- Developer

- Taptap Send, Inc.

- Version

- 2.63.0

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.7

Introducing Taptap Send: Seamless International Money Transfers

As globalized economies thrive, the need for quick, affordable, and secure cross-border money transfers has never been more pressing. Taptap Send steps into this space with a clear mission: to simplify remittances for migrant workers and their families, providing a trustworthy platform that bridges continents with just a few taps on your smartphone.

Developed by a Dedicated Team Focused on Financial Accessibility

Created by a passionate fintech company committed to financial inclusion, Taptap Send is designed to serve underserved communities with an easy-to-use, low-cost remittance solution. Their team emphasizes transparency, security, and user-centered design, ensuring users from diverse backgrounds can navigate the app effortlessly.

Core Highlights That Make Taptap Send Stand Out

- Affordable and Transparent Fees: Offers some of the lowest transfer costs with upfront fee disclosures, preventing unpleasant surprises at checkout.

- Fast and Reliable Transfers: Ensures money reaches recipients within minutes to a few hours, depending on countries involved, supported by a robust network.

- Multiple Coin and Country Partnerships: Supports numerous countries in Africa, Asia, and the Caribbean, broadening users' remittance options.

- Focus on Security: Implements bank-level encryption and compliance standards to safeguard user data and funds.

Vivacious Journey Through the App's Core Features

Imagine sending money as easily as sending a quick text to a good friend; Taptap Send makes this possible through its intuitive design and streamlined process. Once you open the app, you're greeted with a friendly, clean interface—bright icons, straightforward menus, and a welcoming vibe that eases even the most technologically timid users.

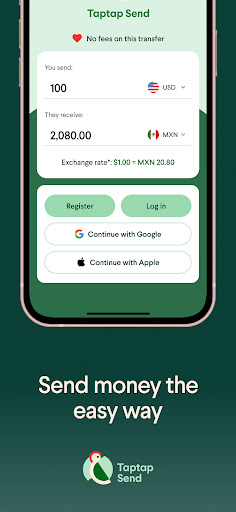

Effortless Transaction Experience

The centerpiece of Taptap Send is its simple transaction workflow. After selecting the recipient's country and entering the amount, users quickly compare fee options—transparent and upfront—making decisions transparent. Payment can be made via bank transfer, card, or accepted mobile money wallets. The app instantly confirms the transfer, providing real-time tracking updates. This smooth process transforms the often cumbersome remittance experience into a hassle-free activity, much like chatting with a good friend across the table.

Prioritized Security and Trustworthiness

What truly sets Taptap Send apart from many competitors is its unwavering commitment to security—think of it as a vault that you can trust with your most valuable possessions. All transactions are encrypted with bank-grade standards, and the company adheres to strict regulatory compliance across its operating regions. Users can feel confident that their sensitive data and funds are protected, bolstering trust in an often volatile industry. Comparing to other finance apps, Taptap Send's focus on security reassures users, especially those transferring significant sums or handling sensitive information.

Intuitive Interface with Honest Learning Curve

Even if you're new to digital money transfers, Taptap Send makes onboarding quite friendly. The app's design is minimalistic, and helpful prompts guide your steps seamlessly. While becoming fully proficient might require some initial exploration, the overall learning curve is gentle—a friendly nudge rather than a steep climb. This thoughtful usability makes it accessible for users of all ages and tech-savviness, akin to learning to ride a bike with training wheels before going full speed.

Unique Selling Points in a Crowded Field

Among its peers, Taptap Send's standout feature is its unwavering focus on both cost-efficiency and security for the everyday remitter. The app's transparent fee structure combined with rapid, reliable transfers positions it as a top choice for migrant workers sending money home. Unlike some competitors that obscure hidden charges or offer inconsistent transfer speeds, Taptap Send emphasizes honesty and dependability. Moreover, its regional partnerships and user-centric approach cultivate a sense of community trust—turning a transactional process into a reliable lifeline.

Final Verdict: A Recommended Choice for Everyday Remitters

While no app is perfect, Taptap Send strikes a compelling balance of affordability, security, and ease of use. If your primary aim is to send money quickly and securely without breaking the bank—especially across Africa, Asia, or the Caribbean—it deserves a spot on your shortlist. For those willing to explore a platform that truly prioritizes user trust and convenience, Taptap Send is a solid, friendly companion in your financial journey.

Pros

- Low Transfer Fees

- Fast Transaction Speeds

- User-Friendly Interface

- Wide Recipient Coverage

- Robust Security Features

Cons

- Limited Payment Methods (impact: Medium)

- Occasional App Stability Issues (impact: Medium)

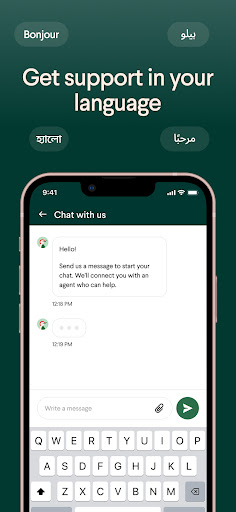

- Customer Support Response Time (impact: Low)

- Limited Promotional Offers (impact: Low)

- Information Clarity on Exchange Rates (impact: Low)

Frequently Asked Questions

How do I get started with Taptap Send?

Download the app on Android or iOS, register with your phone number, and follow the on-screen instructions to set up your account easily.

Is it safe to use Taptap Send for international transfers?

Yes, Taptap Send uses PCI-compliant encryption, is regulated in multiple countries, and never stores card data, ensuring your funds and information are secure.

How can I send money to my family abroad?

Open the app, select 'Send Money,' choose the recipient, enter amount, and select your preferred payout option like mobile wallet, bank transfer, or cash pickup.

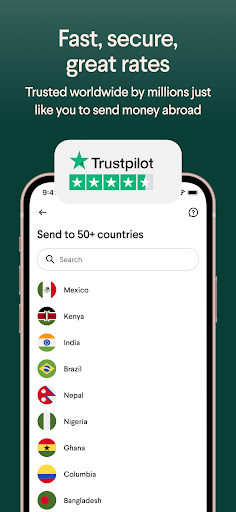

What countries and destinations does Taptap Send support?

You can send money from countries like the US, UK, Canada, Australia, and the UAE to over 50 countries, including India, Nigeria, Pakistan, Brazil, and Mexico. Visit taptapsend.com for a full list.

What payout options are available for my recipient?

Recipients can choose mobile wallets (e.g., JazzCash, MTN), bank transfers, or cash pickups at partner locations, making receiving funds flexible and convenient.

Are there any fees when I send money with Taptap Send?

Taptap Send offers transparent, low-cost transfers with no hidden fees; some transactions may be fee-free depending on promotion or transfer method. Check the app for details.

How does Taptap Send achieve competitive exchange rates?

The app offers real-time, market-oriented rates that often outperform traditional banks, maximizing the amount your recipient receives. Rates are displayed before confirmation.

Can I track my transfer in real time?

Yes, Taptap Send provides real-time tracking of your transactions within the app, so you know exactly when your funds reach the recipient.

How do I resolve a transfer issue or failure?

Contact support via [email protected] through the app or email for assistance. Our multilingual team is ready to help resolve any transfer problems quickly.

Are there any subscription or premium features I need to pay for?

Taptap Send primarily offers free transfers; some special features or faster delivery options may have costs. Check the app's billing section under Settings > Account for details.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4