- Developer

- Root, Inc

- Version

- 342.1.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 3.1

Root: Better Car Insurance – A Smart Upgrade for Your Vehicle Safeguarding

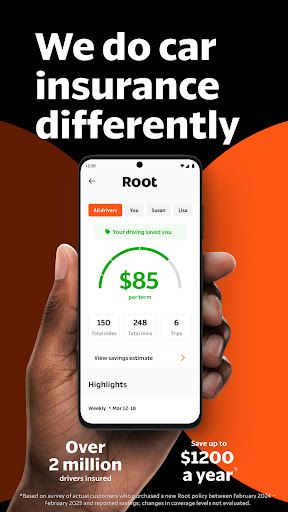

Root: Better Car Insurance is an innovative mobile application designed to personalize and streamline the process of obtaining and managing car insurance, emphasizing user-centric features and modern digital security.

About the App and Its Creators

Root: Better Car Insurance is developed by Root, Inc., a company renowned for leveraging advanced data analytics and app-based solutions to revolutionize traditional insurance models. Their mission is centered around making car insurance fairer, more transparent, and tailored to individual driving habits.

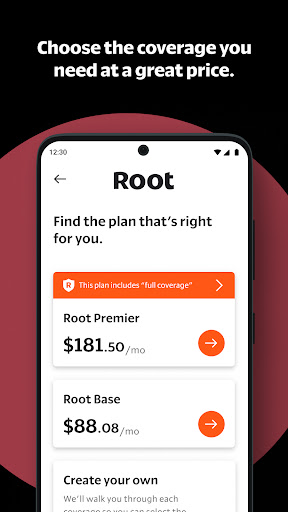

The primary features that set Root apart include a usage-based insurance (UBI) model that adjusts premiums based on real driving data, a seamless digital claim process, and robust security measures to protect user data and transactions. The app is especially crafted for tech-savvy drivers, insurance consumers looking for transparent rates, and those seeking a hassle-free experience with their auto coverage.

Engaging and Intuitive User Experience with a Purpose

Imagine sitting behind the wheel of your digital insurance companion — sleek, confident, and ready to adapt to your every move. Root's interface offers a refreshing departure from cluttered dashboards, providing a clean, friendly layout that feels more like a trusted co-driver than a mere application. Its intuitive design ensures that setting up your account, taking a driving assessment, or managing claims happens smoothly, like gliding on a well-paved road.

During my exploration, the app impressively balances simplicity with functionality. The onboarding process is straightforward, guiding users gently into the core features without feeling overwhelmed. The responsiveness of the interface and clarity of instructions make even newcomers comfortable, reducing the typical learning curve found in insurance apps.

Driving the Core Features: Personalization and Data Security

Real-World Driving Assessment: The Heart of Fair Pricing

Root's standout feature is its utilization of smartphone sensors to monitor your driving in real time. Unlike traditional insurance that heavily relies on static metrics like age or vehicle type, Root employs a usage-based model that assesses your actual driving behavior—such as turns, acceleration, braking, and even the times of day you drive. Think of it as having a personal driving coach who evaluates your skills not by assumptions but by action.

This real-world assessment creates a fairer pricing system, rewarding safe drivers with lower premiums. It's akin to having a tailor-made suit—designed precisely to fit your driving habits, rather than a one-size-fits-all solution.

Streamlined Claims and Digital Security

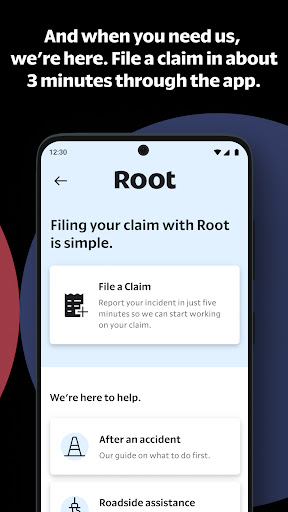

When accidents happen, the last thing you need is a bureaucratic maze. Root's app simplifies claims by enabling users to initiate and track claims digitally, often with photo uploads and minimal paperwork. The process feels like sending a message to a friend—easy and straightforward. Additionally, Root places a high emphasis on security, employing encryption and privacy protocols that safeguard sensitive data during transactions and personal information storage. This is crucial in an era where digital security is as vital as a good seatbelt.

Differentiators: How Root Stands Out

What truly sets Root apart from similar financial applications is its dual focus on **Account and Fund Security** and **Transaction Experience**. While many apps claim to protect data, Root's approach integrates continuous security measures with transparent data collection, ensuring users' habits and sensitive information stay confidential without sacrificing the convenience of digital monitoring.

Moreover, the app's transaction process—whether adjusting premiums, paying bills, or claiming—is seamless, akin to a quick tap on a familiar smartphone screen. Unlike traditional insurance providers that rely on lengthy paperwork and in-person visits, Root leverages technology to deliver a real-time, frictionless experience, making it stand out as a truly modern solution.

Final Verdict and Recommendations

Overall, Root: Better Car Insurance is a thoughtfully crafted app that brings a much-needed breath of fresh air to the auto insurance landscape. Its core advantage—the usage-based driving assessment—not only promises fairer premiums but also encourages safer driving habits. The app's clean design, smooth user interface, and commitment to security make it a reliable companion for today's digital-savvy drivers.

For those who value transparency, convenience, and personalized pricing, I would confidently recommend giving Root a try. It's particularly suitable for drivers who are comfortable with using their smartphones to manage complex services or those seeking a more equitable insurance experience. Just like upgrading your vehicle with the latest tech, switching to Root could make your insurance journey safer, smarter, and more aligned with your lifestyle.

Pros

- User-friendly interface

- Personalized insurance quotes

- Real-time driving insights

- Transparent pricing

- Easy claim filing process

Cons

- Limited coverage options (impact: medium)

- Coverage availability varies by state (impact: high)

- Occasional app crashes (impact: low)

- Limited customer support channels (impact: low)

- Premium rates may be high for some drivers (impact: medium)

Frequently Asked Questions

How do I start using Root car insurance for the first time?

Download the app on iOS or Android, create an account, and complete the test drive setup to receive your personalized quote.

Can I manage my policy and claims within the app?

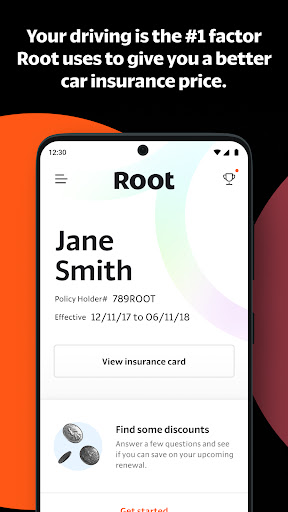

Yes, you can manage your coverage, file claims, and view documents all through the app dashboard for convenience.

How does the driving analysis process work?

The app uses your phone's sensors during a test drive to monitor your driving habits and calculate your safety score automatically.

What features are available to customize my coverage?

You can choose coverage levels, pause your policy when not driving, and bundle auto with renters or home insurance within the app.

How does Root determine my insurance premium?

Premiums are primarily based on your driving habits and safety score, not age or credit, after completing the test drive period.

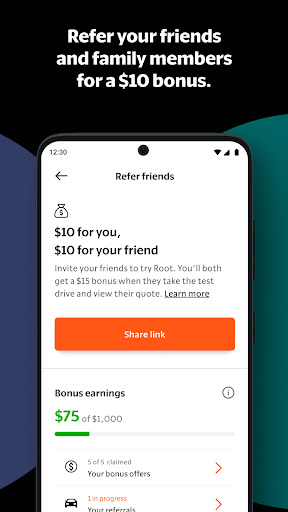

How can I earn discounts or savings with Root?

Drive safely to improve your safety score, pause coverage when not driving, or refer friends via the app's referral program to earn credits.

What is the process for filing a claim with Root?

Open the app, tap ‘File a Claim,' follow the prompts, upload photos if needed, and track your claim status from the app dashboard.

Are there any additional costs for roadside assistance?

No, roadside assistance is included in your policy without extra charges, providing help with emergencies anytime within coverage.

How can I change or update my coverage or billing information?

Navigate to Settings > Policy in the app, where you can update coverage options, payment methods, or contact customer support.

What should I do if I experience technical issues with the app?

Try reinstalling the app or contact Root's customer support via the help section for troubleshooting assistance and guidance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4