- Developer

- Varo Bank, N.A.

- Version

- 4.21.2

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.9

Varo Bank: Pioneering Effort in Digital Personal Banking

Varo Bank, a fully digital online banking platform, aims to revolutionize personal finance management with a user-centric approach, combining innovative features and robust security measures to serve primarily tech-savvy individuals seeking convenience and transparency in their banking experience.

Developed by a Forward-Thinking Fintech Team

Created by Varo Money, Inc., a fintech company known for its commitment to accessible banking solutions, Varo Bank leverages cutting-edge technology and customer-first design to challenge traditional banking paradigms and offer a seamless, mobile-first experience.

Standout Features That Make Varo Shine

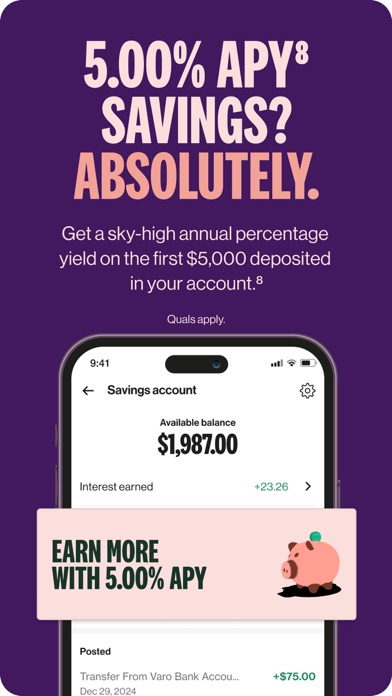

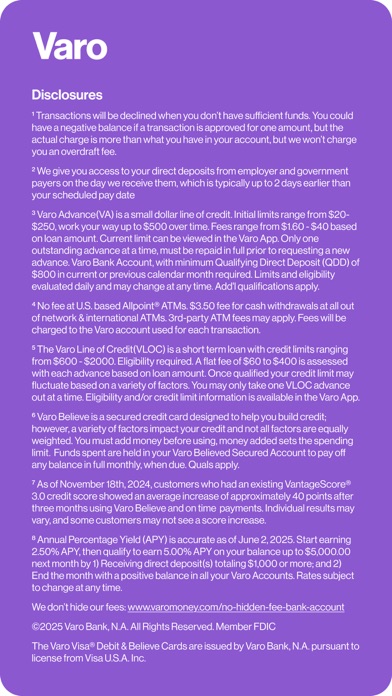

- High-Yield Savings Accounts: The app offers savings accounts with competitive interest rates, encouraging users to grow their funds effortlessly.

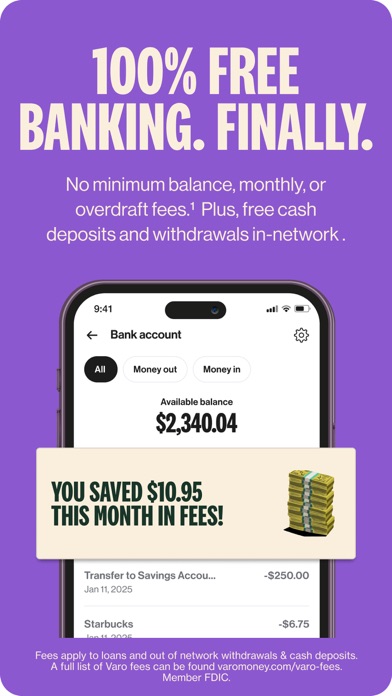

- No Monthly Fees & No Minimum Balance: Varo prioritizes accessibility by removing common banking barriers, making it easier for a broader audience to maintain their finances.

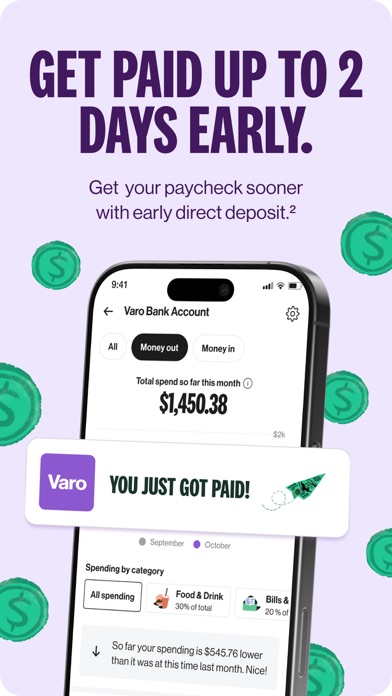

- Early Direct Deposit & Instant Transfers: Users can receive paychecks up to two days early and enjoy swift transfers, akin to having a financial concierge in your pocket.

- Automatic Budgeting & Expense Alerts: An intelligent system helps users monitor spending habits and stay within budgets, transforming complex financial data into easy-to-understand insights.

A User Experience That Feels Like Chatting with a Smart Friend

Imagine opening your banking app as if greeting an attentive friend who knows your financial goals. Varo's interface embraces vibrant colors and intuitive icons, making navigation feel like flipping through a well-organized digital notebook. The onboarding process is smooth, with clear prompts that help even first-time users master the platform within minutes. The app's responsiveness is impressive — animations are silky smooth, and transitions between functions occur seamlessly, reminiscent of slipping into a comfortable groove. The layout prioritizes simplicity without sacrificing depth, making complex tasks such as setting savings goals or transferring money as easy as chatting over coffee.

Core Functionalities That Elevate Your Banking Experience

Secure and Transparent Account & Fund Management

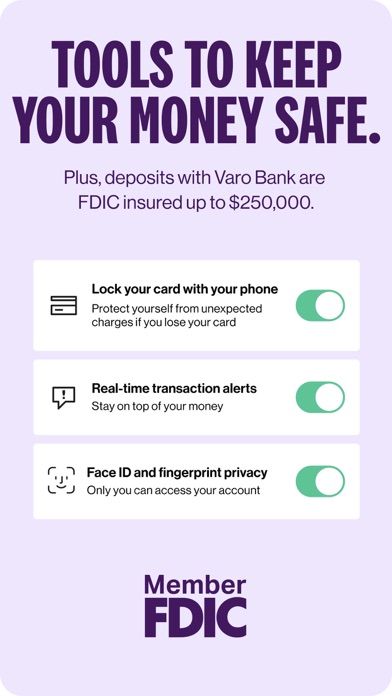

Security is a cornerstone of Varo Bank, with features like biometric login and real-time alerts guarding your assets like a vigilant guardian. What sets Varo apart is its commitment to transparency — all fees are clearly disclosed, and users have full control over account permissions. The app employs advanced encryption standards and FDIC insurance, ensuring funds are protected while providing peace of mind comparable to that of holding cash in a secure vault. Its clear visualizations of account balances and transaction histories allow users to effortlessly track financial flow, making budget management less of a chore and more of a transparent conversation.

Transaction Experience: Fast, Flexible, and User-Friendly

When it comes to sending or receiving money, Varo really shines. Transfers within Varo are instant, akin to passing a note to a friend across the table — swift and smooth. External transactions, whether paying bills or sending money to other accounts, are streamlined through integrations with Zelle and direct ACH transfers. The app's intuitive layout minimizes the number of steps needed, transforming what used to be a chore into a simple tap. Users can also utilize virtual debit cards for online shopping, adding a layer of security against fraud — a modern touch that caters well to digital shopping habits. This combination of speed, security, and ease positions Varo as a reliable financial companion in our increasingly cashless lives.

Is Varo Bank the Right Choice for You? Recommendations & Final Thoughts

Given its innovative features, user-friendly design, and robust security practices, Varo Bank is highly recommended for individuals seeking a fully digital banking solution that combines simplicity with powerful financial tools. Its standout features — especially the high-yield savings and instant transfer capabilities — make it particularly appealing for young professionals and digital natives who prefer managing finances on-the-go.

However, if you require extensive branches or personalized in-person consultation, traditional banks might still hold some appeal. Meanwhile, Varo's approach to combining transparency, security, and convenience makes it a compelling choice for those prioritizing simplicity and technology-driven banking experiences.

Overall, I suggest giving Varo a try if you're comfortable with fully digital platforms and want a bank that feels both smart and supportive — a true digital partner that keeps pace with the modern financial landscape.

Pros

- Intuitive Digital Interface

- Real-Time Access to Account Info

- No Monthly Fees

- Automatic Savings Features

- Strong Security Measures

Cons

- Limited ATM Network (impact: medium)

- Delayed Customer Support Response (impact: medium)

- No Physical Branches (impact: low)

- Initial Setup Requires Verification (impact: low)

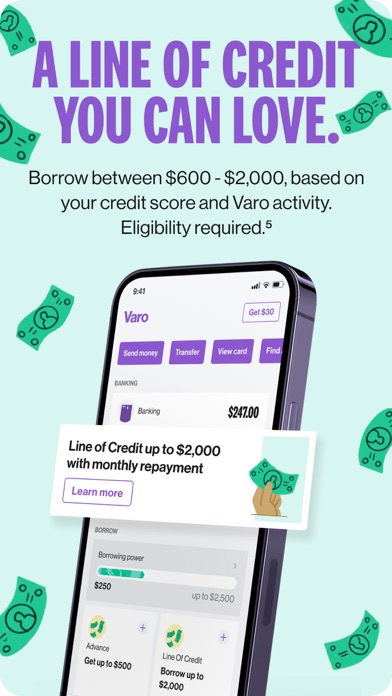

- Limited Investment or Credit Services (impact: low)

Frequently Asked Questions

How do I open a new account with Varo Bank?

Download the app, tap ‘Sign Up,' and follow the on-screen instructions to provide your personal info and verify your identity to open a new account.

Can I access Varo Bank on multiple devices?

Yes, Varo Bank is accessible on multiple devices through the app, just log in with your credentials on your smartphone or tablet.

What features are available in Varo's savings account?

You can earn up to 5.00% APY, use automated savings tools, and set savings goals directly in the app under ‘Savings' or ‘Accounts' settings.

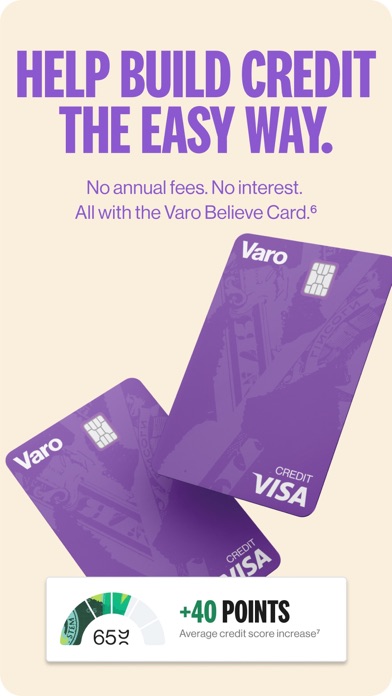

How does Varo help me build my credit score?

Use the free secured credit card and enable automatic payments. Track your credit progress in the ‘Credit Building' section of the app.

What is the process for requesting a cash advance?

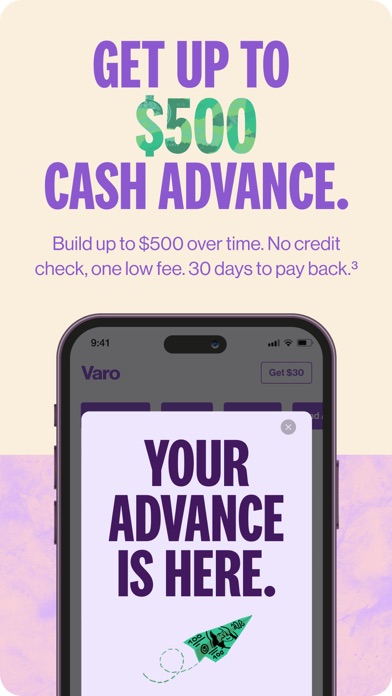

Go to ‘Accounts,' select ‘Cash Advances,' and choose the amount ($20–$250, or up to $500 for qualified users), then confirm the request within the app.

How do I send money to friends or family with Varo?

Tap ‘Send Money,' enter the recipient's phone number or email, specify the amount, and confirm to complete the transfer instantly and securely.

Are there any fees for using Varo's banking services?

No, Varo offers fee-free banking including no monthly maintenance fees, overdraft, or foreign transaction charges. Check the app for specific fee details.

Does Varo offer any paid subscription plans?

No, Varo's core banking services are free, but advanced features like higher cash advance limits may require eligibility or account activity.

How do I get help if I experience issues with the app?

Visit the ‘Help' section within the app or contact Varo Customer Support through the app's chat feature for assistance and troubleshooting.

What security measures does Varo use to protect my information?

Varo employs encryption, secure login, and remote disable features to keep your account safe, along with FDIC insurance for your funds.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4