- Developer

- Safeco Insurance Company of America

- Version

- 4.35.1

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.7

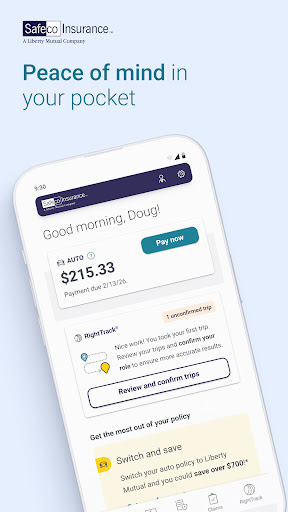

Safeco Mobile: Your Secure Companion for Financial Management

Safeco Mobile is a thoughtfully designed financial app aimed at providing users with robust security features and seamless transaction experiences, all while maintaining an intuitive interface tailored for both beginners and seasoned users.

About Safeco Mobile

Safeco Mobile is developed by the innovative team at Safeco Technologies, dedicated to creating secure and user-friendly financial tools. The app shines in offering multi-layered account protection and streamlined transaction processes, making daily financial activities effortless and safe. Its core features include real-time transaction alerts, advanced biometric security, and an integrated fund management dashboard. Designed primarily for individual users looking for secure and efficient personal finance management, Safeco Mobile caters to a broad audience—from tech-savvy millennials to older adults prioritizing data security and ease of use.

Engaging the User: A Friendly Dive into Safeco Mobile

Imagine managing your money as smoothly as navigating your favorite app on a lazy Sunday—clear, responsive, and worry-free. That's the experience Safeco Mobile aspires to provide, turning what could be a mundane task into a delightful ritual. Whether you're paying bills, tracking expenses, or checking your account security, this app aims to be your trustworthy virtual wallet that safeguards your assets with a gentle but firm grip.

Core Features That Stand Out

Unparalleled Security with Multi-Layered Protection

Safeco Mobile's highlight is its comprehensive security architecture. Beyond basic PIN codes, it employs biometric authentication—face recognition and fingerprint scans—to ensure that only you can access sensitive information. Additionally, it offers real-time alerts for every transaction, giving users a vigilant eye over their accounts. This multi-layered approach acts like a digital fortress, preventing unauthorized access and alerting users immediately if suspicious activity is detected.

Smooth and Secure Transaction Experience

Unlike many finance apps that sometimes feel clunky during transfers, Safeco Mobile emphasizes a frictionless transaction process. With a few taps, users can move funds, pay bills, or even split expenses with friends—effortlessly turning complex processes into quick, guided steps. The app provides visual confirmation at each stage, reducing errors and boosting confidence. Its transaction management interface is intuitively laid out, similar to flipping through a familiar contact list, which ensures users spend less time figuring out how and more time doing.

Intuitive Fund Management Dashboard

Managing multiple accounts or monitoring savings goals becomes a visual pleasure with Safeco's integrated dashboard. Graphs, summaries, and detailed reports present your financial data in a digestible manner. This feature is like having a financial compass guiding your decisions, whether you're budgeting for a vacation or tracking your investment growth. The interface's clean design and dynamic filters make it easy for users to personalize their viewing experience and obtain the insights they need—without drowning in numbers.

User Experience and Unique Selling Points

From the moment you open Safeco Mobile, the interface welcomes you with a neat, minimalistic design—like a well-organized desk that encourages easy access. Navigating through features is smooth; transitions are swift, and the app responds promptly to user commands, providing a sense of reliability akin to driving a well-tuned vehicle. Its learning curve is gentle; even those new to digital finance can quickly grasp its functions thanks to guided tutorials and clear icons.

Compared to competitors like PayPal or Revolut, Safeco Mobile's standout is its integrated focus on security—combining biometric login and instant alerts—that's seamless rather than intrusive. Its real-time transaction tracking is highly responsive, ensuring users are always aware of their funds' whereabouts, akin to having a vigilant guardian angel watching over your money.

Recommendation and Usage Suggestions

Considering its comprehensive security features and user-friendly interface, I would confidently recommend Safeco Mobile to anyone prioritizing safety in their digital financial activities. It's particularly suitable for individuals managing multiple accounts or emphasizing transaction transparency. For those seeking a straightforward, reliable app to handle daily expenses and monitor account health, Safeco Mobile offers a balanced blend of security, simplicity, and efficiency.

My advice? Dive in with initial exploration of the dashboard and activate biometric security settings right away. Once familiar, transactions become second nature—like flipping a light switch—making your financial management not just safer but truly effortless. Just remember to keep your device's software up to date to maintain optimal security levels.

Pros

- User-friendly interface

- Comprehensive insurance management

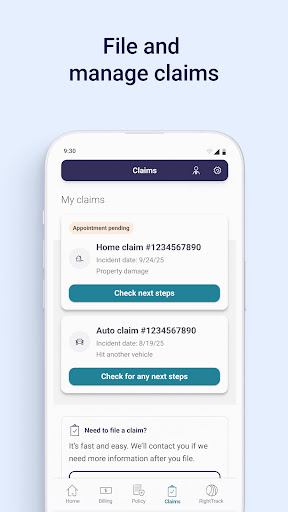

- Real-time claim status updates

- Secure data encryption

- Quick claim filing process

Cons

- Limited features in the free version (impact: medium)

- Occasional app crashes on older devices (impact: low)

- Language support currently limited to English and Mandarin (impact: medium)

- Some claims processing times could be faster (impact: low)

- Notification customization options are basic (impact: low)

Frequently Asked Questions

How do I register and log into Safeco Mobile for the first time?

Download the app from your device's app store, open it, and follow the on-screen instructions to create an account or log in using secure options like face or touch recognition.

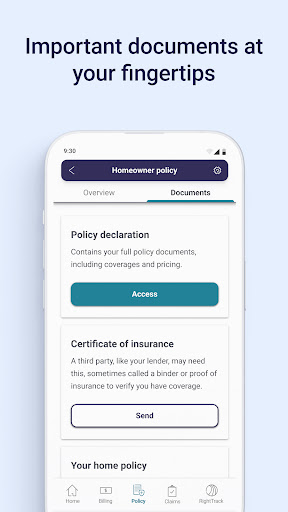

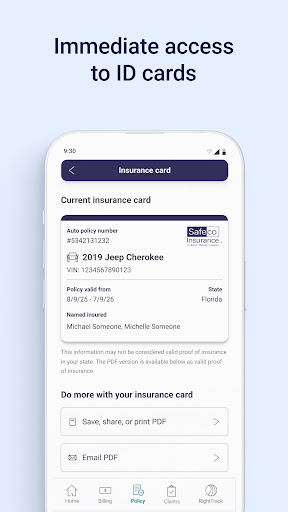

Can I access my insurance policies and ID cards easily?

Yes, after logging in, navigate to the 'Policy Management' section to view and download your digital ID cards quickly and securely.

How do I pay my insurance bills through the app?

Go to 'Payments' in the app, select your bill, choose a payment method, and follow prompts to complete automatic or manual payments.

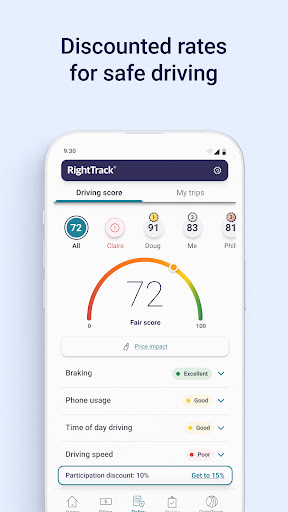

What features does Safeco Mobile offer for safe driving rewards?

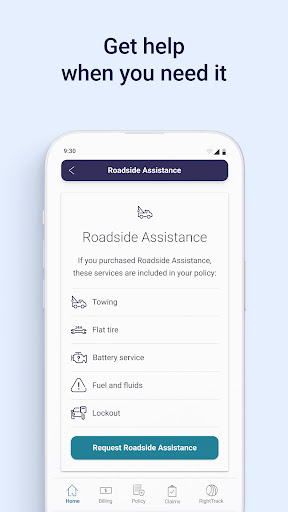

The app uses the RightTrack program to monitor driving habits automatically and rewards responsible driving with potential discounts. Activate via 'More' > 'RightTrack'.

How do I file a claim using Safeco Mobile?

Tap 'File a Claim,' upload photos, enter details, and track your claim status in real time through the 'Claims' section of the app.

How can I set up automatic payments in the app?

Navigate to 'Payments,' select 'Automatic Payments,' add your payment information, and confirm to enable auto-billing.

Is there a way to get reminders for policy documents or payments?

Yes, enable push notifications in the app settings to receive timely alerts about policy updates, payments, and required actions.

What should I do if I experience app crashes or login issues?

Try updating the app, restart your device, or reinstall. If problems persist, contact Safeco support through the 'Help' section.

Are there any subscription fees for using Safeco Mobile features?

Basic features are free; additional services like safe driving rewards or premium support may have costs, view details in 'Settings > Subscriptions' to manage your options.

Can I access Safeco Mobile on multiple devices?

Yes, the app is available on both Android and iOS. Log in with your credentials on each device to access your insurance information seamlessly.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4