- Developer

- True Money Co. Ltd.

- Version

- 5.73.0 (1852)

- Content Rating

- Everyone

- Installs

- 0.05B

- Price

- Free

- Ratings

- 3.4

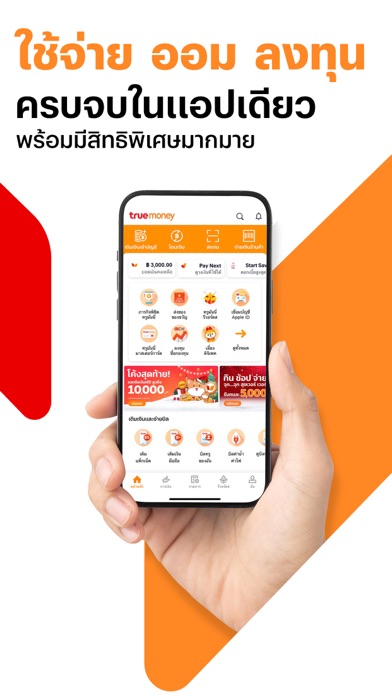

TrueMoney: Seamless Digital Wallet for Modern Payments

TrueMoney is a comprehensive financial app designed to streamline digital transactions, offering users a secure and user-friendly platform to manage their finances effortlessly. Developed by the reputable TrueMoney Group, this app aims to bridge the gap between traditional cash-based transactions and the digital economy, empowering users with a variety of innovative features tailored for everyday use.

Key Features That Truly Stand Out

At first glance, TrueMoney seems like just another e-wallet, but its core functionalities are where it truly shines. The app offers a combination of security, convenience, and versatility—delivering an experience that encourages users to move beyond cash and embrace a smarter way to handle their money.

- Advanced Account and Fund Security: TrueMoney employs biometric authentication, multi-factor security protocols, and real-time transaction alerts, ensuring user funds are protected against unauthorized access.

- Effortless Transaction Experience: Whether transferring money, paying bills, or topping up mobile plans, the app's intuitive interface and instant processing make every transaction smooth—like sliding a card across a polished surface.

- Rewarding Loyalty Program: A distinctive feature where users earn points and rewards with every transaction, incentivizing continued usage and making payments not just convenient but also rewarding.

Design and User Experience: Navigating with Ease

Imagine walking into a well-organized convenience store where everything is within arm's reach—that's how TrueMoney's interface makes you feel. The design adopts a clean, modern aesthetic with vibrant icons and straightforward navigation paths that reduce the learning curve to almost zero. Whether you are a tech novice or an experienced user, you'll find yourself completing transactions quicker than you can say “wallet refill.”

Operationally, the app demonstrates remarkable responsiveness. Swiping through menus or executing tasks feels fluid, attributable to its optimized performance even on lower-end smartphones. This smoothness ensures that users can perform multiple functions without frustrating lag or glitches, providing a consistently reliable experience.

Getting started is simple: after a quick registration, most features are accessible immediately, making onboarding less like a chore and more like opening the door to your personal financial hub.

Security and Transaction Experience: Trust at the Core

One of TrueMoney's most compelling aspects is how it approaches financial security. Think of it as having multiple locks on your digital vault—biometric login (face recognition or fingerprint), encrypted transactions, and immediate alerts when funds are accessed or moved. These mechanisms work behind the scenes but give users peace of mind that their assets are safeguarded against breaches or fraud.

Compared to many mainstream finance apps, TrueMoney's emphasis on real-time transaction alerts and anti-fraud measures makes it particularly trustable for daily use. Its transaction process is streamlined yet emphasizes security—users can approve payments with a fingerprint, verifying each operation safely without cumbersome steps. This balance of speed and protection is what elevates TrueMoney from being merely functional to truly reliable.

Unique Advantages and How It Differs from Competitors

While apps like PayPal or Alipay focus heavily on global or regional reach, TrueMoney situates itself as a local champion with a clear emphasis on security and user rewards. Its standout feature—the combination of robust security measures with a compelling loyalty scheme—sets it apart. Users aren't just paying; they're earning points, discounts, or cashback with each transaction, turning routine payments into a rewarding habit.

Additionally, the app's transaction experience is designed to be effortless and lightning-fast—think of it as instant messaging for your wallet, where every payment feels like a quick chat rather than a formal procedure. Its local focus ensures compatibility with regional banks, mobile operators, and billers, making it incredibly practical for daily financial needs.

Final Verdict: A Practical, Trustworthy Choice

If you're seeking an app that combines security, ease of use, and added bonuses, TrueMoney deserves serious consideration. Its most special features—top-tier security protocols and rewarding transaction experience—are thoughtfully integrated to serve users efficiently and safely. For those who value peace of mind and a few extra perks with every payment, it's a highly recommended tool to keep in your digital arsenal.

Whether you're a casual user wanting simplicity or someone who regularly transacts online, TrueMoney offers a balanced platform that is both professional and personalized. Dive in and experience a smarter way to manage your money—your wallet will thank you.

Pros

- User-friendly interface

- Fast transaction processing

- Wide acceptance network

- Multiple payment options

- Secure transaction protection

Cons

- Limited international support (impact: medium)

- Occasional app crashes during peak hours (impact: medium)

- Customer service response times can be slow (impact: low)

- Limited features for small businesses (impact: low)

- Missing some popular payment integrations (impact: low)

Frequently Asked Questions

How do I sign up and start using TrueMoney?

Download the app, open it, and follow the on-screen registration process by providing your personal details and verifying your identity to activate your account.

Can I use TrueMoney without linking my bank account?

Yes, you can fund your wallet through mobile top-ups, cash-in at agents, or bank transfers, then use it for payments without linking a bank account.

How do I top up my TrueMoney wallet for the first time?

Go to 'Top-up' in the app, choose your preferred method (bank transfer, cash-in agent, or mobile recharge), and follow the instructions to add funds.

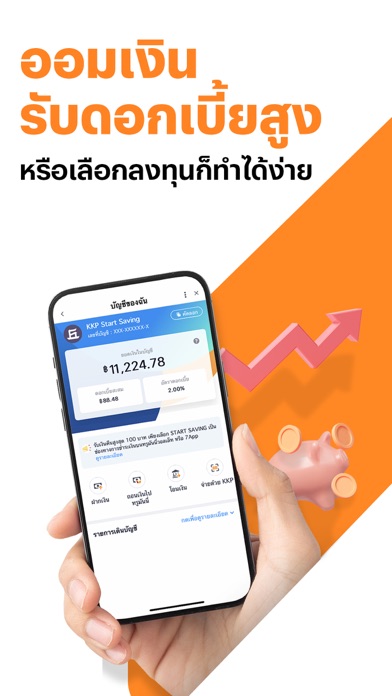

What are the main payment features of TrueMoney?

You can pay bills, recharge mobile credits, transfer money, and shop online or in-store by linking your wallet or using QR code payments.

How can I make an instant mobile top-up?

Navigate to 'Mobile Top-Up' in the app, select your provider (TrueMove H or Dtac), enter your number, and confirm to recharge immediately.

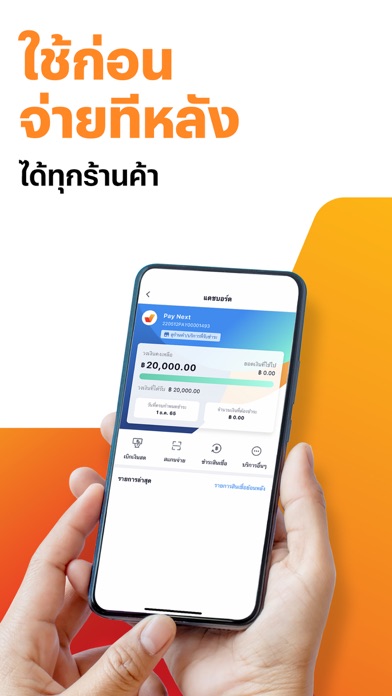

What types of loans are available on TrueMoney?

The app offers revolving credit lines and term loans, which can be accessed via the 'Loans' section, with quick approval and flexible repayment options.

How do I apply for a loan on TrueMoney?

Go to 'Loans', choose the suitable product, complete the application with your details, and wait for approval. Funds are disbursed after approval.

Are there any fees for sending money or making payments?

No, TrueMoney offers free money transfers and payments, including special features like gift envelopes for personal gifting.

How do I link my TrueMoney wallet to online stores like Google Play?

Open the Google Play Store, go to 'Payment methods', select 'Add wallet', and choose TrueMoney as your payment option to complete linking.

What should I do if I encounter transaction issues?

Try restarting the app, check your internet connection, or contact TrueMoney support via the app's help section for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4