- Developer

- Branch Messenger

- Version

- 2026.2.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.9

Uber Pro Card: Rethinking Business Class with a Swipe

The Uber Pro Card emerges as a streamlined financial tool tailored for Uber drivers and gig economy workers, promising enhanced security, smoother transactions, and rewards—making it more than just a payment app but a trusted companion on the road.

Who Behind the Wheel: Developer and Core Offerings

Developed by Uber Technologies Inc., the Uber Pro Card is crafted with the gig workforce in mind, aiming to simplify financial management while rewarding loyalty. Its key features include seamless integration with Uber earnings, advanced security measures to protect drivers' funds, and a transparent rewards program directly linked to driver performance. Additionally, the app offers tailored cashback schemes and expense management tools to keep drivers financially in the driving seat.

This app primarily targets Uber drivers and gig economy workers who seek a reliable, secure, and rewarding financial solution that adapts to their irregular work hours and earnings patterns.

An Engaging Ride into the Features

Imagine yourself winding through city streets, steering your car with confidence not just in your driving but also in your digital wallet. The Uber Pro Card positions itself as your digital co-pilot—easy, efficient, and insightful. Let's take a cruise through its cornerstones.

Secure Transactions and Account Security

The Uber Pro Card prioritizes security with bank-level encryption and multi-layered fraud detection, resembling a vigilant safety guard ensuring your earnings are safeguarded at every turn. Unlike traditional payment apps that might leave gaps, Uber's focus on high-security standards means drivers can confidently access their funds without worrying about hacking or unauthorized access. The app also supports biometric login, adding an extra layer of privacy, so your earnings stay just yours.

Smooth and Transparent Transaction Experience

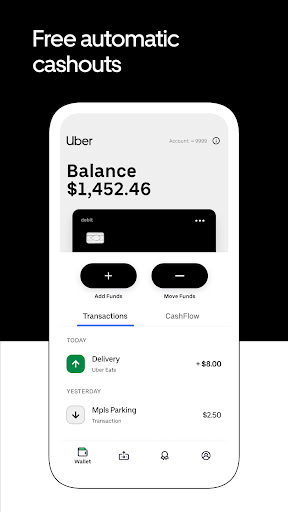

Driving is unpredictable enough—your financial tools shouldn't add to the chaos. The Uber Pro Card offers nearly instantaneous transaction processing, giving drivers real-time visibility into their spending and earnings via intuitive dashboards. Whether you're topping up fuel or paying for a quick meal, every transaction feels as seamless as a well-oiled engine, minimizing waiting and maximizing efficiency. Furthermore, the app provides detailed statements, helping drivers track expenses effortlessly—like having your own financial co-pilot reviewing every mile driven and dollar earned.

Loyalty Rewards and Expense Management

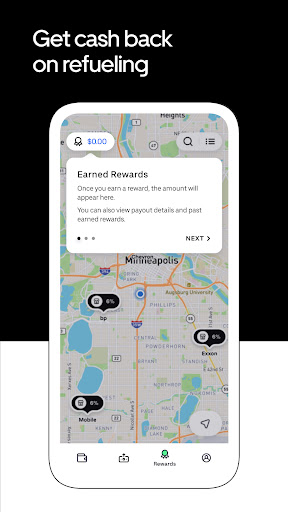

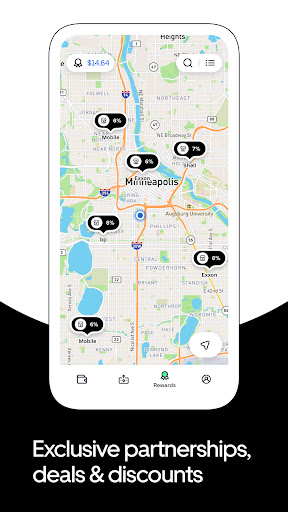

The app shines brightest in its rewards and expense features. Think of it as the loyalty program you didn't know you needed—earn cashback points that grow with your driving hours and performance metrics. These points can be redeemed for gas discounts, vehicle maintenance, or even boosts in your Uber earnings. Plus, the integrated expense management tools enable drivers to categorize their expenditures easily, turning their apps into miniature financial advisors that help maximize profits and reduce hassle.

Design, Usability, and Unique Selling Points

The interface of the Uber Pro Card feels akin to a sleek dashboard—clean, modern, and user-friendly. Navigation is intuitive; new users find onboarding steps straightforward, with guided tutorials that make understanding features a breeze. Operational speed is commendable—transactions clear within seconds, and the app remains responsive even during peak hours, indicative of solid backend architecture.

Compared to similar financial applications tailored for gig workers, Uber Pro Card's standout attribute is its tight integration with Uber's ecosystem. This proximity not only streamlines payout processes but also enhances security by reducing transfer points and potential vulnerabilities. Additionally, its tailored rewards system aligns directly with drivers' performance, turning routine driving into a partnership for financial growth—something most generic financial apps overlook.

Would I Recommend It? Setting Your GPS for Financial Success

For Uber drivers and gig workers who want a dependable, secure, and rewarding financial tool, the Uber Pro Card presents a compelling option. It's not a one-size-fits-all solution but a dedicated companion designed to fit the nuances of flexible, on-the-go earnings. Its strongest suit—integration with Uber and the focus on driver-centric rewards—makes it particularly appealing. However, those seeking broader investment features or advanced budgeting tools might find it slightly limited.

My advice? If you're active on Uber and looking for a simple, secure way to manage your money that adds a touch of rewards to your routine, give the Uber Pro Card a try. It's akin to having a trusted co-driver by your side, ensuring your financial ride is smooth and rewarding.

Pros

- User-friendly interface

- Enhanced earning opportunities

- Real-time reward tracking

- Integration with Uber platform

- Priority customer support

Cons

- Limited availability in some regions (impact: high)

- Occasional app crashes or bugs (impact: medium)

- Reward accumulation may delay updates (impact: medium)

- Limited reward options for some drivers (impact: low)

- Additional fees for certain services (impact: low)

Frequently Asked Questions

How do I apply for the Uber Pro Card and get started?

Download the Uber Pro Card app, complete the registration process, and request your card. It's free and can be done via the app under 'Get Card' in Settings.

Can I use the Uber Pro Card anywhere Mastercard is accepted?

Yes, you can use your Uber Pro Card at any location accepting Mastercard, both online and in-store, for everyday purchases.

How do I link my earnings to the Uber Pro Card?

Earnings are automatically deposited into your Uber Pro Card after each trip. Make sure your account is active in the Uber app under 'Payment Settings.'

How does cashback on gas work and where can I find participating gas stations?

Use your Uber Pro Card at participating gas stations to earn up to 7% cashback. Find nearby stations in the Uber Pro Card app via the map feature or Mastercard Easy Savings portal.

What is the process to access instant earnings deposits?

Earnings are automatically deposited after trips. To ensure instant deposits, enable automatic cashouts in the app under 'Payments' > 'Cashout Settings.'

How can I set up and use the backup balance feature?

Backup balance is available if you have automatic cashouts enabled. You can view and manage it in the app under 'Financial Tools' > 'Backup Balance' settings.

Are there any fees for using the Uber Pro Card?

No, the Uber Pro Card is free to get and use. However, ATM withdrawals outside the Allpoint network may incur fees, which can be minimized by using in-network ATMs.

Does the Uber Pro Card provide any rewards besides cashback?

Yes, drivers with the Uber Pro Card can access perks like insurance subsidies, discounts on vehicle maintenance, and ride milestone rewards, all managed via the app.

Can I upgrade my Uber Pro status to unlock more benefits on the card?

Your Uber Pro status is based on your driving performance and milestones. Higher tiers like Diamond unlock greater cashback and perks, tracked automatically in the Uber app.

What should I do if my Uber Pro Card isn't working properly?

Try reloading the app or contact customer support through the app's Help section. For urgent issues, visit 'Settings' > 'Support' for direct assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4