- Developer

- Sendwave

- Version

- 26.2.1

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.6

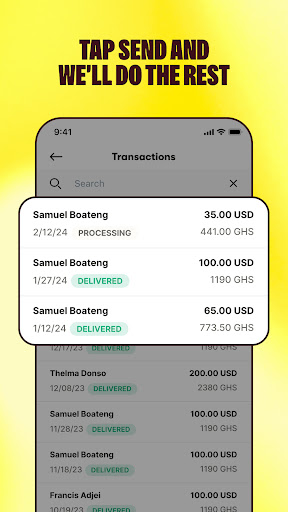

Sendwave—Send Money: A Reliable Companion for Fast and Secure International Transfers

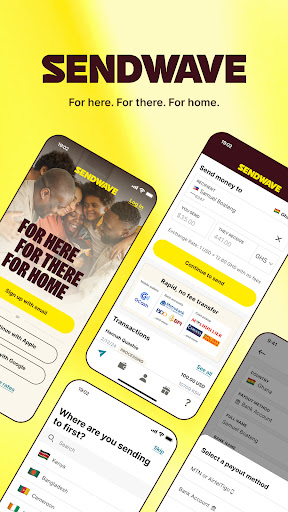

Sendwave is a mobile application designed to simplify cross-border money transfers with a focus on speed, security, and user-friendly experience. Developed by Zealo Limited, the app aims to serve consumers who need quick remittances, especially to countries in Africa, Asia, and Latin America. With its straightforward features and innovative approach, Sendwave seeks to stand out in the crowded financial app landscape.

What Makes Sendwave Stand Out?

At its core, Sendwave's primary charm lies in its ability to make international money transfers as simple as sending a text message. The app simplifies the often-complex process of remittance, appealing to a diverse user base including expatriates, migrant workers, and even casual users sending funds home. Key highlights include zero transfer fees for most routes, instant delivery, and a focus on user safety. These features work together to create a seamless experience catering to both newcomers and seasoned digital remitters.

Intuitive Interface and User Experience

Imagine opening an app that's as welcoming as a familiar conversation—bright, clean, and straightforward. Sendwave's interface embodies this aesthetic, with a simple home screen that directs you effortlessly through sending money. From registration to confirmation, the process feels smooth, like gliding down a well-paved road. The design emphasizes ease of use, reducing the typical learning curve often associated with financial apps. Navigating through the app is intuitive—no overwhelming menus or confusing jargon—making it accessible even for first-time users.

Operational performance is equally impressive. The app runs smoothly with minimal lag, thanks to optimized coding and thoughtful backend infrastructure. Transactions are executed swiftly, often within minutes, which can be a lifesaver in urgent situations. The app's responsiveness ensures users won't get lost in endless confirmation screens or delayed responses, fostering trust and satisfaction.

Core Features Explained

Fast and Fee-Free Transfers

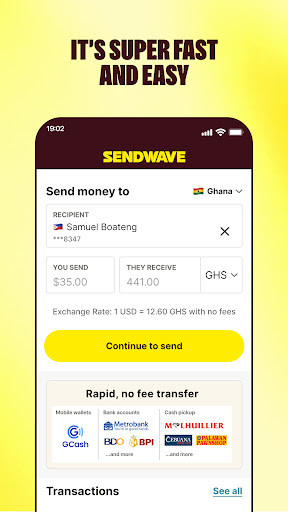

The standout feature of Sendwave is its ability to offer fee-free transfers on most routes. Unlike traditional banks or other remittance services that slap hefty fees on each transaction, Sendwave's model minimizes costs for users. Transfers are processed instantly or within a few hours—perfect for emergency situations or regular support payments. The transparent rate display means users know exactly how much their recipient will get before confirming, eliminating surprises or hidden charges. This transparency fosters confidence and encourages frequent use.

Enhanced Security and Safety Protocols

Money security is the backbone of any financial app, and Sendwave prioritizes this through robust encryption, identity verification, and compliance with international security standards. It uses multi-layered security measures—like device authentication and data encryption—to protect user information and funds. Unlike some competitors, Sendwave emphasizes a no-identity-theft promise, reassuring users that their hard-earned money is in safe hands. This focus on security isn't just a feature; it's a core value, making it particularly appealing to those wary of digital financial scams.

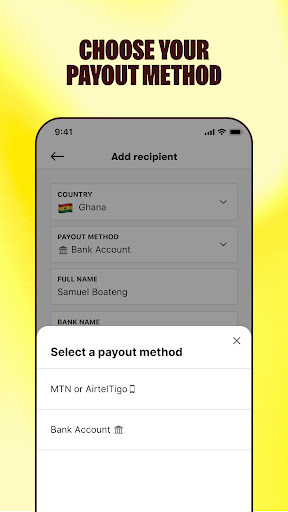

Wide Network and Local Payment Options

Sendwave's extensive partner network allows users to send money directly to bank accounts, mobile wallets, or cash pick-up points, where available. This flexibility means recipients in different countries can choose the most convenient method to receive funds—whether it's depositing into a bank or collecting cash at a local agent. By aligning with local providers and payment systems, Sendwave ensures that the transfer reaches the recipient swiftly and conveniently, often outpacing similar apps in terms of accessibility.

User Experience and Differentiators

Compared to other financial apps like PayPal or Western Union, Sendwave's user experience feels less like navigating a complex maze and more like a friendly digital handshake. Its key advantage lies in its seamless account and fund security—built into every transaction—making it stand out in an industry often marred by security concerns. The app's integration with local mobile money services also enhances delivery speed and reduces costs, which is a huge plus. Furthermore, the 'instant transfer' capability offers an edge over traditional banks that may take days to process international wires.

Another standout is Sendwave's transparent fee structure; it often waives fees altogether, emphasizing affordability. Its straightforward interface simplifies what can be an intimidating process, making it accessible to users with limited financial literacy. These attributes combine to position Sendwave as a trustworthy, efficient, and user-centric solution for international remittance.

Final Recommendation and Use Cases

If you're someone who often sends money across borders—be it to support family abroad, pay for services, or manage international expenses—Sendwave deserves a serious look. Its emphasis on security, speed, and zero fees makes it especially appealing for regular remitters or new users wary of hidden charges and long processing times.

However, it's worth noting that Sendwave may not yet cover every country or offer every payment method globally. For users needing larger transfer limits or more diverse financial products, other apps might be more suitable. Still, for quick, secure, and straightforward remittance needs, Sendwave stands out as a reliable choice.

Overall, I'd recommend giving it a try if the app's coverage aligns with your needs. It's like having a trustworthy friend you can rely on for sending money—simple, dependable, and always ready to help in a pinch.

Pros

- User-friendly interface

- Fast transfer speed

- Low transfer fees

- Multiple currencies supported

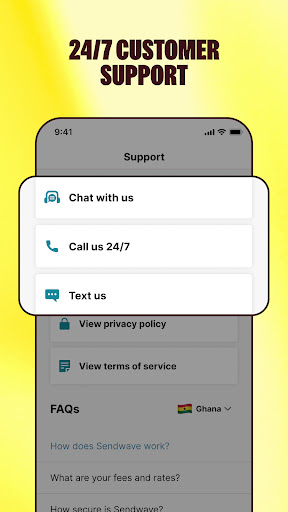

- Excellent customer support

Cons

- Limited recipient options (impact: medium)

- Availability in select countries only (impact: high)

- Occasional app crashes during high traffic (impact: low)

- Verification process can be lengthy (impact: medium)

- Limited features for tracking transaction status (impact: low)

Frequently Asked Questions

How do I set up my Sendwave account for the first time?

Download the app, sign up with your email or phone number, verify your identity, and add your preferred payment methods through Settings > Account.

Is Sendwave available for both Android and iOS devices?

Yes, Sendwave is available on both Android and iOS platforms. Download it from Google Play or the App Store and follow the setup instructions.

How do I send money to my family using Sendwave?

Open the app, select 'Send Money', choose the recipient, input transfer amount, select delivery method (Mobile Money, bank transfer, or cash pickup), and complete the payment.

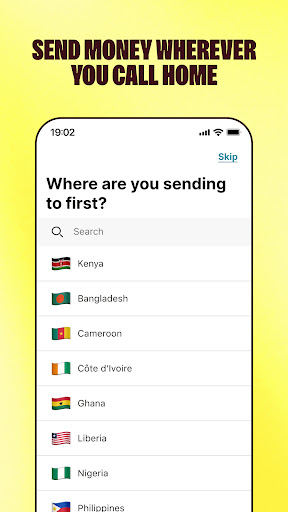

What currencies and countries does Sendwave support?

Sendwave supports transfers mainly to Africa, Asia, and Europe, including countries like Kenya, Nigeria, the Philippines, and more; currencies depend on the recipient country.

How does Sendwave ensure the security of my transactions?

Sendwave employs industry-standard 256-bit encryption and is regulated by global authorities, ensuring your data and transactions are protected.

How can I manage my funds within the Sendwave Wallet?

Access your Wallet via the app, load money, track transactions, and support recipients to cash out in local currency through Mobile Money, bank transfer, or cash pickup.

Are there any fees for sending money with Sendwave?

Sendwave provides transparent pricing with competitive exchange rates; there are no hidden fees. The transfer fee is displayed before you confirm your transaction.

Can I set up recurring transfers or subscriptions?

Currently, Sendwave does not support recurring transfers. Check Settings > Payments for available options and future updates.

What should I do if my transfer is delayed or failed?

Use the app's support feature or contact 24/7 customer service via Settings > Support for assistance and updates on your transfer status.

Is there technical support if I encounter app issues?

Yes, Sendwave offers 24/7 customer support through the app's support section, available to help troubleshoot any technical problems.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4