- Developer

- Super (previously SnapTravel)

- Version

- 13.3.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

Super.com - Save, Earn, Travel: A Comprehensive Review of a Modern Financial Companion

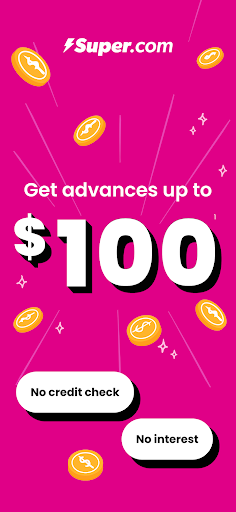

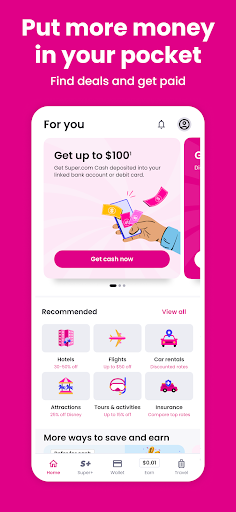

Super.com is a versatile app designed to help users effortlessly save money, earn rewards, and plan trips—packaged into an intuitive platform that aims to simplify personal finance and travel planning for everyday users.

About the App: Basic Info and Core Highlights

Developed by Super Technologies Inc., a team dedicated to merging financial management with travel convenience, Super.com positions itself as an all-in-one financial lifestyle app. Its main features include automatic savings tools that round up purchases, earning opportunities through cashback and rewards, and integrated travel planning services. Designed primarily for busy professionals, students, and travel enthusiasts, the app targets users seeking a seamless approach to managing their finances while also preparing for their next adventure.

A Vibrant Entry into the Digital Financial World

Imagine a magic wallet that not only helps you save a little with every purchase but also rewards you for your everyday spending—Super.com acts like that, turning mundane transactions into opportunities for financial growth. Its clean interface and playful design make the experience feel less like a chore and more like a game—encouraging users to stay engaged without feeling overwhelmed. Whether you're a budgeting novice or a travel-minded globetrotter, Super.com aims to turn your financial routines into enjoyable, rewarding activities.

Smart Saving and Spending Automation

Round-Up and Savings Goals

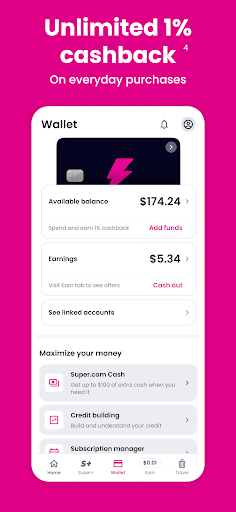

One of Super.com's flagship features is its automatic round-up system. When you make a purchase, the app rounds your transaction amount to the nearest dollar (or any chosen increment) and funnels that spare change into a dedicated savings pot. It's like having a tiny financial assistant that silently works in the background, helping you build a nest egg without feeling the pinch. Additionally, customizable savings goals allow you to set specific targets—saving for a vacation, new gadget, or emergency fund—making your financial aspirations tangible and trackable.

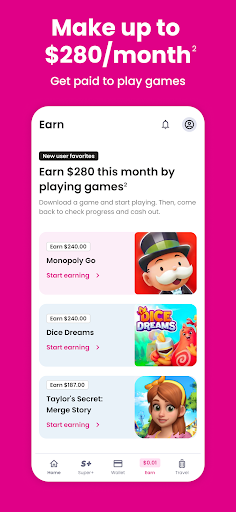

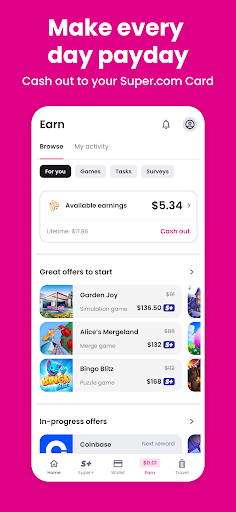

Reward System and Cashback Offers

Whether you're shopping online or at local stores, Super.com's integrated cashback feature ensures you earn rewards on everyday expenses. It partners with various merchants to offer cashback and special promotions, turning your usual spending into a rewarding experience. Users can view tailored deals within the app, making it easy to capture savings without extra effort. This feature distinguishes Super.com from many traditional budget apps by seamlessly blending saving and earning functionalities in one interface.

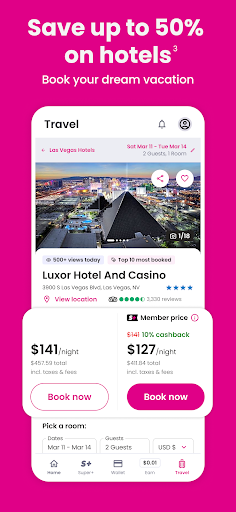

Travel Integration: Turn Savings into Adventures

Trip Planning Meets Financial Prep

What sets Super.com apart is its unique synergy between financial management and travel planning. Users can allocate their saved funds directly toward future trips, create travel itineraries, and receive personalized recommendations—all within the same app. It's like having a dedicated travel agent and accountant in your pocket, inspiring you to turn your savings into memorable journeys. For globetrotters, this integration fosters motivation to save, knowing each dollar is a step closer to their dream destination.

Security and User Experience

In terms of security, Super.com employs bank-level encryption and multi-factor authentication, ensuring your financial data stays private and protected. The app's interface is refreshingly straightforward—minimalist but powerful—allowing users to navigate effortlessly between savings, rewards, and travel planning sections. The learning curve is gentle; even newcomers to financial apps can quickly grasp core functionalities without frustration. Transactions are smooth and responsive, reducing any anxiety associated with digital money management.

How Does It Stand Out From Its Peers?

Compared to other financial apps like Mint or Acorns, Super.com's highlight is its dual focus on **automatic savings paired with integrated travel planning**. Unlike typical budgeting tools that purely track expenses, Super.com actively helps users grow their savings through automation and rewards. Its reward system, combined with seamless cashback offers, also adds a layer of earning potential not always found in similar apps. Furthermore, the emphasis on secure, user-friendly interfaces makes it a reliable companion for those wary of complex financial services—striking a balance between functionality and simplicity.

Final Thoughts and Recommendations

Super.com is a thoughtfully designed app that brings a fresh perspective to combining personal finance with lifestyle aspirations. Its most impressive feature—automatic savings coupled with travel planning—serves as a motivating force for users to stay financially disciplined while dreaming bigger. The app's intuitive design, coupled with strong security measures, ensures a positive user experience suitable for a broad demographic.

For anyone looking to make their savings work harder and turn everyday expenses into travel opportunities, Super.com offers a compelling platform worth trying. Beginners can find it approachable thanks to its straightforward layout, while experienced users will appreciate its integrated reward ecosystem. Overall, I'd recommend Super.com as a friendly yet potent tool for managing money smarter—think of it as your digital pal helping you earn, save, and explore more confidently.

Pros

- User-friendly interface

- Multiple earning opportunities

- Integrated travel booking

- Personalized offers

- Secure transactions

Cons

- Limited international coverage (impact: medium)

- Reward redemption complexity (impact: medium)

- Occasional app bugs (impact: low)

- Limited customer support channels (impact: low)

- Some offers are region-specific (impact: medium)

Frequently Asked Questions

How do I get started with Super.com and create an account?

Download the app from app stores, open it, tap Sign Up, and follow the prompts to create your account quickly and easily.

Is Super.com free to use, and are there any subscription fees?

Yes, Super.com is free to download and use. Some premium features may require a subscription, which can be managed via Settings > Subscription.

How can I earn rewards or cashback with Super.com?

Complete activities like bookings, surveys, or referrals. Rewards appear in your account dashboard; manage via Menu > Rewards & Cashback.

What travel discounts can I expect with Super.com?

Enjoy up to 50% off hotels, discounted flights, car rentals, and attractions. Book through the Travel section within the app for savings.

How do I track my savings and rewards in the app?

Access Reward Center or My Account to view cashback, discounts, and accumulated benefits in one place for easy tracking.

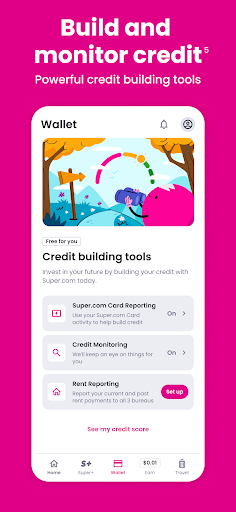

Can I use Super.com to build my credit score?

Yes, apply for the Super.com Card in Settings > Card. Use it responsibly; activity can be reported to bureaus to boost your credit.

What are the costs involved for using the Super.com Card?

The card itself has no upfront fees. You load funds onto it; no interest charges apply if you spend within your balance. Check in Settings > Card for details.

How do I manage subscriptions and unnecessary expenses within Super.com?

Use the Subscription Manager feature in the app under Settings > Subscription Manager to identify and cancel unused subscriptions.

What should I do if I encounter technical issues with the app?

Try restarting your device, update the app, or contact Support via Settings > Help & Support for assistance.

Can I refer friends to Super.com and earn rewards?

Yes, invite friends through Menu > Refer & Earn. You'll earn cashback and rewards when they join and use the app.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4