- Developer

- Venmo

- Version

- 10.78.2

- Content Rating

- Everyone

- Installs

- 0.05B

- Price

- Free

- Ratings

- 4.9

Venmo: Simplifying Digital Payments with a Personal Touch

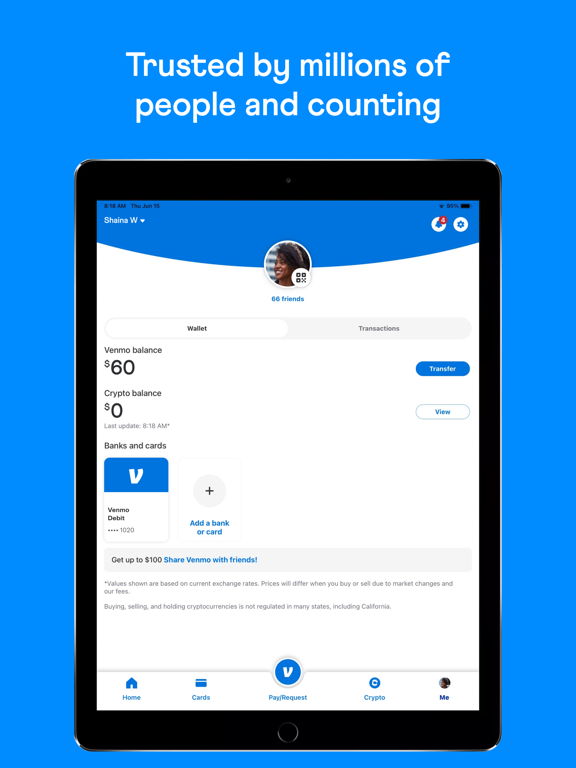

Venmo is a widely-used peer-to-peer payment app designed to make splitting bills, sharing expenses, and transferring funds straightforward and social, all within a user-friendly interface. Developed by PayPal, it's become an indispensable tool for friends, family, and small groups seeking quick, social money exchanges. Its standout features include instant payment notifications, social media-like transaction feeds, and robust security measures—aimed at users who value convenience, social interaction, and safety in their digital transactions.

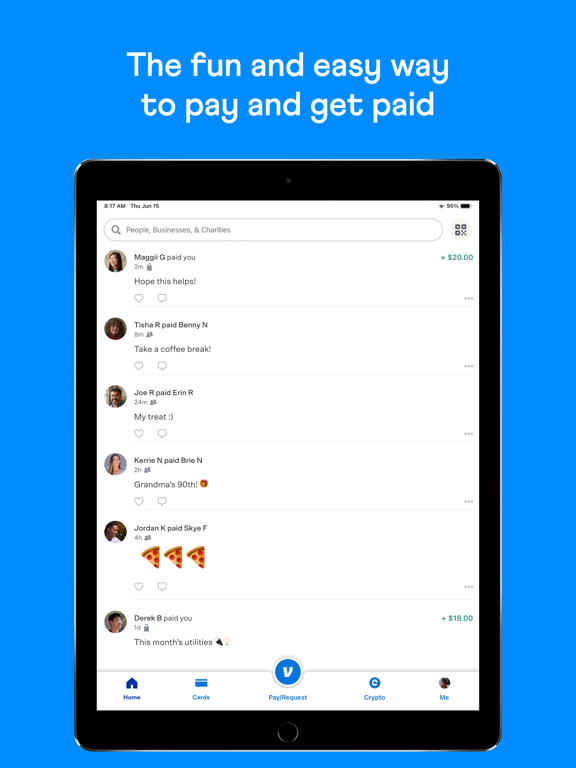

Experience the Ease and Fun of Easy Money Transfers

Imagine a world where paying back your friends feels as natural as chatting over coffee—that's exactly what Venmo strives to deliver. The app transforms what used to be a mundane task into a seamless, almost social ritual. With its visually appealing interface and intuitive navigation, using Venmo feels less like a chore and more like interacting within a familiar social network. The app's simplicity invites users to jump right in, regardless of technical savvy, thanks to its minimal learning curve and thoughtful design.

Core Features in the Spotlight

First, the instant transaction notifications keep users in the loop, mimicking a real-time conversation. Whether you've just paid your share of the dinner or received a quick reimbursement, Venmo promptly alerts you, making transaction history transparent and trustworthy. Second, the social feed adds a unique twist—it allows users to see friends' recent payments and comments, adding an engaging social layer to financial activity. Think of it as a micro social network dedicated to your shared expenses, which makes the process more engaging and less transactional. Lastly, Venmo's security features deserve mention: it employs encryption, multi-factor authentication, and fraud detection algorithms that safeguard user funds and sensitive data, maintaining trust in a space where many are wary of digital vulnerabilities.

Smooth, User-Centric Design and Experience

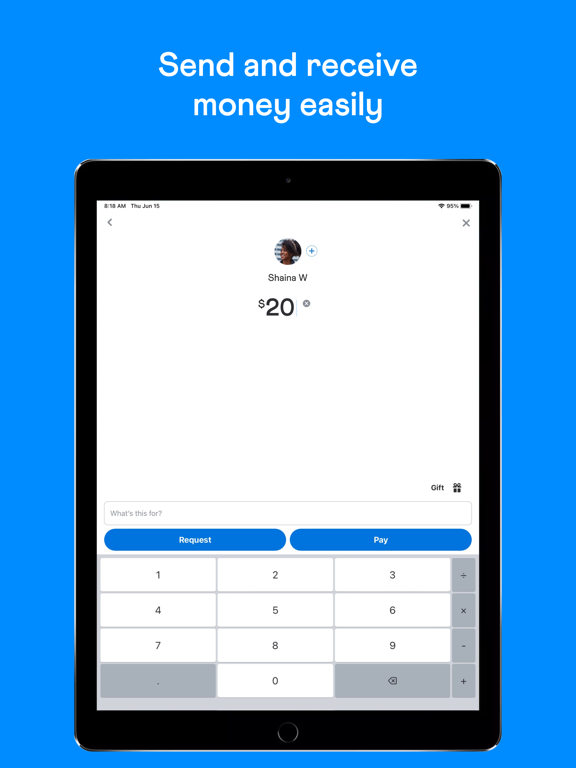

Venmo's interface resembles a lively social media app—bright, clean, and inviting, with clear icons guiding the way. Setting up an account or linking a bank account is straightforward, often completed within minutes, thanks to guided prompts. As you navigate through the app, the flow remains natural—sending money is as simple as choosing a contact, entering an amount, and hitting send. The transaction process is swift, with minimal lag, and the app's responsiveness ensures a fluid experience even during peak usage times. Learning to leverage advanced features, such as splitting bills or requesting payments, is intuitive, making it accessible for new users while offering depth for power users.

Unique Strengths Over Competitors

While many digital wallets offer similar basics, Venmo's social aspect and real-time updates set it apart. Its social feed, where you can see friends' payment comments and emojis, fosters a sense of community and fun—turning financial transactions into a shared experience. Additionally, Venmo's emphasis on security is particularly notable. Its multi-layered protection measures provide reassurance amidst growing concerns about digital fraud and data breaches, paralleling the security of traditional banking, yet maintaining the simplicity of a mobile app. Compared to competitors like PayPal or Cash App, Venmo's focus on social interaction gives it a distinctive edge, encouraging users to engage more comfortably and frequently.

Final Verdict: A Handy Companion for Social Savvy Users

Based on its user-centric design, engaging social features, and strong security stance, Venmo comes highly recommended for individuals who prioritize ease of use combined with a touch of social interaction. It's especially suitable for younger users, groups splitting expenses regularly, or those who enjoy partially gamified experiences. However, users should remain mindful of privacy settings and transaction limits for security reasons. Overall, Venmo offers a balanced blend of straightforward functionality and social charm, making digital money management feel less like a chore and more like a shared experience among friends.

Pros

- User-friendly interface

- Free transactions between friends

- Social media integration

- Instant transfer options

- Wide acceptance among merchants

Cons

- Limited international support (impact: High)

- Privacy concerns over social feed (impact: Medium)

- Charge for instant transfers (impact: Medium)

- Fraud and security risks (impact: High)

- Limited customer support options (impact: Low)

Frequently Asked Questions

How do I set up my Venmo account for the first time?

Download the app, sign up with your email or phone number, link your bank account or card, and verify your identity through the app's prompts.

Can I use Venmo internationally?

Venmo is primarily for use within the U.S. for domestic transfers. International use is limited; check the app for specific regions or services.

How do I send or receive money on Venmo?

Open the app, tap 'Pay' or 'Request,' enter your friend's username, phone, or email, input the amount, add a note if desired, then confirm the transaction.

What is the process to split a bill among friends?

Tap 'Pay or Request,' select the friends involved, choose 'Split,' enter amounts for each person, and send the payment requests simultaneously.

How does the Venmo Credit Card work and how do I activate it?

Request the card via Settings > Venmo Credit Card, activate it in the app, and start earning rewards on qualifying purchases everywhere Visa is accepted.

How can I buy or sell cryptocurrencies on Venmo?

Navigate to 'Manage Investments' in the app, select 'Crypto,' choose your desired amount (minimum $1), and follow prompts to buy or sell.

How do I apply for the Venmo Debit Card?

Go to Settings > Venmo Debit Card, follow the instructions to request the card, and once received, activate it in the app for use anywhere Mastercard is accepted.

Are there any fees for sending money or using certain features?

Standard personal transactions are free when using your bank balance or debit card. Fees may apply for instant transfers or crypto transactions—check the app for details.

How do I link my bank account or card to Venmo?

Go to Settings > Payment Methods, select 'Add Bank or Card,' and follow on-screen instructions to securely link your accounts.

What should I do if I encounter a transaction error or account issue?

Try restarting the app, ensure your info is up-to-date, and contact Venmo Support via Settings > Help for further assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4