- Developer

- Social Finance, LLC

- Version

- 3.81.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 3.9

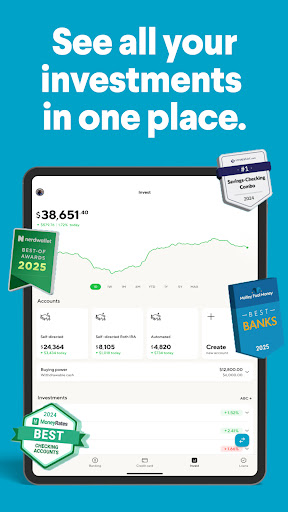

SoFi - Banking & Investing: A Modern Hub for Financial Wellness

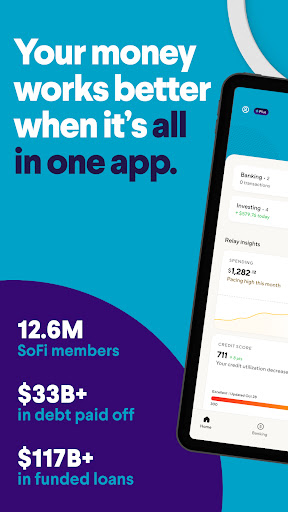

SoFi is a comprehensive financial app that seamlessly combines banking, investing, and lending services into one user-friendly platform, ideal for young professionals and digital-savvy users looking for a streamlined financial experience.

The Team Behind the Innovation

Developed by SoFi Technologies Inc., a recognized leader in fintech innovation, the app reflects their mission to provide accessible, flexible, and integrated financial solutions. The company has built a reputation for user-centric design and cutting-edge security measures to protect user assets.

Core Features That Make a Difference

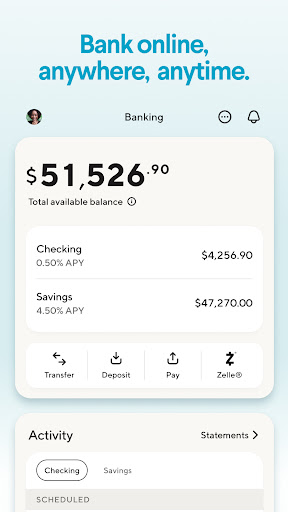

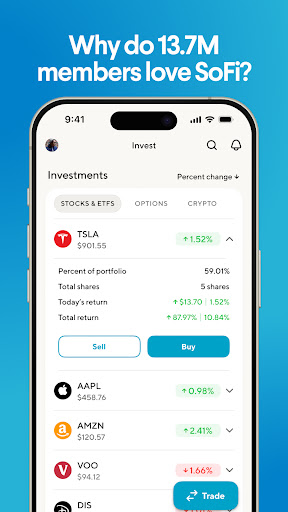

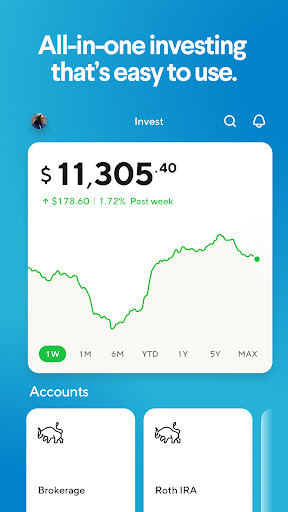

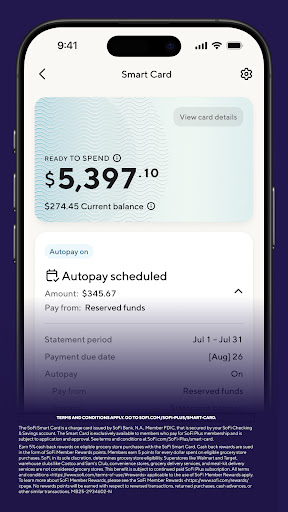

- Integrated Banking and Investment Management: Easily manage checking and savings accounts alongside investment portfolios without switching apps.

- Automated Investment Options: Features like automated round-ups and robo-advisors make investing straightforward, even for beginners.

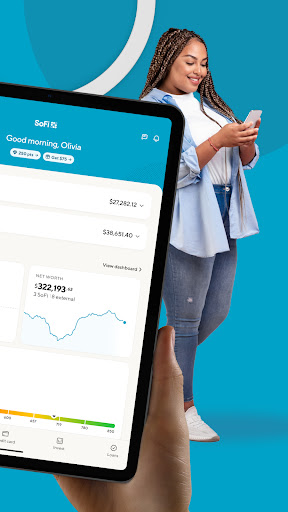

- Financial Planning Tools and Insights: In-app calculators, credit score monitoring, and personalized advice help users plan their financial future more effectively.

- Distinctive Security Measures: Multi-layered account protections and real-time fraud alerts foster trust and peace of mind.

User Experience: Navigating the Financial Roadmap

Stepping into the SoFi app feels like entering a well-organized, friendly financial dashboard—clean, intuitive, and thoughtfully designed. The home interface uses lively yet unobtrusive visuals, making it easy to find features at a glance. Navigating between banking and investing sections is effortless thanks to a bottom navigation bar that's accessible and responsive.

The app's operation flow is smooth, with lightning-fast load times and minimal lag, even during peak usage. Beginners may appreciate the onboarding process, which gently guides users through setting up their accounts and choosing investment options without feeling overwhelmed. For experienced users, advanced features such as portfolio rebalancing and detailed transaction histories are readily available, ensuring a flexible experience tailored to different levels of expertise.

Standing Out in a Crowded Marketplace

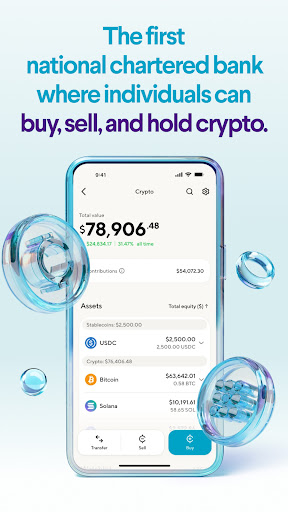

Compared with other finance apps like Robinhood or Chase, SoFi's distinguishing factor lies in its holistic approach to personal finance. Its integrated platform allows users to handle banking and investing within a single app—think of it as a financial “Swiss Army knife.”

One of the app's most noteworthy strengths is its focus on security, especially for account and fund safety. Multi-factor authentication, encryption, and real-time transaction alerts with instant freeze options ensure user assets are well-guarded. This integrated security approach makes SoFi particularly appealing for cautious investors who value peace of mind.

Additionally, SoFi excels in transaction experience. Funds transfer seamlessly across accounts without delays, and the onboarding process for new investments is simplified thanks to automated advice and AI-driven suggestions. The platform eliminates most of the friction commonly associated with investment apps, making the process feel more approachable and less intimidating.

Final Thoughts: Is SoFi Worth a Try?

For those searching for a one-stop-shop that combines banking, investing, and personal financial management, SoFi shines as an accessible, secure, and intuitive platform. While it may not yet replace dedicated robo-advisors or traditional banks for highly sophisticated needs, its overall balance of features, ease of use, and security makes it a compelling choice for everyday financial management.

Given its user-friendly design and comprehensive service suite, I recommend SoFi especially for young professionals, students, or anyone beginning their journey into personal finance. It's like having a trusted financial buddy in your pocket—ready to help you navigate your money matters confidently.

Pros

- User-friendly interface

- Comprehensive investment tools

- No-fee banking services

- Integrated banking and investing

- Educational resources

Cons

- Limited international support (impact: medium)

- Delayed customer service response (impact: medium)

- Lack of certain advanced trading features (impact: low)

- Limited cash deposit options (impact: low)

- Some features are only available in premium plans (impact: low)

Frequently Asked Questions

How do I get started with opening a new account on SoFi?

Download the app, sign up with your details, verify your identity, and link your bank accounts via the Profile > Accounts section to start using SoFi.

Can I use SoFi without any prior banking or investing experience?

Yes, SoFi is beginner-friendly with easy-to-understand tools, educational resources, and guided setup within the app to help new users start managing finances confidently.

How do I set up my budget tracking and savings goals?

Go to the Budget & Goals tab, create a new budget, and set savings targets or Vaults to organize and monitor your financial progress easily.

What features are available for investing on SoFi?

You can trade stocks, ETFs, cryptocurrencies, and fractional shares, access IPOs, and use automated portfolio management via the Invest tab in the app.

How do I transfer money between my SoFi accounts or to external accounts?

Navigate to Transfers in the app, select your accounts, choose the transfer type, enter the amount, and confirm to complete the transaction securely.

What is the cost of using SoFi's premium membership, and what are the benefits?

The SoFi Plus membership costs $10/month, offering enhanced banking features, exclusive rewards, discounts, and sweepstakes participation, accessed via the Membership > SoFi Plus section.

Are there any fees for using SoFi's banking or investing services?

Core banking features like checking, ATM withdrawals, and transfers are fee-free; some investment trades or premium services might have fees, detailed in the app or on the website.

How do I cancel or modify my SoFi Plus membership?

Go to Profile > Membership, select SoFi Plus, and follow the prompts to cancel or update your subscription easily within the app.

What should I do if I encounter login issues or account access problems?

Use the 'Forgot Password' feature on the login screen or contact SoFi support through the in-app chat or call for secure assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4