- Developer

- Self Financial, Inc.

- Version

- 7.1.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

Self - Credit Builder: Empowering Financial Confidence with a Simple Tap

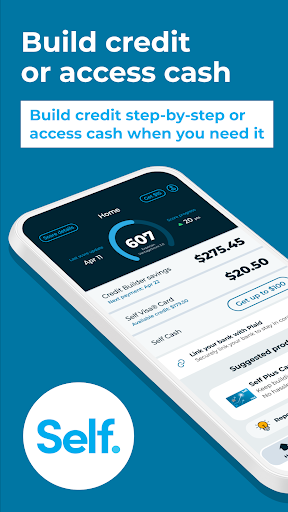

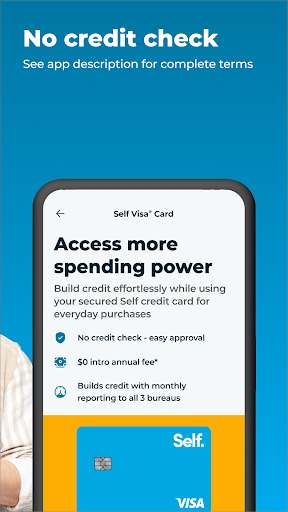

Imagine building your credit score as effortlessly as saving a few bucks—this is where Self - Credit Builder shines. Developed by the forward-thinking team at Self, this innovative app aims to help users establish or improve their credit profiles through accessible and transparent tools. Whether you're just starting out or repairing past credit mishaps, Self offers a streamlined pathway to financial health with features designed to demystify credit building for everyday users.

Key Features That Make Self Stand Out

At its core, Self sets itself apart with a handful of standout features: an accessible credit-building loan program, personalized financial insights, and a commitment to transparency around credit data. These tools work in harmony to make the journey toward a better credit score both practical and empowering. Plus, the app integrates educational content to guide users through the often confusing world of credit, making each step clear and manageable.

Bright and Intuitive Interface: Seamless User Experience

Stepping into the Self app feels like entering a well-organized personal finance dashboard. The design is modern yet inviting, with a color palette that's easy on the eyes—think calming blues and whites that evoke trust and clarity. Navigation is straightforward; key functions are just a tap away, reducing any ashen hesitation and making it suitable even for tech novices. The app's responsiveness is smooth, with quick load times and fluid transitions that keep users engaged without frustration. Learning curve? Minimal. The app's helpful tips and guided prompts act like friendly co-pilots, guiding users through each feature comfortably.

Core Functionality: Building Credit Made Clear and Reliable

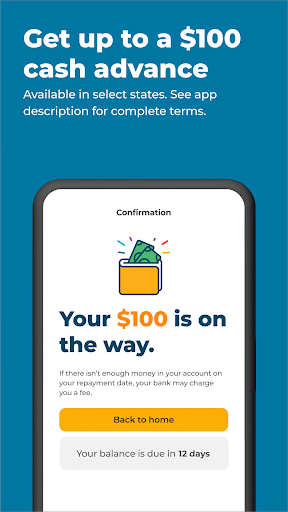

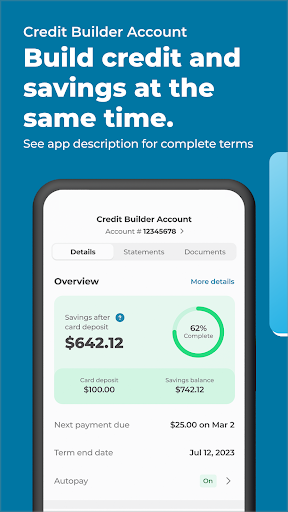

1. The Credit Builder Loan Program: Turning Small Steps into Big Gains

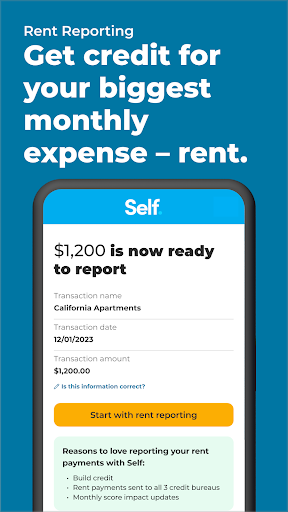

The bedrock of Self's approach is its credit builder loan—an innovative twist on traditional loans, designed specifically for credit history enhancement. Users make manageable monthly payments, which are reported to credit bureaus to demonstrate creditworthiness. Think of it as planting tiny seeds every month; over time, these regular contributions nurture a healthy credit profile. The process is transparent, with real-time updates on progress and how each payment influences credit scores—like watching a garden flourish with consistent care.

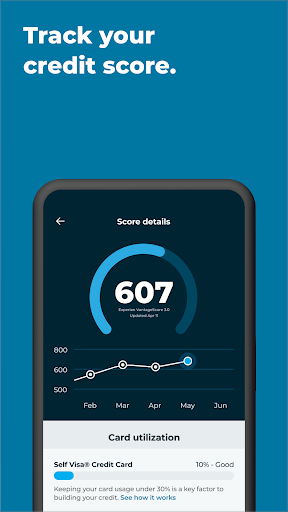

2. Personalized Credit Insights and Educational Tools

Beyond just tracking your credit, Self offers tailored insights that explain exactly what impacts your score and how to improve it. Interactive tutorials, glossaries, and tips turn what used to be opaque credit jargon into understandable, actionable advice—like having a personal coach holding your hand through the credit maze. These educational components are especially valuable for first-time users or those rebuilding after financial setbacks, ensuring they're not navigating blindly.

3. Secure and Transparent Data Handling

Security is the backbone of Trust; Self emphasizes protection and transparency. The app uses robust encryption protocols to safeguard sensitive information, and its reporting process ensures that users always know what data is shared and why. Compared to other financial apps, Self's commitment to data clarity helps users feel assured, knowing their personal information isn't floating in the dark but is handled ethically and securely—much like having a privacy shield customized just for them.

How Self Differs from Other Financial Apps

While many financial management tools focus on budgeting or investments, Self zeroes in on a specific, often overlooked aspect: establishing or rebuilding credit. Its standout feature—the credit builder loan—works like an automated, guided savings and credit journey, making the process feel less daunting. Compared to apps that only display credit scores, Self provides tangible actions, reporting progress over time and helping users see how their efforts translate into scores—like watching a small flame turn into a controlled but powerful blaze.

In terms of security, Self maintains a transparent data handling policy and uses bank-level encryption, which is comparable or superior to many competitor apps. When it comes to transaction experience, Self makes the process of making payments and viewing updates smooth, with real-time feedback that feels intuitive and non-intrusive. This focus on reliability and user comfort makes Self not just another app, but a trustworthy companion in your financial journey.

Recommendation and Usage Tips

Overall, Self - Credit Builder earns a solid recommendation for anyone aiming to establish or repair their credit without the complexity and stress often associated with credit products. It's especially suited for young adults, newcomers to credit, or those with past financial challenges, thanks to its educational support and gentle approach.

If you're considering using Self, start with its guided setup and treat the monthly payments as an investment in your future. Regular check-ins on the app will help you stay motivated, and the clear progress updates make it satisfying to see your efforts pay off. Remember, improving your credit isn't an overnight task; but with Self's straightforward tools and friendly guidance, you can lay down a solid foundation for your financial health, one small step at a time.

Pros

- User-friendly interface

- Transparent credit reporting

- Affordable and flexible plans

- Educational resources included

- Prompt customer support

Cons

- Limited credit-building features (impact: medium)

- Requires a bank account (impact: high)

- Slow credit score updates (impact: medium)

- Limited geographic availability (impact: low)

- Basic reporting format (impact: low)

Frequently Asked Questions

c

c

c

c

g

g

d

d

f

f

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4