- Developer

- Splitwise

- Version

- 25.11.3

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 3.8

Splitwise: Simplifying Shared Expenses with Smart Precision

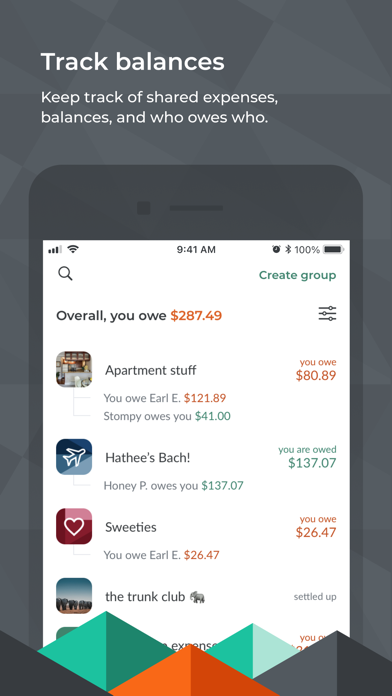

Splitwise is a user-focused app designed to seamlessly manage and settle shared expenses among friends, roommates, and groups, turning the often complex web of IOUs into clear, straightforward balances.

Who Created It and What Are Its Main Highlights?

Developed by the talented team at Splitwise Inc., this app aims to eliminate the awkwardness and confusion of splitting bills. Its core strengths include intuitive expense tracking, automatic debt balancing, and prioritized payment suggestions—ideal for anyone who frequently shares costs in social settings. Whether you're splitting rent, group trips, or dinner tabs, Splitwise offers a reliable digital ledger tailored to your needs.

Goodbye Confusion: An Entertaining Dive into Splitwise's Core Features

Effortless Expense Management & Transparent Group Balances

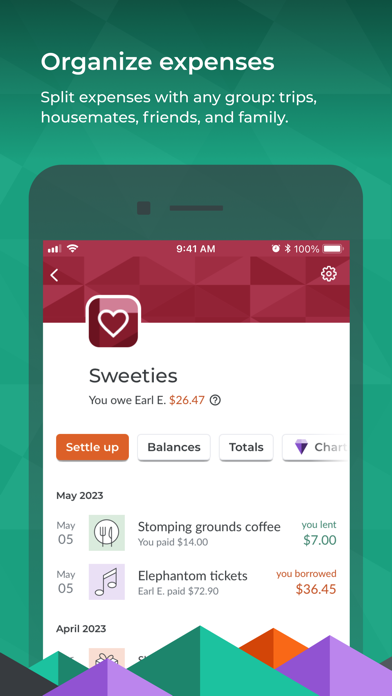

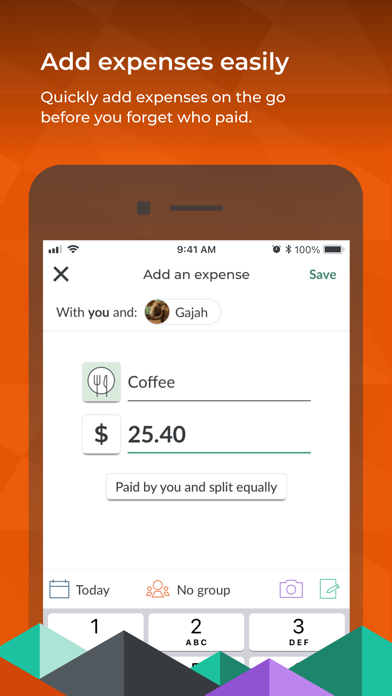

Imagine splitting a tab at a bustling restaurant; Splitwise acts like a friendly accountant who notes every expense with a click. Its interface simplifies data entry: just add members, record the expense, assign shares, and voila—each participant's owed amount is automatically calculated. The app consolidates all debts, offering a clear overview of who owes whom, turning what used to be a confusing patchwork of IOUs into a clean, easy-to-understand ledger. Smooth animations and logical layouts make navigating this section feel almost fun, transforming what could be mundane into a lighthearted experience.

Automatic Debt Settlement & Payment Optimization

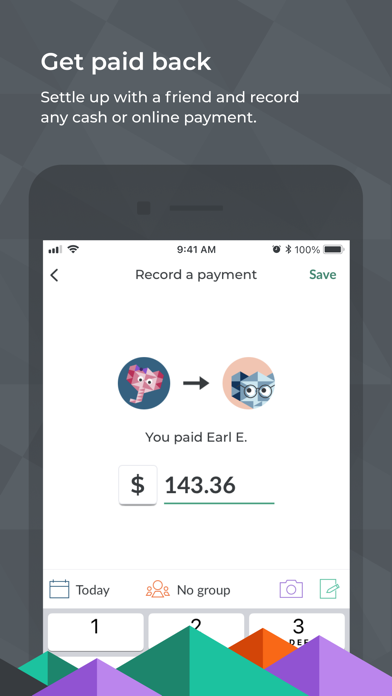

The real magic of Splitwise lies in its ability to suggest simplified payment routes—potentially reducing multiple transactions into one or two. For instance, instead of Alice paying Bob and Bob paying Charlie, the app might recommend Alice settling directly with Charlie, if that streamlines the debts. This feature, powered by its intelligent algorithms, minimizes transaction hassles, saves time, and reduces the number of transfers needed. It's akin to having a savvy financial mediator in your pocket, ensuring everyone pays and gets paid efficiently, avoiding the typical tangle of multiple small transactions.

Intuitive User Experience & Unique Security Aspects

The app boasts a clean, inviting design reminiscent of a friendly notebook, with bright colors and simple icons that make navigation effortless. It's built for users of all ages—be it young students splitting pizza nights or families managing shared expenses. The learning curve is friendly; most users grasp its functionalities within minutes. Moreover, Splitwise emphasizes data privacy and account security by encrypting sensitive information and offering effortless login options through trusted credentials. Unlike some finance apps that focus solely on individual wealth management, Splitwise's niche focus on group expense transparency makes it uniquely trustworthy for communal financial dealings.

How Does It Compare & When to Use

Compared to other finance apps that primarily track personal budgets or investments, Splitwise's specialization in shared expenses sets it apart. Its focus on debt simplification through intelligent algorithms ensures that group payments are not just logged but optimized for minimal fuss. This feature shines in scenarios such as renting shared living spaces, traveling with friends, or coordinating event costs. It eliminates the common headache of tracking who owed what, when, and how to settle quickly and fairly.

Verdict: Your Go-To Group Expense Companion

Overall, I recommend Splitwise to anyone who often manages shared expenses. Its standout feature—the intelligent debt-simplification algorithm—is a game-changer for group transactions, making settling up both seamless and less stressful. If you're tired of escalating IOU spaghetti and want a reliable, transparent, and straightforward way to handle group finances, this app deserves a place on your mobile device. Just imagine it as having an invisible accountant who smartly orchestrates your collective expenses, giving you more time to enjoy your weekends rather than sweating over who paid last.

Pros

- User-Friendly Interface

- Multiple Currency Support

- Automatic Balance Calculations

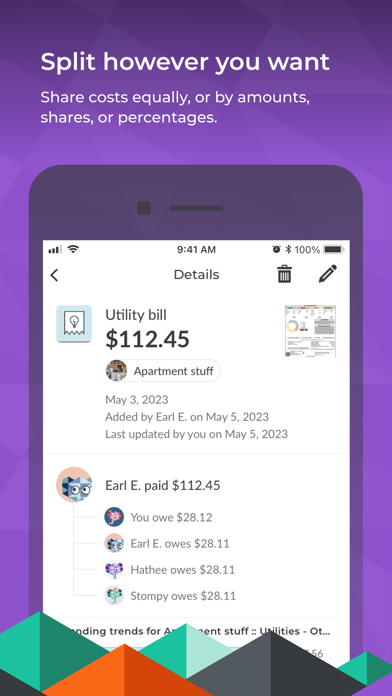

- Split Customization Options

- Integration with Payment Services

Cons

- Limited Offline Functionality (impact: medium)

- Notification Overload (impact: low)

- Basic Expense Tracking Without Advanced Budgeting (impact: medium)

- Limited Custom Reports (impact: low)

- Occasional Sync Delays (impact: low)

Frequently Asked Questions

How do I start using Splitwise for my group expenses?

Download the app, create an account, then tap 'Create Group' to add friends or family and start recording expenses easily.

Can I use Splitwise offline to enter expenses?

Yes, you can add expenses offline; they will sync automatically online once you're connected to the internet.

How do I add expenses to a shared group?

Open the group, tap 'Add Expense,' enter details, select payers and amount, then save. You can also split costs equally or unequally.

How can I settle up my balances with friends in Splitwise?

Use the 'Settle Up' button to record cash payments or connect supported payment services like Venmo or PayPal for quick settlements.

What features help me organize expenses better?

You can categorize expenses, split costs in various ways, add comments, and create recurring bills for regular expenses.

How does Splitwise support multi-currency transactions?

In the settings, go to 'Currency' to select your preferred currency. Pro users can convert expenses with Open Exchange Rates for international use.

Is there a premium version and what features does it include?

Yes, Upgrade to Splitwise Pro via 'Settings > Subscription' to access currency conversion, receipts OCR, budgets, and advanced search features.

How do I upgrade to Splitwise Pro?

Navigate to 'Settings > Subscription', choose Splitwise Pro, and follow the prompts to subscribe and unlock additional features.

What should I do if I encounter a syncing problem or app bug?

Try relaunching the app, ensure your device has internet access, or update to the latest version. Contact support via 'Help & Support' if needed.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4