- Developer

- Rocket Money - Bills & Budgets

- Version

- 12.7.0

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.5

Rocket Money - Bills & Budgets: A Personal Finance Companion with a Spin

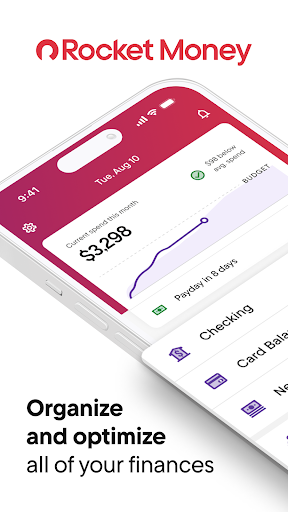

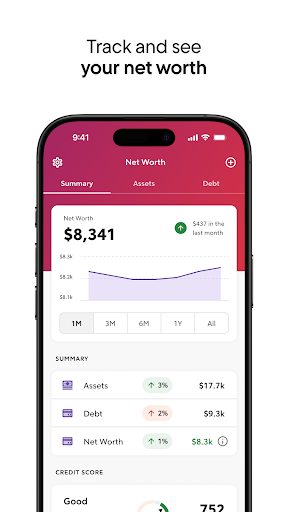

Rocket Money is a thoughtfully designed financial management app aimed at helping users track expenses, save more, and take control of their financial lives through intuitive tools and smart automation.

Developed by a Passionate Fintech Team

This app is crafted by a dedicated team of financial technology enthusiasts committed to making personal finance accessible and manageable for everyone. Their goal is to simplify the often overwhelming world of bills and budgets into a seamless experience that empowers users to make informed decisions.

Key Features That Make It Shine

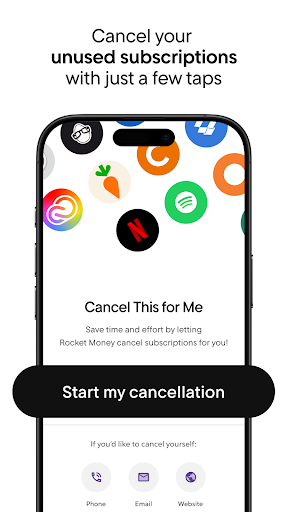

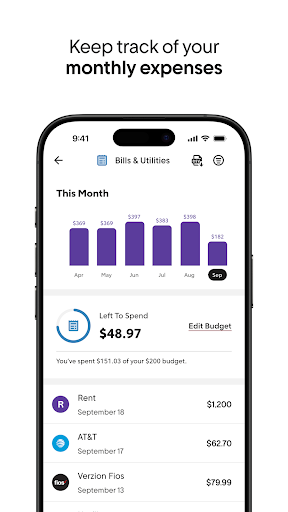

- Automatic Bill Tracking & Cancellation: Connect your accounts, and Rocket Money scans for upcoming bills, enabling you to review, pay, or even cancel subscriptions directly within the app.

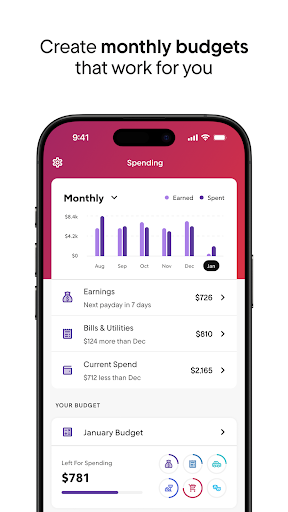

- Customizable Budgeting Tools: Set personalized budgets, categorize expenses, and visualize spending trends with easy-to-understand graphs — making money management less of a headache and more of a habit.

- Smart Savings Goals & Insights: Define your financial targets and receive tailored insights and suggestions to help reach your savings goals efficiently.

- Security & Privacy Focus: Prioritizes user data protection with bank-level encryption and transparent privacy policies, ensuring your financial data stays safe.

Engaging User Experience with a Friendly Touch

Imagine trying to navigate a cluttered dashboard — overwhelming and confusing. Rocket Money, however, feels more like a friendly assistant guiding you through your financial universe. Its interface adopts a clean, modern aesthetic with intuitive navigation, reducing the learning curve to a matter of minutes. Whether you're a novice or a seasoned budgeter, you'll appreciate how effortlessly the app translates complex financial data into digestible summaries. The animations and visual cues act as gentle nudges, keeping users engaged without feeling bombarded.

Core Functionality Deep Dive

The real magic lies in how Rocket Money simplifies complex tasks. Its automatic bill tracking feature acts like a vigilant fly on the wall, quietly monitoring your linked accounts and alerting you about bills due soon. Unlike traditional apps where you manually add bill dates, Rocket Money scans transactions and upcoming charges, making the entire process feel like having a diligent financial assistant. The ability to cancel subscriptions with a single tap is another highlight — no more digging through emails or multiple websites to cancel those recurring services you no longer need.

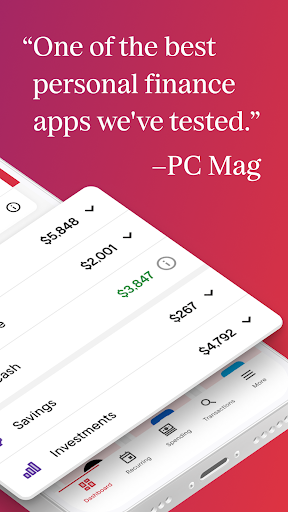

On the budgeting front, the app excels at helping users create customized spending boundaries. Its visual dashboards display your expenses categorized into familiar labels like Food, Utilities, Entertainment, and more, with color-coded charts that make identifying spending patterns a breeze. The insights and recommendations are actionable; for example, if you're overspending on dining out, Rocket Money suggests specific ways to cut back, turning data into practical advice.

Speed, Security, & Unique Selling Points

Speed in processing data and updating dashboards is noteworthy; the app stays responsive even with multiple accounts linked. This fluidity ensures that users can make real-time adjustments without feeling left behind by lag or sluggishness. From a security standpoint, Rocket Money stands out by encrypting all data and offering secure login options, instilling confidence that your sensitive information remains protected. Its unique advantage over similar apps is the proactive subscription management combined with intelligent insights, which not only helps track expenses but actively assists in reducing unnecessary costs — a rare but invaluable feature.

Final Verdict: A Friend in Financial Distress

Considering its array of features, user-friendly interface, and focus on security, Rocket Money is highly recommended for anyone seeking a comprehensive yet approachable financial management solution. It's especially suitable for users who want to automate mundane tasks like bill tracking and benefit from intelligent suggestions to optimize savings. While beginners will find the onboarding smooth and straightforward, experienced users will appreciate the depth of customization and automation.

In conclusion, Rocket Money isn't just another budgeting app; it's like having a dependable financial companion that makes managing your money less of a chore and more of a clear, manageable journey. If you're ready to take charge of your bills and budgets with confidence, this app deserves a spot on your home screen.

Pros

- Effective Budget Management

- Subscription Tracking and Cancellation

- User-Friendly Interface

- Bill Payment Reminders

- Secure Data Handling

Cons

- Limited Manual Entry Options (impact: low)

- Occasional Sync Delays (impact: medium)

- Advanced Budget Features Missing (impact: low)

- Premium Features Require Subscription (impact: low)

- Customer Support Response Time (impact: medium)

Frequently Asked Questions

How do I get started with Rocket Money and link my bank accounts?

Download the app, create an account, then navigate to Settings > Accounts to securely link your bank and credit card accounts for automatic tracking.

Is Rocket Money suitable for users new to budgeting?

Yes, Rocket Money features a user-friendly interface and guided setup to help beginners easily create budgets and manage finances effectively.

How does Rocket Money identify my subscriptions?

The app automatically scans your linked accounts to find recurring payments; go to Subscriptions to review and cancel unwanted services.

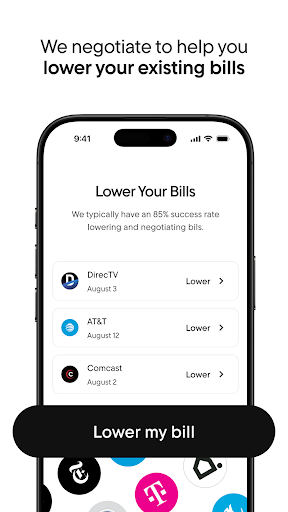

Can Rocket Money help me negotiate my bills?

Yes, the app's concierge service analyzes your bills and can negotiate better rates; access this feature in the Bill Reduction section.

How do I set up a budget in Rocket Money?

Navigate to Budget > Create New Budget, set categories and spending limits, then enable alerts to stay on track.

How can I automate my savings with Rocket Money?

Go to Savings > Set Up Automatic Transfers, specify goals and amounts, then activate autopilot to save regularly.

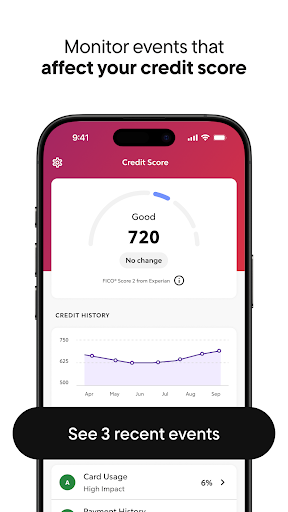

Does Rocket Money help monitor my credit score?

Yes, the app provides tools to check and monitor your credit score; find this feature under the Credit section in the app.

What are the costs or subscription fees for Rocket Money?

Basic features are free; optional premium services like bill negotiation or detailed insights may require a subscription, check the In-App Store for details.

How do I cancel a subscription I no longer need?

Go to Subscriptions, select the unwanted service, then tap Cancel Subscription to stop future payments.

What should I do if the app is not linking my accounts correctly?

Try re-authenticating your bank accounts in Settings > Accounts, or contact customer support for assistance with connection issues.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4