- Developer

- The Vanguard Group, Inc.

- Version

- 11.20.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 3

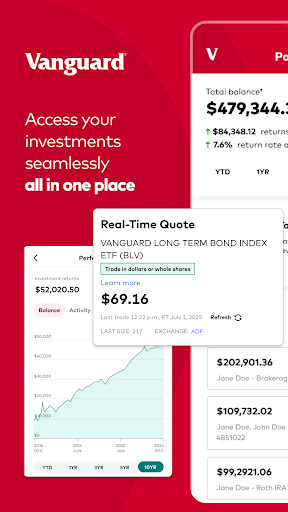

Vanguard: Save, Invest, Retire — Your Trusted Partner in Financial Planning

Vanguard: Save, Invest, Retire is a comprehensive finance app that guides users through the journey of building wealth, from saving diligently to investing wisely and preparing for retirement. Developed by Vanguard Group, renowned for its investor-first philosophy, this app aims to democratize long-term financial management for a broad audience.

A Closer Look at the Basics: What Makes It Stand Out

This app is designed by Vanguard Group, a globally respected investment management firm known for its mutual funds and ETFs. It embodies their ethos of transparency and investor empowerment.

- Core Functionality: It seamlessly integrates saving tools, investment management, and retirement planning into a single platform, making complex financial concepts easy to navigate.

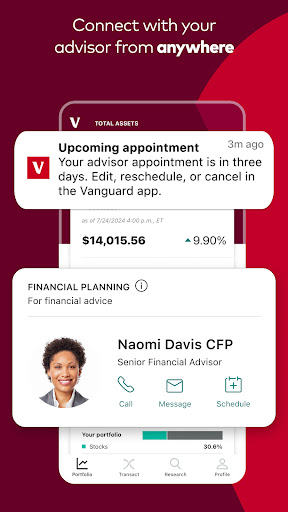

- Personalized Advice: Tailors recommendations based on user goals, risk tolerance, and financial situation, providing a ‘personal financial coach' experience.

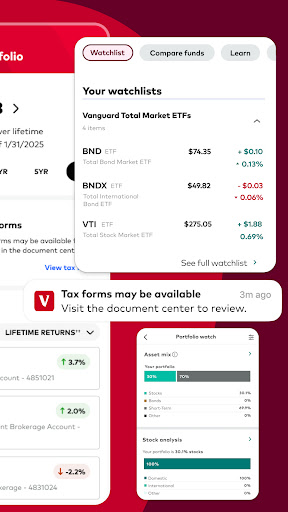

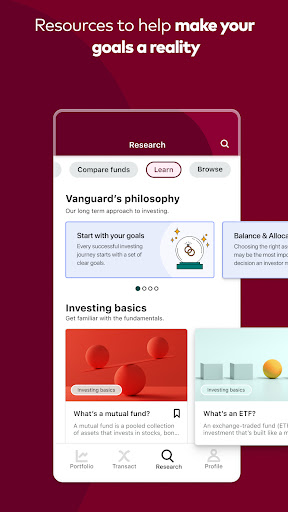

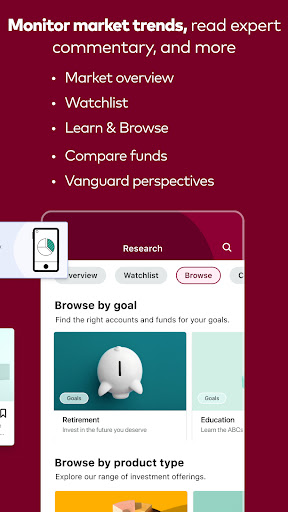

- Findings & Insights: Offers in-depth market insights, educational resources, and progress tracking to keep users informed and motivated.

- Security & User Trust: Built with Vanguard's robust security protocols, ensuring user data and investments are well protected.

Targeted primarily at novice investors, young professionals, and anyone looking to streamline their financial planning, this app makes long-term wealth management accessible and approachable.

Engaging the User: An Exciting Introduction

Imagine having your own financial GPS—Vanguard's app acts like a friendly guide, lighting the path from humble piggy banks to polished portfolios and comfortable retirements. Its vibrant yet intuitive interface invites users to explore each step confidently—whether you're just starting to save or fine-tuning your retirement plan, it's like having a seasoned financial advisor in your pocket, minus the hefty fees.

Core Features That Make a Difference

1. Smart Saving Meets Automated Investing

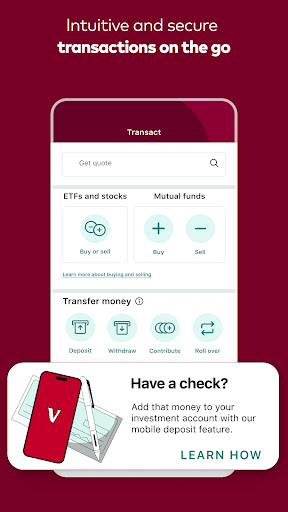

The app's saving module feels like setting your financial goals on autopilot. Users can establish custom savings targets, choose preferred accounts, and set up automatic transfers effortlessly. What truly sets it apart is its intelligent algorithm that recommends optimal contribution amounts based on your income and expenses—think of it as having a financial planner whispering in your ear, “Save a little more here, invest a little smarter there.” Once savings are in motion, the app offers automated investing options, directly linking to Vanguard's low-cost funds and ETFs. This creates a smooth, worry-free experience—saving and investing become like a well-choreographed dance rather than a complicated puzzle.

2. Personalized Retirement Blueprint

The standout feature in Vanguard's app is its dynamic retirement planning tool. Instead of static calculators, this feature adapts in real-time to your changing financial data, goals, and market conditions. It visualizes different retirement scenarios with vivid graphs and projections, making the future feel tangible and manageable. Users can tweak variables like retirement age, expected expenses, or market returns, and see instantly how these impact their plans. This empowers users with confidence and clarity, transforming abstract goals into actionable steps. Whether your dream is a seaside cottage or a cozy city apartment, the app helps craft a detailed map to get there.

3. Secure Transactions and Robust Account Safety

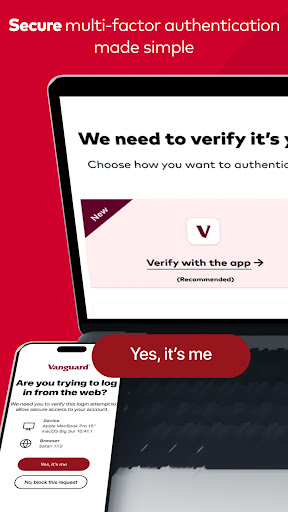

Vanguard's reputation for security is vividly reflected in the app's design. Multi-layered encryption, biometric login, and real-time fraud monitoring ensure that your money and data stay safe. Unlike many competing apps where security often feels secondary, here, protection is woven into the experience. This peace of mind encourages users to engage more fully with their financial journey, knowing their assets are shielded like a vault door with fingerprint access.

User Experience: Friendly, Flowing, and Familiar

The interface embodies Vanguard's reputation for clarity and simplicity. Bright, clean visuals and straightforward menus make navigation feel like flipping through a well-organized personal finance magazine. The learning curve is gentle—tools are explained with concise tutorials and helpful prompts, making it accessible even for absolute beginners. The app responds rapidly, with no lag or frustrating glitches, enhancing the overall seamless experience.

Compared to other financial apps, Vanguard's integration of security, personalized guidance, and intuitive design offers a refined experience. While many apps focus solely on investment tracking or basic budgeting, Vanguard's holistic approach, emphasizing both education and protection, truly stands out. Its investment recommendation engine, which accounts for current market conditions and secure account management, facilitates a level of sophistication that feels both professional and approachable.

Final Verdict: A Solid Choice for Long-Term Financial Health

If you're looking for an app that combines the trustworthiness of Vanguard's legacy with user-friendly digital tools, this app is highly recommended. Its most remarkable feature—the dynamic retirement blueprint—makes planning less daunting and more inspiring. For those beginning their savings journey or refining their investment strategy, Vanguard: Save, Invest, Retire offers a balanced blend of security, personalization, and ease of use. I'd suggest it especially for long-term planners who value clarity and peace of mind over flashy gimmicks. All in all, it's a dependable, thoughtfully designed companion for anyone serious about their financial future.

Pros

- User-Friendly Interface

- Comprehensive Investment Options

- Progress Tracking and Goals

- Educational Resources

- Low Fees and Transparent Pricing

Cons

- Limited Advanced Features (impact: Medium)

- Occasional App Lag (impact: Low)

- No Instant Messaging Support (impact: Low)

- Limited International Account Management (impact: Medium)

- Basic Notification System (impact: Low)

Frequently Asked Questions

How do I get started with the Vanguard app and create an account?

Download the app from your app store, open it, and follow the on-screen instructions to sign up with your personal details and set up your login preferences.

Can I access my investment account details on the app?

Yes, log in to the app to view your account overview, balances, recent transactions, and detailed investment performance anytime.

How can I monitor my investment performance regularly?

Navigate to the 'Accounts' tab in the app to track your holdings, see day-to-day changes, and analyze historical performance data.

How do I buy or sell stocks and ETFs within the app?

Go to the 'Trade' section, select the asset you want, choose 'Buy' or 'Sell,' input your amount, and confirm the transaction.

How can I deposit checks into my Vanguard account using the app?

Use the 'Deposit Checks' feature in the app, follow the instructions to photograph your check, and submit it for processing.

Where can I find my transaction history in the app?

Tap on 'Transaction History' in your account menu to review all past deposits, withdrawals, and trades.

Are there any subscription fees or premium features in the Vanguard app?

The basic app is free; some advanced features or advisory services may require additional fees, which are detailed in your account settings.

How do I update my login preferences or security settings?

Navigate to 'Settings' > 'Account Security' or 'Login Preferences' within the app to update your two-factor authentication, fingerprint ID, or password.

How can I provide feedback or report an issue with the app?

Use the 'Support' tab in the app to leave feedback, report problems, or contact customer service directly.

What should I do if I experience login issues or the app crashes?

Try restarting your device, ensure your app is updated, or contact Vanguard support through the 'Support' tab for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4