- Developer

- TransUnion Interactive, Inc.

- Version

- 5.5.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 3.4

Introducing TransUnion: Credit Monitoring – Your Personal Credit Guard

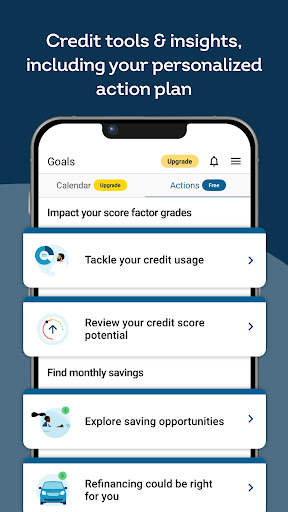

If you're someone keen on keeping a vigilant eye on your credit health without the fuss, TransUnion: Credit Monitoring steps in as a reliable digital companion. Designed to give users clear visibility into their credit status, this app aims to demystify the complexity of credit scores and provide straightforward, real-time insights. Developed by TransUnion, a recognized leader in credit reporting, the app integrates innovative tools to help you understand, monitor, and protect your financial reputation easily. Whether you're a seasoned investor or just starting your financial journey, this app caters to anyone who values transparency and security in their credit profile.

Core Functionality: What Makes It Stand Out

Firstly, the app offers real-time credit score updates, allowing users to see changes as they happen—much like having a financial cockpit at your fingertips. Secondly, it provides personalized alerts for any significant activity, such as new credit inquiries or account changes, acting like a vigilant watchdog against potential fraud. Thirdly, the app emphasizes identity protection with features like credit freeze management and fraud alerts, giving users peace of mind in a digital age rife with cyber threats. Lastly, an insightful credit report overview helps users understand what factors influence their score, fostering better financial habits.

Design and User Experience: Seamless and Intuitive

Stepping into the app feels akin to entering a well-organized control tower—sleek, intuitive, and user-friendly. The interface employs a calming color palette with clear icons and logical navigation paths, making it approachable even for first-time users. The flow from account login to viewing your latest credit updates is smooth, with transitions that feel natural rather than abrupt. Importantly, the learning curve is gentle; users can quickly grasp how to interpret their credit data without wading through technical jargon. The app's responsiveness ensures that checking your credit status takes mere seconds, transforming what used to be a tedious task into a quick daily ritual.

Unique Strengths: What Sets It Apart

Compared to other financial monitoring apps, TransUnion's app shines brightest in its emphasis on Account and Fund Security. Unlike competitors that primarily focus on credit scores, this app places a notable spotlight on transaction security and identity protection. For example, its credit freeze management allows users to instantly restrict new inquiries, akin to locking a safe, which is especially vital during sensitive periods or suspected fraud attempts. Additionally, the transaction experience is crafted to reassure you—each alert and report is detailed yet clear, avoiding overwhelming the user with technical overload. This thoughtful approach ensures users are well-informed without feeling daunted, a fine balance that many apps struggle to achieve.

Final Verdict: Solid, Secure, and User-Centric

For anyone serious about safeguarding their credit profile, TransUnion: Credit Monitoring is a dependable choice. Its standout features—particularly the real-time alerts and robust security tools—serve as a personal guard, warding off threats before they escalate. The app appeals to users across the spectrum, from cautious individuals monitoring their credit for the first time to seasoned financial veterans managing multiple accounts. While it is straightforward to set up and navigate, those seeking highly advanced investment or credit management features may find it more suited to the core monitoring functions rather than comprehensive financial planning.

In conclusion, I'd recommend this app as a trustworthy companion in your financial life. Its user-centric design combined with its focus on security makes it a valuable addition for anyone keen to keep their credit safe, informed, and under control. A small daily investment of checking your credit status can pay off massively in the long run—think of it as giving your financial health a daily health check-up, ensuring peace of mind in your digital wallet and beyond.

Pros

- Comprehensive credit monitoring

- Early fraud alerts

- User-friendly interface

- Credit score tracking

- Identity theft protection

Cons

- Limited free features (impact: mid)

- Delayed alerts at times (impact: low)

- No credit score simulation (impact: low)

- Limited educational content (impact: low)

- Occasional app crashes on older devices (impact: mid)

Frequently Asked Questions

How do I get started with the TransUnion Credit Monitoring app?

Download the app from your app store, sign up with your personal info, and verify your identity to access your free credit reports and scores.

Is there a fee to use the basic features of this app?

No, the basic credit score monitoring and reports are free; you don't need a credit card to sign up.

How can I view my credit score and report in the app?

Open the app, log in, and navigate to the Dashboard to see your current credit score and detailed report.

What are the main features of this app for my credit health?

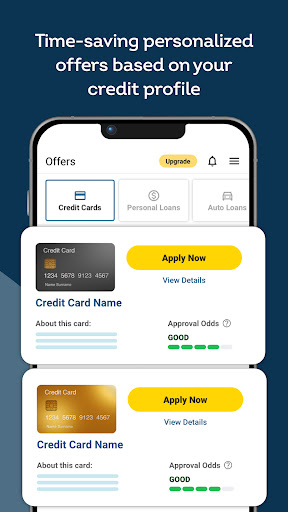

It provides real-time credit alerts, score tracking, personalized insights, and tailored credit offers to help manage your credit.

How do the real-time alerts work, and what do they notify me about?

You receive instant notifications for major report changes like new accounts or inquiries, helping detect suspicious activity immediately.

Can I see my credit reports from all three bureaus?

Basic reports are from TransUnion only. Upgrading to premium offers quarterly 3-bureau reports for comprehensive insights.

Are there any costs for upgrading to premium features?

Yes, premium features such as additional reports and identity monitoring are available through a paid subscription. Check Settings > Subscription.

How do I upgrade my account to access premium features?

Go to Settings > Account > Subscriptions in the app to view and subscribe to premium plans.

What should I do if the app is not updating my credit score or reports?

Try refreshing the app, ensure a stable internet connection, or restart your device. If issues persist, contact customer support.

How is my personal data protected when I use the app?

The app employs secure encryption and follows privacy policies outlined in the Terms of Service to safeguard your information.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4