- Developer

- Step Mobile, Inc

- Version

- 25.24.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

Step: Instant Cash and Rewards — A Fresh Approach to Earning on Your Terms

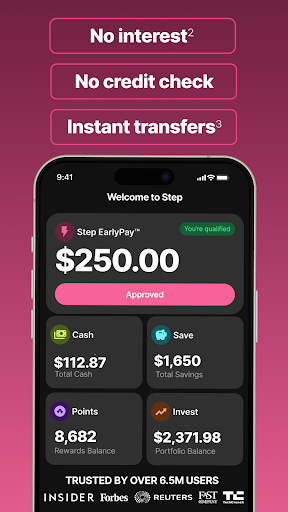

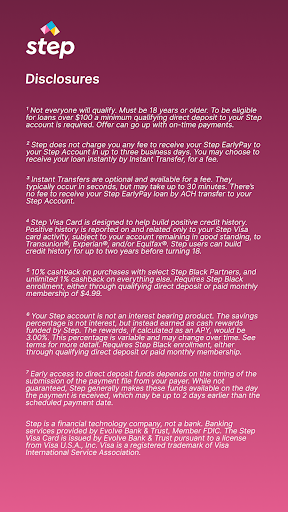

Step is a mobile application designed to transform the way users earn rewards and instant cash by engaging in simple, everyday activities. Developed by a dedicated team committed to user-centric financial solutions, this app offers a seamless experience with features aimed at maximizing earning potential for a broad audience — from students and part-timers to busy professionals. With its focus on security, ease of use, and innovative reward systems, Step aims to stand out in the crowded landscape of financial apps.

Core Features That Make Step Shine

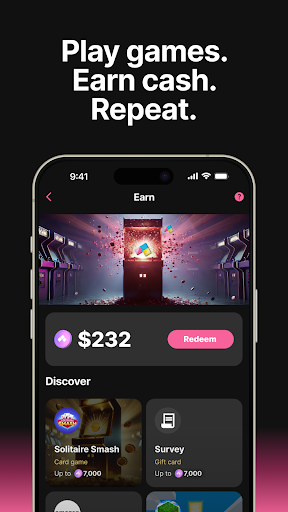

The app's primary draw lies in its straightforward yet versatile functionalities. First, its reward system is built around micro-tasks that users can complete in their daily routines. Second, the instant cash-out feature ensures users see benefits without long waits, adding immediacy to their earning experience. Third, the app offers personalized cashback offers and bonus opportunities based on user activity, encouraging continued engagement and loyalty. Lastly, its simple referral program helps users grow their earning opportunities organically, making it a community-driven platform.

Engaging and Intuitive User Experience

From the moment you open Step, you're greeted with a clean, colorful interface that feels like flipping through a well-designed digital wallet rather than navigating a complicated app. The dashboard is intuitively arranged, with a clear overview of your current earnings, available rewards, and upcoming tasks. The app's operation is remarkably smooth, with animations and transitions that are both fluid and unobtrusive. Completing a task, claiming rewards, or checking your balance feels quick and effortless, akin to having a trusted, helpful assistant by your side.

Learning curve wise, Step is friendly for newcomers. Its onboarding process guides you through how to participate in tasks and maximize your rewards. Frequent users will find the app's layout familiar and easy to navigate, encouraging longer engagement without feeling overwhelmed.

Distinctive Strengths: Security and Transaction Experience

One of the standout features of Step is its emphasis on account and fund security, setting it apart from many peers. The app employs robust encryption protocols for all transactions, providing peace of mind that your earnings are protected. Unlike some reward apps that sometimes raise doubts about fund safety, Step's transparent transaction history and secure withdrawal process foster trustworthiness.

In terms of transaction experience, Step excels with its instant cash-out feature. Users can withdraw earnings to their linked bank accounts or digital wallets immediately, mirroring the seamlessness of making a quick digital payment. This immediacy not only enhances user satisfaction but also encourages more frequent engagement, as users see tangible results quickly — much like turning a small seed into a flourishing plant overnight.

Additionally, the app's reward system is flexible, allowing users to choose how and when they cash out, with minimum thresholds kept user-friendly. This level of control is a significant advantage over competing apps that impose strict or complicated withdrawal limits.

Final Thoughts: Friendly Recommendation for the Everyday User

For anyone seeking a straightforward, safe, and rewarding way to supplement their income, Step offers a compelling option. Its most notable features — especially the combination of instant cash-out and a secure, transparent transaction process — make it stand out. The app's design caters well to users of all experience levels, and its emphasis on security reassures those wary of digital financial platforms. While it may not replace your primary income source, it's a trustworthy companion for turning your spare moments into tangible benefits.

In conclusion, I'd recommend giving Step a try if you're looking for an approachable, user-friendly rewards app with a few innovative touches. It's especially suitable for users who value security and instant gratification, making it a valuable addition to your digital toolbox for earning on the go.

Pros

- User-Friendly Interface

- Instant Cash Payouts

- Multiple Reward Options

- Variety of Earning Tasks

- Regular Promotions

Cons

- Limited Earning Potential (impact: medium)

- Account Verification Process (impact: low)

- Limited Availability in Some Regions (impact: medium)

- Occasional Technical Glitches (impact: low)

- Potential for Incentive Saturation (impact: low)

Frequently Asked Questions

How do I create a new account on Step: Instant Cash and Rewards?

Download the app, open it, then follow the registration prompts to sign up using your email or phone number. Complete the verification steps to activate your account.

Can I link my existing bank account to use the Step card?

Yes, during setup, go to Settings > Payment Methods > Link Bank Account, and follow the instructions to connect your bank account securely.

What are the main features of Step that help me earn cash?

You can earn money by playing games, completing surveys, and participating in challenges through the app's Engagement Activities section and reward offers.

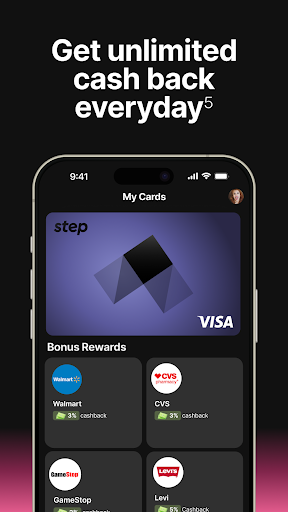

How does the cashback feature work when using the Step card?

Every purchase with your Step card earns at least 1% cashback automatically. Check rotating merchant offers within the app for higher cashback rates.

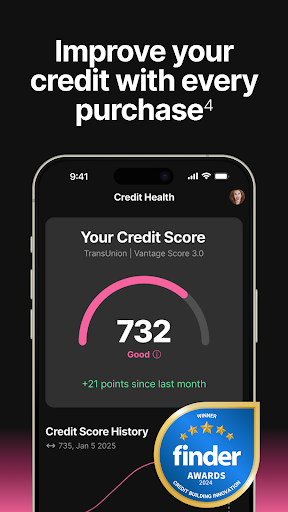

How can I build my credit score using the app?

Use the Step card for everyday purchases and pay on time. The app reports your activity to credit bureaus, helping you improve your score over time.

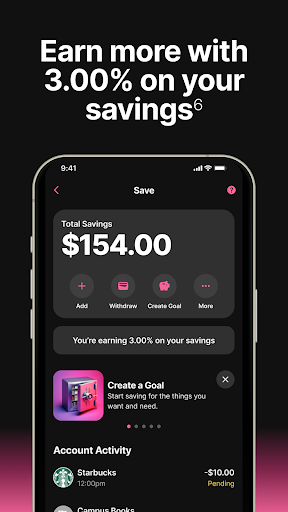

What is the process to set up and start saving with high-yield savings?

Deposit funds into your Step savings account from the app. Go to Savings > Set up a new savings goal, and enjoy up to 4% interest on your balance.

Is there a fee for using the Step app or its services?

Most features, including credit building and basic savings, are free. Check the app's fee section in Settings > Fees for detailed information.

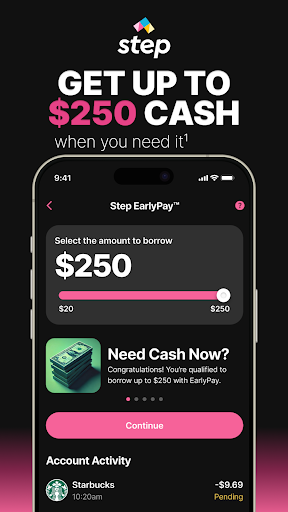

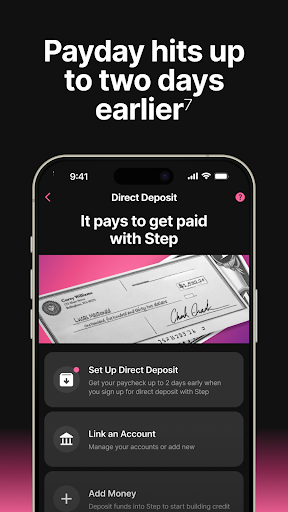

How do I apply for the early access to funds with Step EarlyPay?

Set up direct deposit for your paycheck in Settings > Payments. Then, select the EarlyPay option to receive up to $250 instantly, typically up to 2 days early.

Are there any subscription costs or premium plans I should be aware of?

The app offers free services with optional perks. To view available plans, go to Settings > Premium or Rewards, and choose based on your preferences.

What should I do if the app crashes or I encounter technical issues?

Try restarting the app, ensure your internet connection is stable, or contact customer support via Settings > Help > Contact Support for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4