- Developer

- Wise Payments Ltd.

- Version

- 9.6

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.7

Introducing Wise: A Seamless Way to Send Money Across Borders

Wise (formerly TransferWise) is a fintech application dedicated to simplifying international money transfers with transparent fees and competitive exchange rates. Developed by a company renowned for its innovative approach to cross-border finance, Wise aims to provide users with a secure, fast, and cost-effective alternative to traditional banks when transferring money abroad. Its standout features include real-time exchange rate locking, multi-currency accounts, and enhanced security protocols. Aimed at expatriates, freelancers, small business owners, and anyone needing to send or receive money internationally, Wise seeks to bridge the gap between convenience and financial transparency.

A Fresh Approach to International Transfers

Imagine sending money abroad should feel as easy as handing over cash locally—no more hidden fees, no confusing exchange rates, just straightforward transfers that let you focus on what truly matters. Wise achieves this vision with a sleek interface and user-centric design that turns complex banking procedures into a walk in the park. Whether you're paying a bill in London or receiving earnings from Australia, Wise promises a reliable, transparent experience that takes the stress out of international payments. Let's delve into what makes this app a noteworthy contender in the fintech landscape.

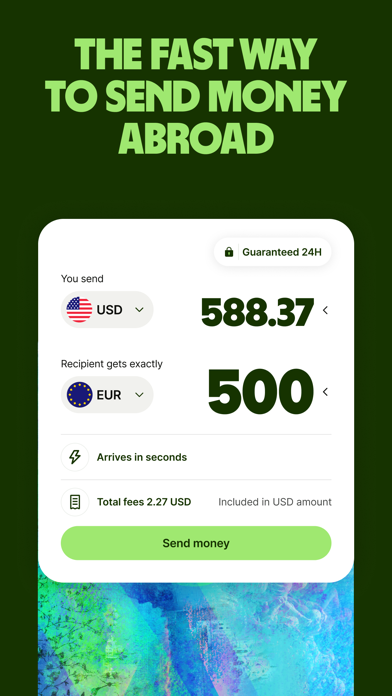

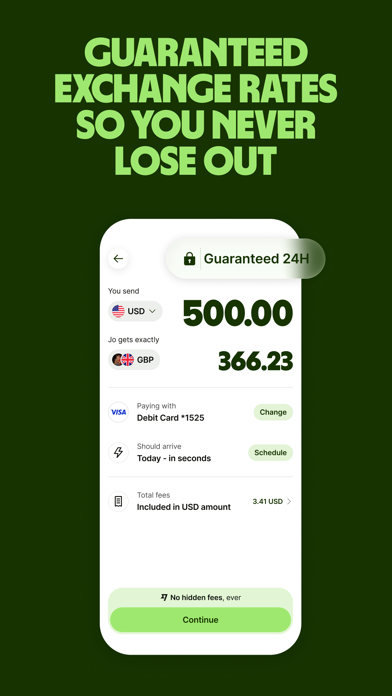

Core Functionality 1: Real-Time Exchange Rate Locking & Transparent Fees

The most compelling feature of Wise is its commitment to transparency. Unlike traditional banks, which often hide hefty margins in exchange rates, Wise displays the real mid-market rate upfront—like a currency exchange rate you'd see online—and charges a clear, low fee. A standout innovation is the ability to lock-in exchange rates for a certain period before confirming a transfer, ensuring users are protected from market fluctuations. This feature is akin to having a financial guardrail, giving peace of mind that the amount received matches expectations, without surprise costs creeping in. Whether you're sending $1,000 to a relative or settling international invoices, this feature places control firmly in your hands.

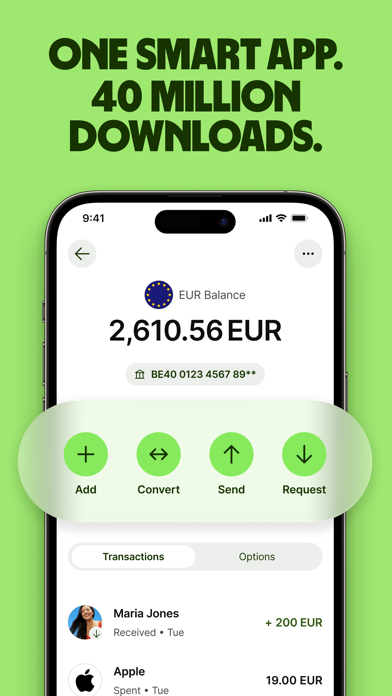

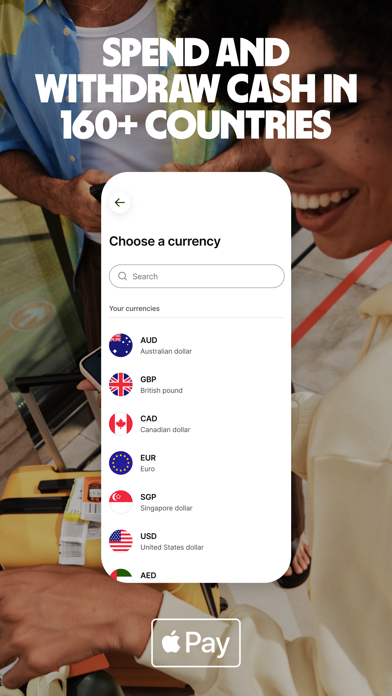

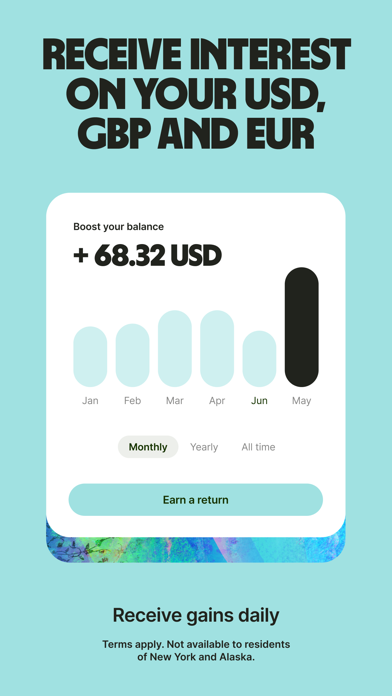

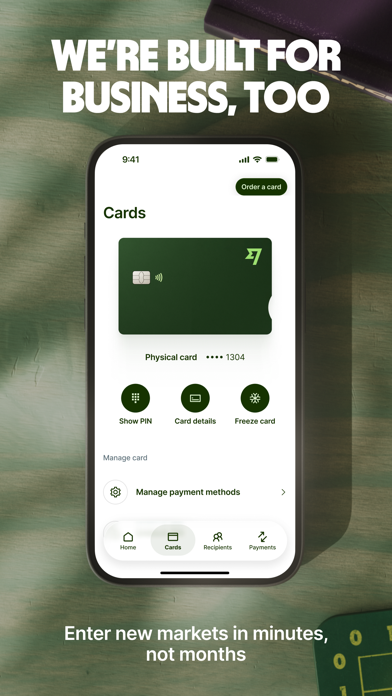

Core Functionality 2: Multi-Currency Accounts & Borderless Spending

Wise's Borderless account is an intriguing offering—think of it as a digital wallet capable of holding and managing multiple currencies simultaneously. This feature is especially useful for frequent travelers and global entrepreneurs who regularly juggle various currencies. Users can receive money in multiple currencies without conversion fees and convert between them at interbank rates when needed. The intuitive interface simplifies managing these balances, with clear visualizations of your holdings. To add a cherry on top, Wise offers a linked Mastercard that allows spending in any linked currency directly from your account, making it really feel like a global financial hub nestled in your pocket.

Enhanced User Experience & Security

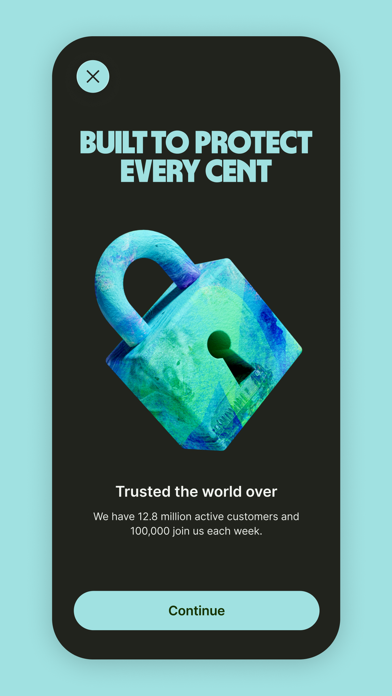

The app's interface is crisp, intuitive, and user-friendly—navigating through transfer options feels akin to flipping through a well-organized magazine. The fee calculator is upfront, and transaction steps are logically sequenced, reducing any learning curve for new users. Operation runs smoothly, with minimal lag, thanks to Wise's optimized backend. Moreover, Wise's security features are robust enough to reassure users—multifactor authentication, encrypted data transmission, and constant compliance with financial regulations ensure your funds and personal data are guarded at all times. Compared to other financial apps, Wise stands out by emphasizing both ease of use and transactional security, making you feel confident about your money's safety.

What Sets Wise Apart

While many fintech apps focus on individual features like budgeting or investment, Wise's core strength lies in its dedicated focus on transparent, cost-effective international transfers. Its real-time rate locking and multi-currency Borderless account work together to reduce the usual hassles and hidden costs associated with cross-border payments. For users who value clarity and security—much like a trusted guide navigating foreign terrain—Wise offers a distinct advantage over traditional banking channels or less transparent money transfer apps. In particular, its emphasis on account and fund security coupled with an excellent transaction experience positions Wise as a trustworthy, efficient choice for global financial needs.

Final Verdict: Highly Recommended for Global Transfers

If you often find yourself crossing borders—whether for work, study, or family—Wise is worth considering. Its innovative rate-locking feature and multi-currency wallet are particularly powerful tools that make international money management straightforward and transparent. The app's clean interface, smooth operation, and high-security standards further justify its value proposition. Though it lacks some comprehensive financial planning tools seen in broader fintech platforms, its core strengths make it an excellent choice for anyone prioritizing reliable and cost-efficient cross-border transactions. For those seeking to replace cumbersome bank processes with a smarter, more transparent solution, Wise comes highly recommended.

Pros

- Low Transaction Fees

- Real-Time Exchange Rates

- Fast Transfer Speed

- Multiple Currency Support

- User-Friendly Interface

Cons

- Limited Countries for Certain Services (impact: medium)

- No In-App Customer Support Chat (impact: low)

- Transfers May Occasionally Be Delayed (impact: medium)

- Limited Deposit Options in Some Countries (impact: low)

- App Language Support Is Mainly English (impact: low)

Frequently Asked Questions

How do I get started with Wise for international transfers?

Download the Wise app, create an account, verify your identity, and add your bank details to start sending and receiving money internationally.

What currencies can I hold and manage in Wise?

You can hold and manage over 40 currencies in your Wise multi-currency account by navigating to 'Accounts' in the app and adding currencies accordingly.

How do I send money to another country using Wise?

Open the app, select 'Send Money', enter recipient details, choose the amount and currency, review fees, and confirm the transfer to complete it quickly and securely.

What is the median transfer time for Wise international payments?

Most transfers—over 65%—arrive within 20 seconds; however, times may vary based on recipient country and payment method.

How can I use my Wise multi-currency card for international spending?

Order and activate your card in 'Cards' in the app, then use it worldwide at over 160 countries, with automatic currency conversion at low rates.

How do I get local banking details for receiving payments?

Navigate to 'Accounts', select the currency and country, and view your local account details to receive local deposits and direct debits.

Can I automate currency conversions at specific rates in Wise?

Yes, set up auto-convert in 'Currencies' > 'Auto-Conversion' and specify your preferred exchange rate for seamless currency management.

Are there subscription fees or charges for Wise's services?

Wise generally charges only for transfers, with no monthly or maintenance fees for holding or managing currencies within the app.

How transparent are the fees and exchange rates in Wise?

Fees and the real exchange rate are displayed clearly before confirming each transfer, ensuring transparent and informed transactions.

What should I do if my international transfer is delayed or failed?

Check your transfer status in 'Activity', verify your account details, and contact Wise support if issues persist for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4