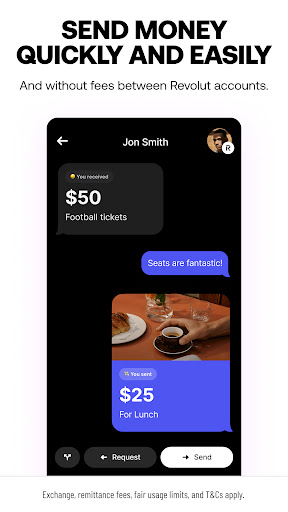

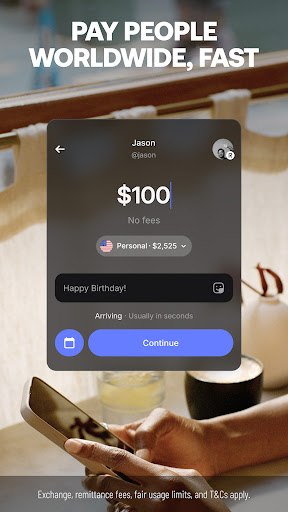

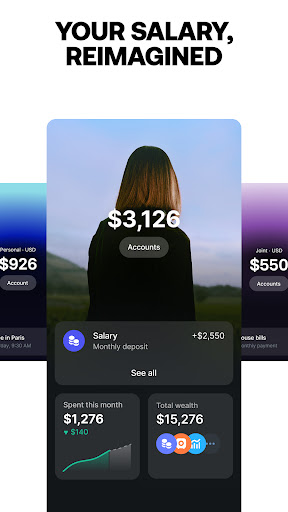

- Intuitive user interface

- Multi-currency support

- Competitive exchange rates

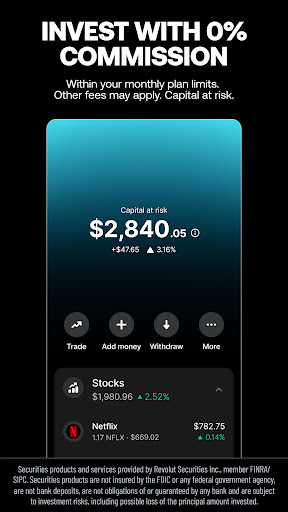

- Integrated trading features

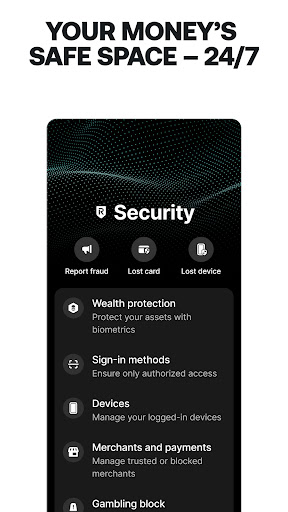

- Secure transactions

Cons

- Limited in-app investment options (impact: medium)

- Occasional slow customer support response (impact: low)

- Some features are geo-restricted (impact: medium)

- Fee structure can be complicated (impact: low)

- Limited free ATM withdrawals (impact: medium)

Frequently Asked Questions

How do I sign up and start using Revolut?

Download the app, tap Sign Up, verify your identity, link your bank account, and set up your profile to start managing your finances effortlessly.

Can I use Revolut outside my home country?

Yes, Revolut allows you to spend and withdraw cash internationally with competitive exchange rates and over 55,000 fee-free ATMs worldwide. Just ensure your account is verified.

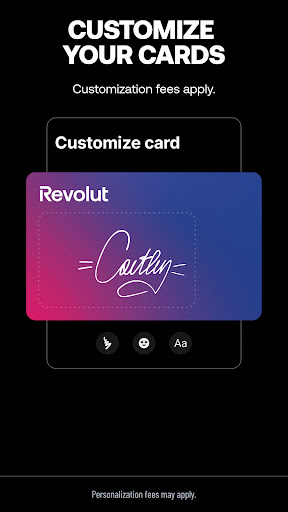

How do I set up a virtual or physical card?

Navigate to 'Cards' in the app, select 'Create New Card,' choose virtual or physical, customize your design if desired, and follow prompts to activate your card.

What features help me manage my spending better?

Use instant notifications, set spending limits, and access analytics tools via Settings > Budgeting & Analytics to monitor and control your expenses.

How do I fund my Savings Vaults?

Go to 'Savings' > 'Vaults,' select or create a vault, then set up recurring transfers or round-ups to automatically save money from your linked bank account.

How can I start trading stocks in Revolut?

Open the 'Wealth & Investing' tab, choose 'Stock Trading,' verify your identity, and fund your trading account to begin buying or selling stocks with as little as $1.

What are the costs of subscribing to Premium or Metal plans?

These plans require a monthly fee (varies per plan) and offer added benefits like exclusive cards, premium perks, and enhanced security—find detailed pricing in Settings > Plans.

Are there any hidden fees I should be aware of?

Most fees are transparent, such as charges for currency exchange or premium features. Check the fee section in Settings > Fees for detailed information before transactions.

What should I do if I encounter a transaction issue?

Use the in-app chat support in Settings > Support to report the issue, and our team will assist you quickly to resolve the problem.

How secure is my account with Revolut?

Revolut offers features like card freeze/unfreeze, single-use virtual cards, and biometric login to protect your account. Enable these in Settings > Security.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4