- Developer

- Paysafe Holdings UK Limited

- Version

- 3.175.1

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.6

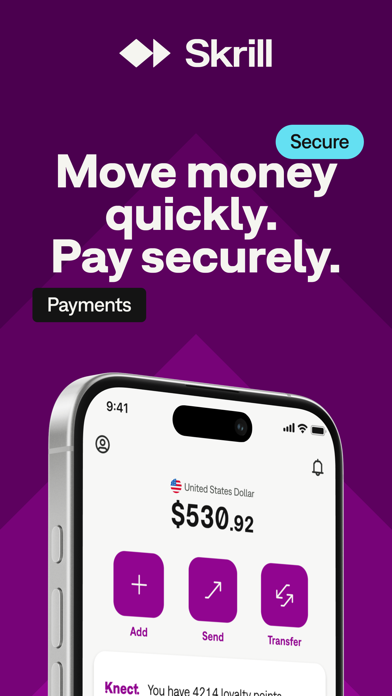

Introducing Skrill: A Fast and Secure Payment Solution for the Digital Age

In a world where digital transactions are ubiquitous, Skrill stands out as a reliable and swift platform designed to streamline online payments with a focus on security and user convenience. Developed by Skrill Limited, this application aims to cater to both everyday users and seasoned online traders who demand efficiency without compromising security.

Key Highlights of Skrill

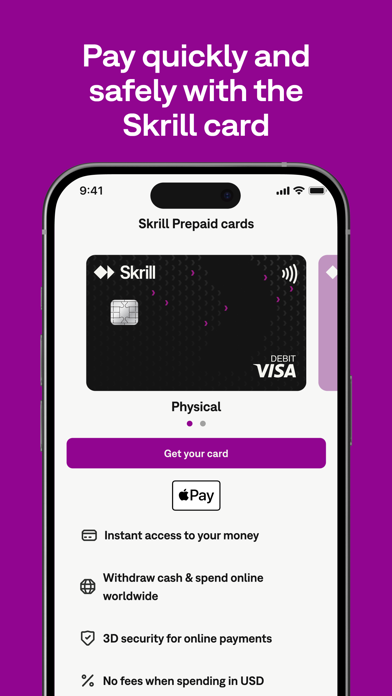

Offering an impressive suite of features, Skrill combines affordability with advanced security measures. Notable highlights include instant international money transfers, an intuitive user interface, a versatile prepaid card option, and robust fraud protection. Its seamless integration with various e-commerce platforms further enhances its appeal, making it a comprehensive financial tool for diverse needs.

Meet the Team Behind Skrill

Developed and operated by Skrill Limited—part of the Paysafe Group—this application benefits from a seasoned team with years of expertise in digital payments and fintech innovation. Their commitment is to provide a platform that balances cutting-edge security protocols with user-friendly features, ensuring a trustworthy experience for millions worldwide.

Who Is Skrill For?

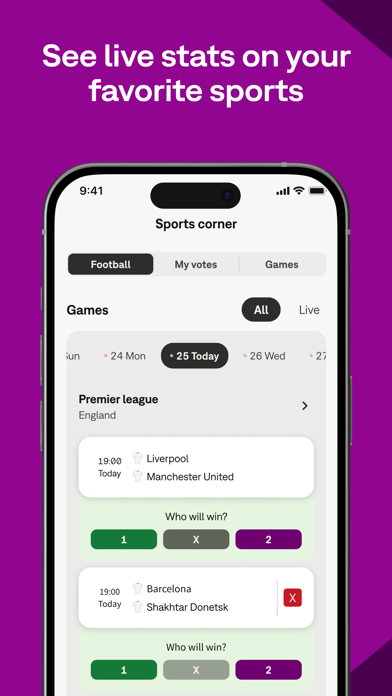

Skrill is tailored for a diverse audience: from freelancers, online entrepreneurs, and e-commerce sellers to casual users seeking quick money transfers. Its versatile functionality makes it especially appealing to those involved in online gaming, trading, and international shopping, all of whom value speed, security, and convenience in their transactions.

An Engaging Dive into Skrill's Core Features

Picture yourself navigating a digital wallet that's as smooth as gliding through a well-paved virtual alley—Skrill makes this a reality. Let's explore the core functionalities that set it apart.

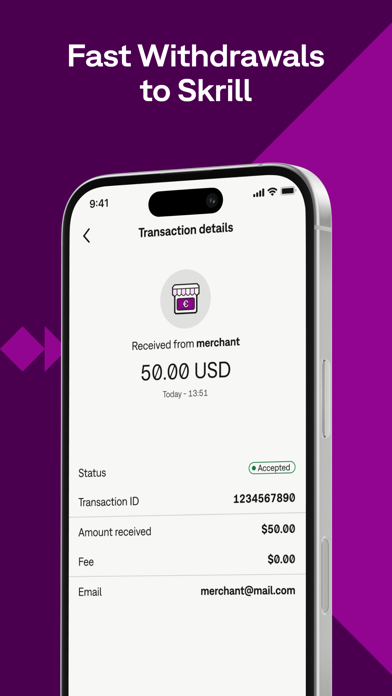

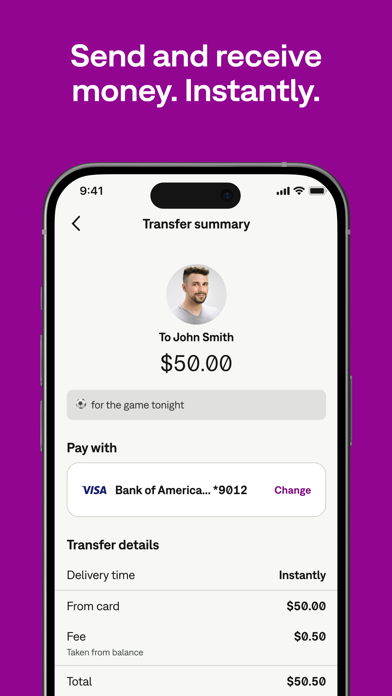

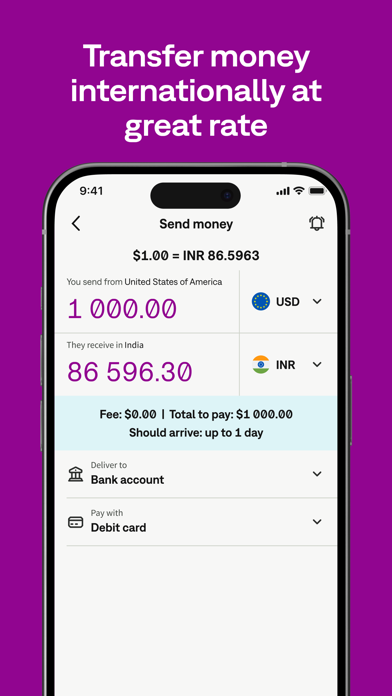

1. Lightning-Fast International Payments

One of Skrill's standout features is its ability to facilitate swift cross-border transactions. Unlike traditional bank transfers that can take days, Skrill leverages real-time processing, making international sending as quick as a wink. Whether you're paying for global services or splitting bills with friends overseas, the process is streamlined. The platform supports over 40 currencies, offering competitive exchange rates and minimal fees, ensuring your money travels efficiently without hefty charges.

2. Security You Can Trust — Top-Notch Account and Fund Safety

Security is the cornerstone of Skrill. It employs multi-layered security protocols, including two-factor authentication (2FA), biometric login options, and advanced encryption standards to safeguard user data and funds. Unlike some competitors that may leave gaps, Skrill's commitment to anti-fraud measures ensures that your account remains protected amid the growing sophistication of cyber threats. The platform also continuously monitors transactions for suspicious activity, adding an extra layer of peace of mind, especially crucial when handling sensitive financial data.

3. User-Friendly Interface and Seamless Experience

Skrill's interface is like a carefully designed cockpit—clean, organized, and easy to navigate. New users might initially feel overwhelmed by the sheer number of features, but the app's intuitive layout provides clear pathways to core functions, reducing the learning curve. Transferring money, topping up accounts, or managing prepaid cards can be done with just a few taps. The app performs smoothly on various devices, ensuring a lag-free experience whether you're on a smartphone or desktop. It's the kind of app that makes you feel confident, like having a trustworthy financial assistant always at your side.

What Makes Skrill Stand Out?

While many digital wallet services exist, Skrill distinguishes itself through its exceptional focus on security and transaction experience. Its proactive fraud detection system and compliance with top-tier banking standards make it a leader in account and fund safety. Moreover, Skrill's emphasis on transparency and minimal fees ensures users know exactly what they're paying, avoiding unpleasant surprises. Compared to competitors like PayPal or Neteller, Skrill often provides more competitive currency exchange rates and fewer hidden charges, which can be a decisive factor for international users.

Final Verdict: Is Skrill the Right Choice for You?

Overall, Skrill is a reliable, secure, and user-centric payment platform suitable for a broad range of users. Its standout ability to ensure fast, secure international transactions without complicated processes makes it particularly appealing for globally-minded individuals. If you're someone who values both speed and security—be it for online shopping, trading, or sending money abroad—Skrill deserves serious consideration.

While it may take a short time to familiarize yourself with all its features, the platform's straightforward design and robust security features make it worth the effort. For those seeking a versatile digital wallet that balances convenience with safety, Skrill remains a commendable option in the crowded fintech marketplace. I recommend giving it a try, especially if you prioritize quick, secure, and transparent online payments.

Pros

- Fast transactions

- High security standards

- Wide acceptance

- User-friendly interface

- Low transaction fees

Cons

- Limited support for certain cryptocurrencies (impact: low)

- Occasional delays in verification process (impact: medium)

- Restricted in some countries (impact: high)

- Limited in-app customer support options (impact: medium)

- Occasional app glitches (impact: low)

Frequently Asked Questions

How do I create a Skrill account and start using the app?

Download the app, tap 'Sign Up,' then fill in your personal details and verify your email to activate your Skrill account.

Is Skrill free to use for online transfers and payments?

Yes, opening an account is free, but some transactions may incur fees. Check the fee details in the app's 'Fees' section.

How can I link my credit card or bank account to Skrill?

Go to 'Settings' > 'Payment Methods,' then select 'Add Payment Method' to link your cards or bank accounts.

What are the main features of the Skrill digital wallet?

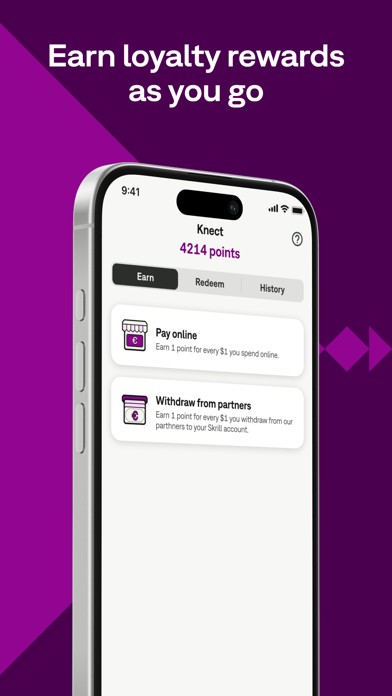

Skrill allows secure online payments, international transfers, currency exchange, and earning rewards through the Knect program.

How do I use the VISA Skrill Prepaid Card?

Create your card in the app under 'Cards,' then load funds and use it for online, in-store, or ATM payments globally.

Can I send money internationally with Skrill?

Yes, go to 'Send Money,' enter recipient details or email, and choose your amount to transfer quickly and affordably.

How do I earn rewards on my transactions?

Join the Knect loyalty program in the app, earn points on transactions, and redeem for cash or offers under 'Rewards'.

What are the benefits of becoming a Skrill VIP?

VIP members enjoy lower fees, higher transaction limits, and exclusive offers. Activate VIP status in 'Account' > 'VIP Benefits'.

How can I exchange currencies within the Skrill app?

Go to 'Wallet,' select 'Currency Exchange,' choose to exchange over 40 currencies with competitive rates.

What should I do if I experience payment issues or the app crashes?

Contact Skrill customer support through 'Help' > 'Support' in the app for troubleshooting assistance or visit their support website.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4