- Developer

- TD Bank, N.A.

- Version

- 26.3.0.27

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.1

TD Bank (US) App: A Secure and User-Friendly Digital Banking Companion

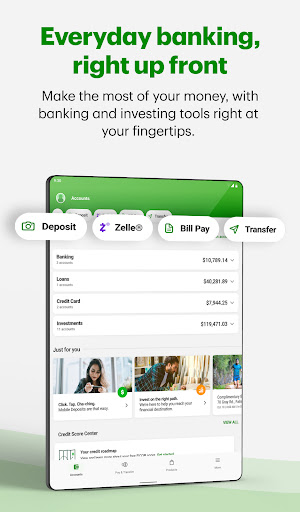

The TD Bank (US) mobile app is designed to bring banking convenience directly to your fingertips, combining robust security features with an intuitive user experience tailored for everyday banking needs.

Developer and Core Highlights

Developed by TD Bank, one of North America's leading financial institutions, this app emphasizes seamless digital banking, security, and personalized financial management. Its main features include real-time transaction updates, advanced account security measures, easy bill pay, and customizable alerts tailored to user preferences. The targeted audience encompasses retail banking customers seeking a trustworthy, easy-to-navigate banking tool that fits into their busy lifestyles.

Engaging and Practical: An Introductory Thought

Imagine having your bank's vault nestled comfortably in your pocket—ready to open at a moment's notice, yet fortified with layers of security that prevent unwanted entry. That's precisely what the TD Bank (US) app strives to offer—an intelligent companion for managing your finances, whether you're at home, commuting, or on vacation. Unlike some clunky or overly complicated banking apps, TD's offering aims for that sweet spot where sophistication meets simplicity, making banking feel less like a chore and more like a natural part of your day.

Core Features That Make a Difference

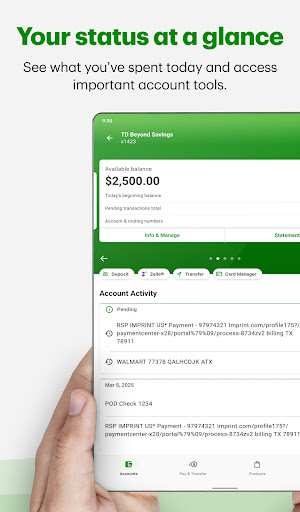

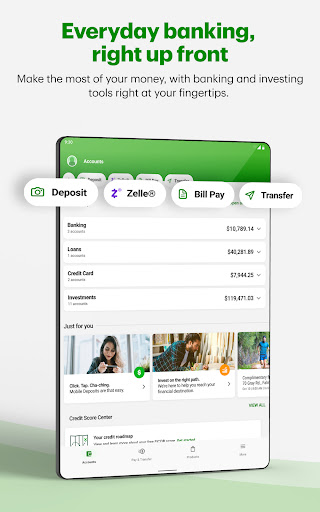

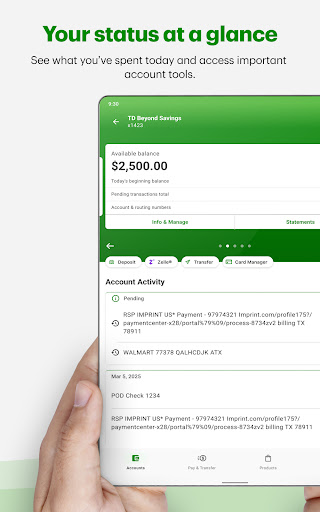

Real-Time Transaction Monitoring and Management

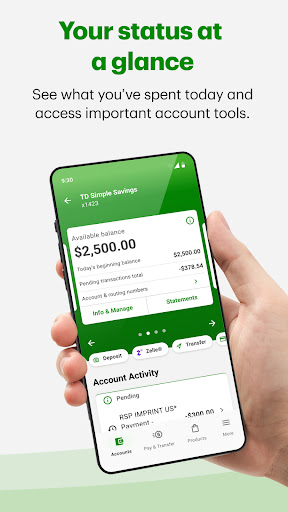

One of the app's standout features is its real-time transaction updates, which function almost like a live newsfeed for your finances. As soon as money moves in or out, notifications pop up, keeping you in the loop without needing to log into your online banking portal. This is especially handy for catching unauthorized transactions early or simply tracking your spending habits to stay within budget. The transaction flow is smooth, with minimal lag, providing a satisfying sense of control and awareness—much like having a financial radar at your fingertips.

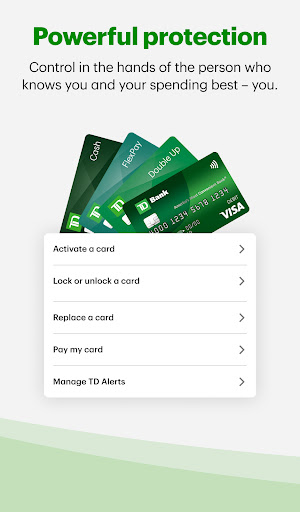

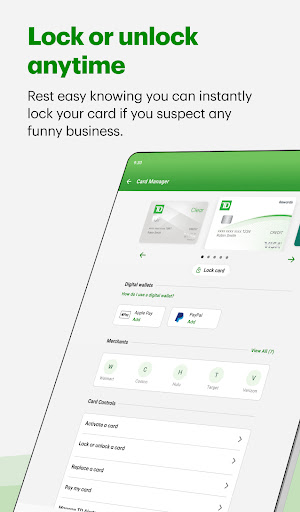

Enhanced Security with Account and Fund Safeguards

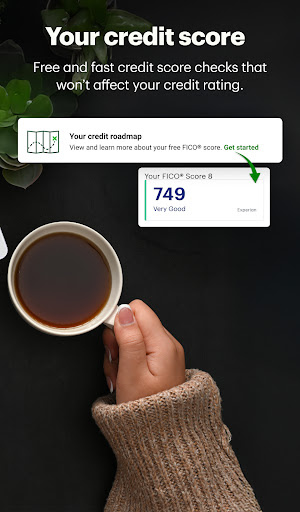

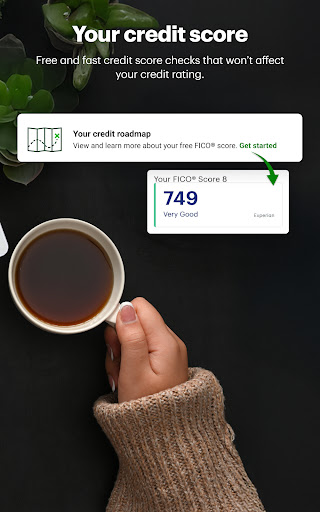

Security is a cornerstone of this app: it employs multi-factor authentication, biometric login options, and anomaly detection algorithms that flag unusual activity. This layered approach is akin to having a digital security guard patrolling your accounts 24/7. What's particularly notable is the biometric login—allowing users to access their accounts with fingerprint or facial recognition, streamlining security without sacrificing convenience. Compared to other financial apps, TD Bank's emphasis on proactive security measures elevates user confidence, positioning it as a leader in safeguarding sensitive data.

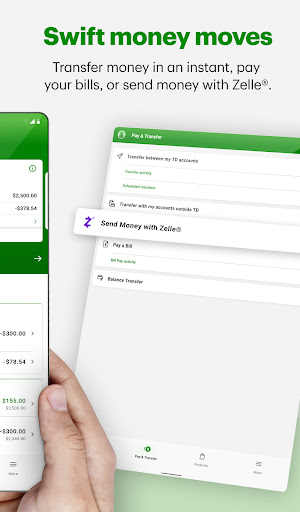

Intuitive Bill Pay and Customized Alerts

The app simplifies bill payments, enabling users to schedule recurring payments or pay one-time bills effortlessly. The process feels more like flipping through a well-organized digital envelope than navigating a complicated menu. Moreover, customizable alerts—such as low balance warnings or large transaction notifications—help users stay ahead of potential financial hiccups. These features foster a proactive approach to money management, transforming what could be stress-filled chores into manageable, even enjoyable, routines.

User Experience: Navigating with Ease

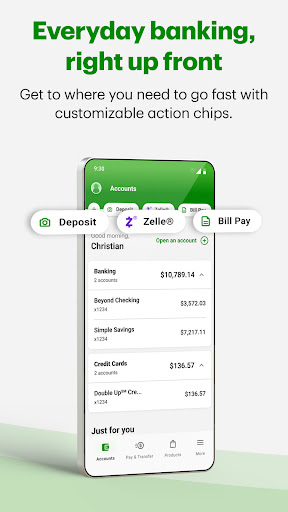

The interface design resembles a clean, inviting dashboard—think of it as the cockpit of your financial airplane, with all controls within easy reach. The layout is uncluttered, employing friendly icons and straightforward language that eases the learning curve for new users. Transitioning from one function to another feels fluid, akin to gliding along a well-paved road, thanks to optimized performance and snappy response times. For seasoned digital banking users, the app's logical structure minimizes confusion, making routine tasks quick and frustration-free. Newcomers will appreciate the guided prompts that help familiarize themselves with features, turning what might seem daunting into a straightforward experience.

Differentiation from Competitors

While many finance apps prioritize basic functions, TD Bank's application stands out with its dual focus on account security and transaction transparency. The app's security features aren't just superficial; they're integrated into every interaction, akin to having a personal bodyguard watching over your assets. The real-time notifications and biometric access give users peace of mind, setting it apart from many peer apps that either lack proactive alerts or rely solely on static passwords. Additionally, the intuitive bill pay system and customization options make financial management feel like a tailored service rather than a generic tool. In a marketplace crowded with similar apps, TD Bank's prioritization of security and user-centric design makes it particularly appealing for those who value both safety and simplicity.

Final Thoughts and Recommendations

Overall, the TD Bank (US) app earns a solid recommendation for anyone looking for a reliable, secure, and user-friendly digital banking experience. It's particularly well-suited for users who prioritize security and real-time transaction updates, making banking feel safer and more transparent. If you're someone who appreciates detailed control over your finances without unnecessary complication, this app could be an excellent addition to your digital toolkit. For those who are more casual users or new to mobile banking, its approachable interface helps ease the transition from traditional banking methods, making digital finance feel less intimidating and more accessible. Given its thoughtful security layers and clean design, TD Bank's application is a trustworthy partner for your daily financial endeavors.

Pros

- Intuitive User Interface

- Robust Security Features

- Comprehensive Account Management

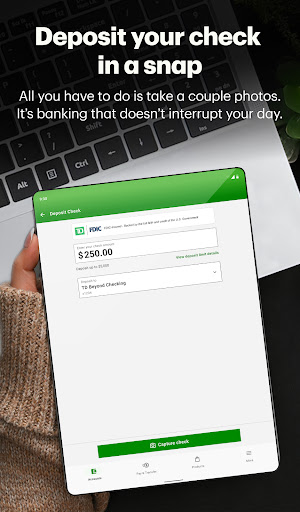

- Bill Payment and Mobile Deposits

- Real-Time Notifications

Cons

- Occasional App Crashes (impact: Low)

- Limited Budgeting Tools (impact: Medium)

- Delayed Customer Support Response (impact: Medium)

- Occasional Login Difficulties (impact: Low)

- Limited International Transfers (impact: High)

Frequently Asked Questions

How do I set up the TD Bank (US) app for the first time?

Download the app from your app store, open it, and follow the prompts to log in or register with your banking details to complete setup.

Can I access my accounts from multiple devices?

Yes, simply log in with your credentials on each device. For added security, enable multi-factor authentication in Settings.

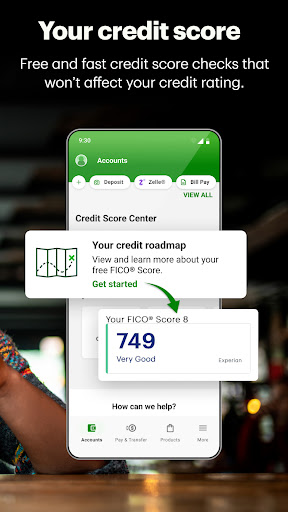

How do I view my account balances and recent transactions?

Log in to the app, then navigate to 'Accounts' to see balances and activity summaries for your linked accounts.

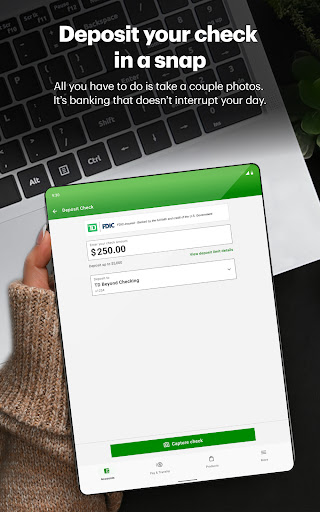

How can I deposit a check using the app?

Select 'Deposit Checks,' follow the instructions, and snap clear pictures of the front and back of your check to complete the deposit.

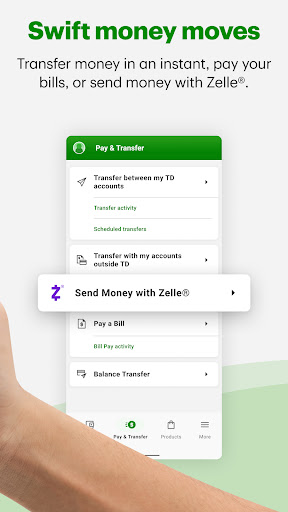

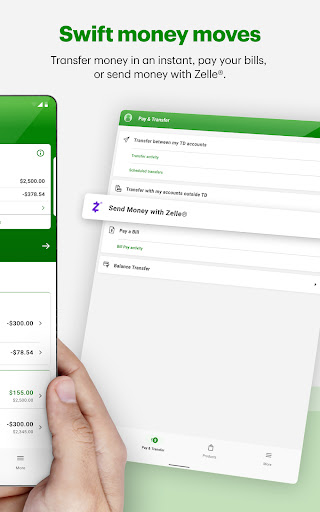

How do I pay bills or transfer money within the app?

Go to 'Payments,' choose the payee or transfer option, enter details, and confirm the transaction to complete the process.

How do I set up Zelle transfers for sending money?

Navigate to 'Send Money with Zelle,' add recipient details, and enter the amount to send money instantly.

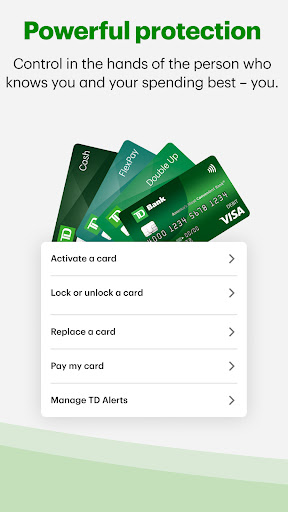

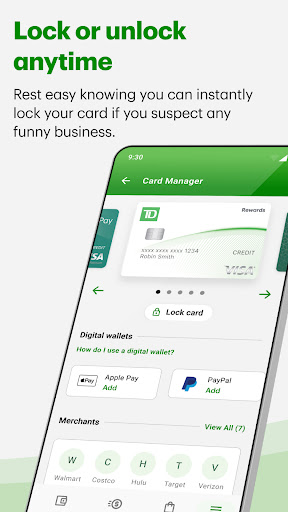

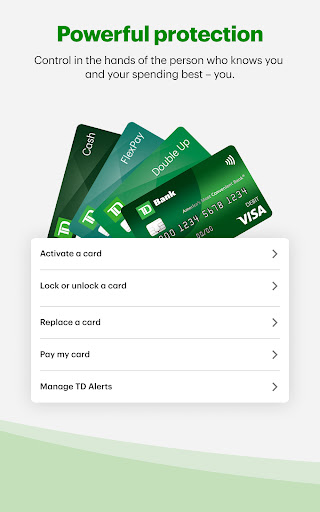

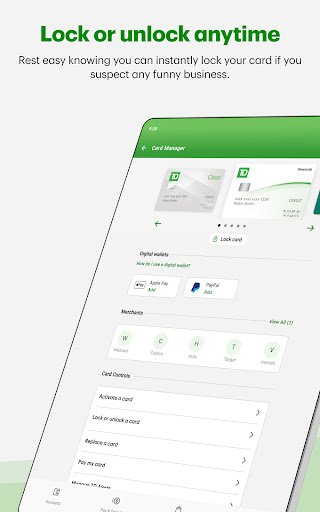

How do I lock or unlock my cards in the app?

Go to 'Manage Cards,' select your card, then choose 'Lock' or 'Unlock' to control card access instantly.

How can I customize my account notifications and alerts?

Visit 'Settings' > 'Alerts,' select your preferences, and enable notifications for transactions or security alerts.

How do I open a new account through the app?

Navigate to 'Open New Account,' select the account type, and follow the prompts to complete the application process securely.

What should I do if the app crashes or my transaction fails?

Try restarting your device, ensure the app is updated, and if issues persist, contact customer support via 'Help' in the app.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4