- Developer

- Western Union Apps

- Version

- 16.4

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.8

Western Union Send Money Now: Your Quick and Secure Way to Transfer Funds

Western Union Send Money Now is a user-friendly mobile application designed to make international and domestic money transfers effortless, safe, and fast—bringing the world a little closer, one transaction at a time.

Developed by a Trusted Leader in Financial Services

This app is crafted by Western Union, a globally recognized leader in cross-border, cross-currency money transfer services with over 150 years of experience. Their team leverages advanced technology and a vast agent network to ensure your money reaches loved ones or business partners efficiently.

Key Features That Make Money Transfers a Breeze

- Fast and Reliable Transfers: Send money instantly or schedule future transfers across numerous countries with real-time tracking and guaranteed delivery options.

- Multiple Payment Options: Pay using bank accounts, credit/debit cards, or even cash at local Western Union agents, offering flexibility based on user preferences.

- Robust Security Measures: Incorporating multi-layer encryption and biometric authentication, ensuring your financial information and transactions are protected at all times.

- Push Notifications and Customer Support: Receive instant updates on transfer status and access dedicated support channels for assistance anytime.

Immersive User Experience and Seamless Performance

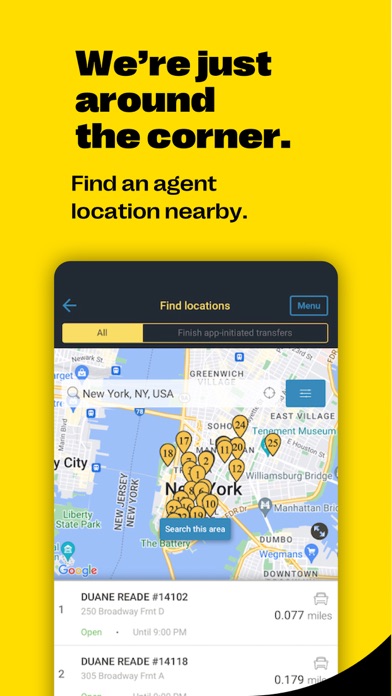

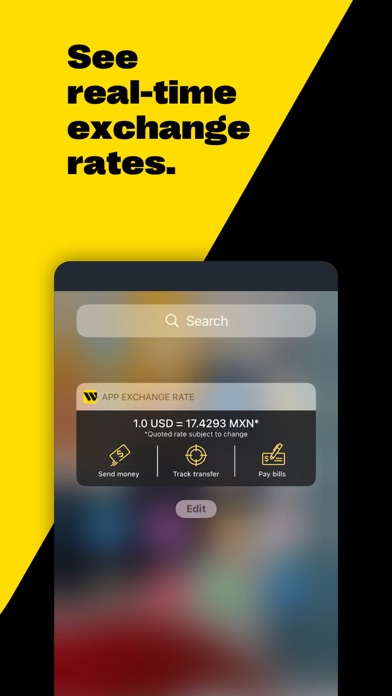

Imagine opening an app where navigating through options feels as smooth as gliding through a well-oiled machine—this is the kind of experience Western Union Send Money Now offers. The interface sports a clean, intuitive design that balances simplicity with functionality, making it approachable even for first-time users. The main dashboard provides clear options—whether to send money, track transfers, or find nearby agents—minimizing any learning curve.

Operationally, the app shuffles along like a high-speed train—you tap, input, confirm, and your transaction is underway swiftly. The load times are minimal, ensuring users aren't left waiting, and transaction feedback, including confirmation and tracking updates, are delivered instantly via push notifications.

On the security front, biometric authentication (fingerprint or facial recognition) adds an extra layer of safeguard, akin to having a personal bodyguard for your funds. The interface's consistent updates and guided processes dramatically reduce user errors, making this app accessible to a broad age range and tech proficiency levels.

What Sets Western Union Apart in the Fintech Crowd?

While many money transfer apps focus solely on the transactional aspect, Western Union Send Money Now shines through its holistic approach to security and transaction experience. Particularly noteworthy is its emphasis on the account and fund security—leveraging advanced encryption and real-time fraud detection mechanisms that give users peace of mind, akin to trusting your safe deposit box rather than leaving your valuables in a tin box. This focus ensures that your funds are protected not just during transfer but also from potential cyber threats.

Another standout is the sheer speed and reliability of transfers. When compared to competitors, the app's capability to process instant transactions—even across borders—makes it feel more like sending money with an invisible, turbocharged courier. Its vast network of Western Union agents further complements its digital prowess, offering users a tangible point-of-contact—an important reassurance especially for those wary of purely digital transactions.

Final Thoughts and Recommendations

All in all, Western Union Send Money Now is a solid choice for anyone needing a dependable, secure, and easy-to-use money transfer app. Its blend of speed, security, and user-centric design makes it particularly suitable for expatriates, small business owners, or families supporting loved ones overseas.

For best results, new users should spend a few moments familiarizing themselves with the app's interface and security features. Given its robust safeguards and reliable transfer options, I would recommend it confidently for both casual and frequent transactions—especially when peace of mind is as important as speed.

In a landscape crowded with fintech options, Western Union Send Money Now stands out not just because it's historically rooted but because it continues to innovate, prioritizing both security and user experience. If you value a straightforward, trustworthy way to send money globally, this app deserves a spot on your device.

Pros

- Fast Money Transfers

- User-Friendly Interface

- Widespread Service Availability

- Secure Transactions

- Multiple Payment Options

Cons

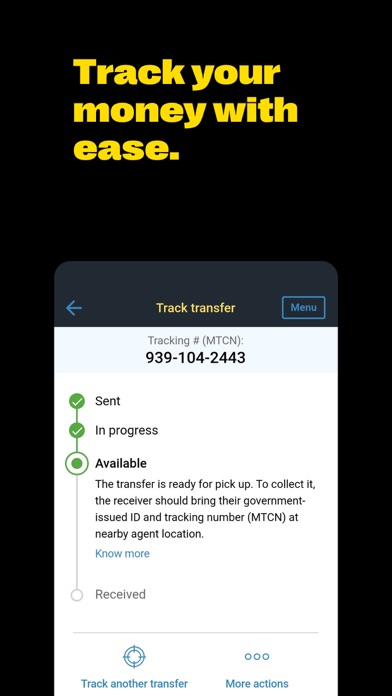

- Limited Transfer Tracking Details (impact: Medium)

- High Service Fees for Some Transfers (impact: Medium)

- Occasional App Crashes (impact: Low)

- Limited Customer Support Channels (impact: Low)

- Restrictions on Some Countries (impact: Low)

Frequently Asked Questions

How do I create an account and start using Western Union Send Money Now?

Download the app, open it, tap 'Register,' fill in your details, and verify your identity. Then you can start sending money by selecting your recipient and payment method.

What are the first steps to send my first international transfer?

After logging in, choose 'Send Money,' select the recipient's country, enter the amount, choose your payment method, and confirm the transaction.

What are the main features of Western Union Send Money Now?

Key features include global money transfers, real-time tracking, multiple payout options, currency exchange rate viewing, and additional services like bill payments and mobile top-up.

How can I track my transfer status in the app?

Use the 'Track' section in the app to see real-time updates on your transfer. You'll get notifications at each stage until completion.

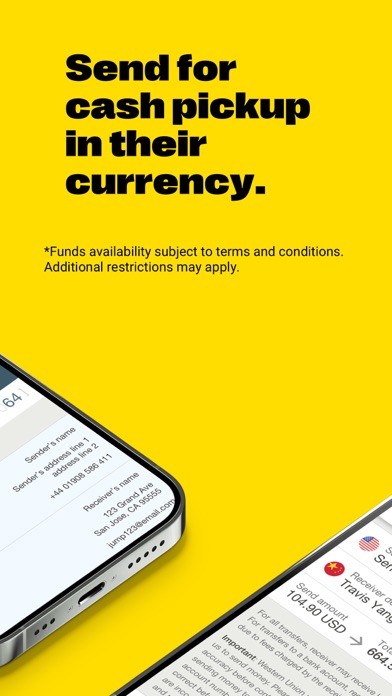

What options are available for delivering money?

You can choose bank deposits, mobile wallet transfers, or cash pickups at agent locations globally for convenient delivery options.

Are there any fees for using the app, especially for my first transfer?

Yes, your first online international transfer has $0 fees—additional charges may apply for currency exchange and other services. Check the app for details.

What payment methods are accepted within the app?

You can pay using credit/debit cards, bank transfers, or cash at agent locations, depending on your region and transfer type.

How do I pay bills or recharge mobile phones with the app?

Navigate to the 'Bill Payment' or 'Mobile Top-up' section, enter your details, select the bill or number, and confirm the payment. The process is straightforward.

Are there any subscription or premium features available for this app?

The app offers free basic services, but premium features like priority transfers or higher limits may be accessible through additional fees or account upgrades. Check settings > Account > Subscription.

What should I do if I encounter a transaction error or the transfer fails?

Check your internet connection, verify your payment details, and ensure your ID is verified. If issues persist, contact customer support through the app's help section.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4