- Developer

- Block, Inc.

- Version

- 6.92.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.7

A Sleek Newcomer in Digital Finance: An In-Depth Review of Square Team's Latest App

Imagine managing your finances with the ease and confidence of a seasoned navigator—Square Team's latest application promises just that, blending cutting-edge security with user-friendly features designed for today's busy digital world. Whether you're tracking expenses, investing, or securing transactions, this app aims to be your all-in-one financial companion.

Meet the Developers and Core Highlights

Developed by Square Team, a forward-thinking group known for innovative financial solutions, this app is crafted with a clear focus on empowering users to handle their money confidently. Its standout features include robust account and fund security, intuitive transaction experiences, and comprehensive financial insights. While it caters to a broad audience, it is particularly well-suited for young professionals, small business owners, and anyone seeking a seamless digital finance tool.

Jump Into the World of Finance: A Fresh and Friendly Introduction

Picture this: you're sitting at a cozy coffee shop, laptop open, phone buzzing with notifications about your latest transactions, investments, and budget goals. The interface of this app feels like a conversation with an expert friend—simple, reassuring, and efficient. Its design invites you to explore your finances without feeling overwhelmed. The app's vibrant yet clean visual language makes navigation a breeze, turning what used to be a chore into an engaging experience. Whether juggling multiple accounts or diving into investment details, users are greeted with clarity and responsiveness that make managing money almost enjoyable—yes, almost as joyful as discovering a forgotten ten-dollar bill in your old jacket pocket.

Core Features Explored

Secure Account and Fund Management

The app's most distinguished feature is its emphasis on security. Utilizing advanced encryption protocols and biometric authentication, it ensures your funds are protected against unauthorized access. Unlike many competitors that sprinkle security as an afterthought, this app integrates it into every layer of operation, giving users peace of mind. Imagine a fortress built into the app; your financial data and transactions are shielded by multiple security gates, making hacking attempts feel like breaking into a digital castle—difficult and unlikely.

Fluid and Intuitive Transaction Experience

Moving money around feels as smooth as sliding a credit card through a reader—quick, seamless, and reliable. Whether transferring funds between accounts, paying bills, or sending money to friends, the app minimizes steps, reducing transaction time and frustration. The transaction history is displayed in a clean, digestible timeline, allowing users to track spending effortlessly. Real-time updates and instant notifications keep you informed, transforming financial management from a chore to a choreographed dance—you're in control and always aware.

Insightful Financial Analysis and Personalized Recommendations

The app doesn't just show you numbers; it paints a picture of your financial health. Using intelligent algorithms, it offers tailored advice—whether suggesting better budget allocations or highlighting saving opportunities based on your spending patterns. This feature acts like a friendly financial coach, helping you understand where your money goes and how to make smarter decisions. This level of personalized insight sets it apart from more static finance apps that merely display data without context.

Evaluating User Experience: Design, Performance, and Learning Curve

The interface strikes a balance between modern minimalism and functional clarity. The color palette is soothing yet lively, making navigation pleasant without causing visual fatigue. Responses are snappy—scrolls, taps, and transitions happen instantly, reinforcing the perception of reliability. For new users, onboarding is streamlined with guided tutorials and tooltips, smoothing out the learning curve. Seasoned users will appreciate customizable dashboards and detailed analytics, which can be tailored to individual preferences. Overall, the app feels polished and mature, yet approachable—like learning to ride a bike with stabilizers that can be removed once you're confident.

Unique Selling Points and How It Stands Out

What truly sets this app apart is its dual focus on security and personalized intelligence. Unlike many other finance apps which primarily provide data views or basic transaction capabilities, this app emphasizes safeguarding your assets using high-end encryption and biometric authentication—making account security the top priority. Additionally, its smart recommendation engine acts almost like a financial GPS, guiding users toward better financial destinations. These features are not just add-ons; they are integrated deeply into the user experience, providing a level of confidence and insight that many competitors fail to match.

Final Verdict and Recommendations

For those seeking a dependable, user-friendly, and secure digital finance tool, this app merits strong consideration. Its thoughtful design and innovative features make managing your finances less of a burden and more of a reliable partnership. While it may require a brief period for beginners to familiarize themselves with the detailed analytics and security settings, the payoff in terms of peace of mind and control is substantial. I recommend this app primarily to users who prioritize security and personalized insights in their financial management, and I believe it stands out as a top-tier choice in today's crowded market.

Pros

- User-Friendly Interface

- Fast Transaction Processing

- Robust Security Measures

- Versatile Payment Options

- Comprehensive Business Tools

Cons

- Limited Customization Options (impact: medium)

- Occasional Slow App Response (impact: low)

- Need for Better Offline Functionality (impact: medium)

- Limited Customer Support Channels (impact: low)

- Device Compatibility Constraints (impact: low)

Frequently Asked Questions

How do I get started with Square Team for my business?

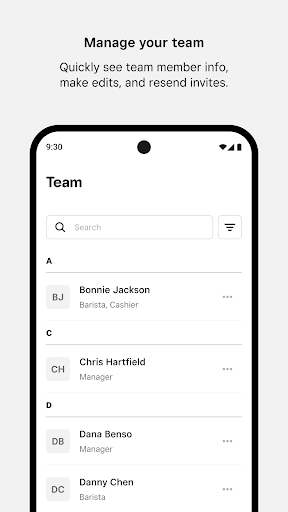

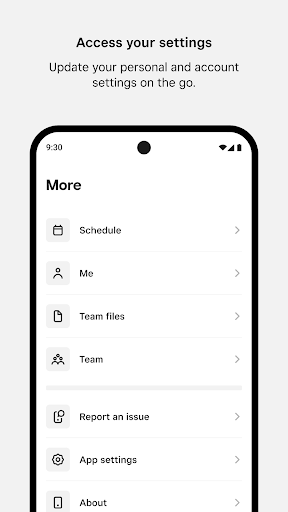

Download the app from App Store or Google Play, then sign up with your business details and invite team members via Settings > Team Management.

Can I use Square Team on both Android and iOS devices?

Yes, Square Team is available on both Android and iOS platforms. Download it from Google Play or Apple App Store and log in with your account.

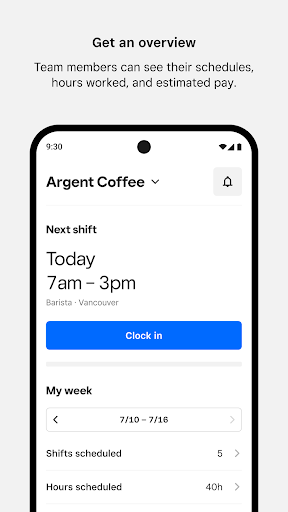

How do I clock in and out for shifts using the app?

Open Square Team, navigate to your shift, and tap 'Clock In' or 'Clock Out' on the home screen or shift details page.

How can I view my scheduled shifts and estimated pay?

Go to the Home Screen; your scheduled hours and estimated pay are displayed in the Weekly Snapshot section.

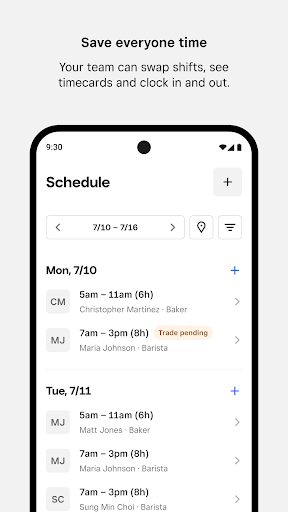

How do I request a shift swap or time off within the app?

Navigate to Shifts > Requests, then select 'Request Time Off' or 'Swap Shift' and follow the prompts to submit your request.

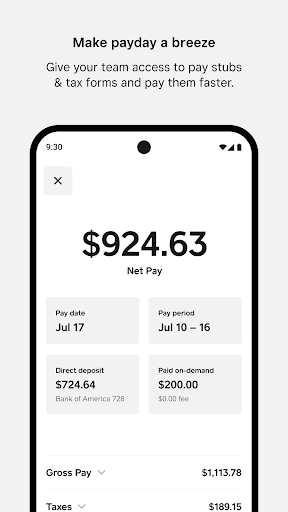

How does the payroll process work with Square Team?

For payroll, connect your Square Payroll account via Settings > Payroll. Timecards and tips are imported automatically to process payments.

How can I view and download my pay stubs or tax forms?

Go to Profile > Income & Taxes, then select 'Pay Stubs' or 'Download Tax Forms' for access and download options.

Is there a subscription fee to use Square Team, and what are the payment options?

Square Team offers both free and paid plans; check Settings > Subscription for available plans and billing details.

How do I upgrade or change my subscription plan?

Navigate to Settings > Subscription, choose your preferred plan, and follow the prompts to upgrade or modify your subscription.

What should I do if I encounter a technical issue with the app?

Try restarting the app or updating it. For persistent issues, contact support via Settings > Help & Support for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4