- Developer

- Early Warning Services, LLC

- Version

- 9.3.2

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.1

Zelle®: Revolutionizing Instant Digital Payments

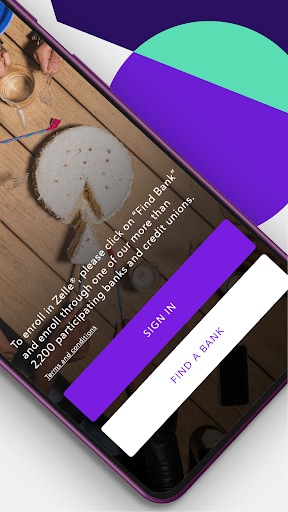

Zelle® is a fast, secure, and user-friendly peer-to-peer payment platform designed to streamline digital money transfers directly between bank accounts.

Developed by a Trusted Network of Major Financial Institutions

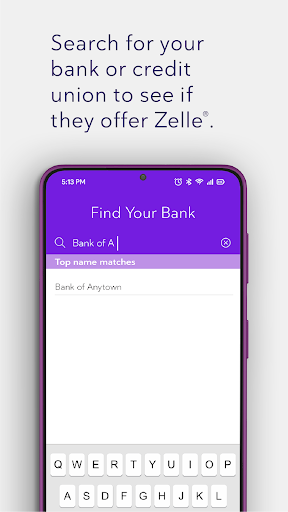

Zelle® is a collaborative effort among over 30 major US banks and credit unions, including JP Morgan Chase, Bank of America, and Wells Fargo. This extensive backing ensures integration with most banking apps and enhances trustworthiness.

Key Features that Make Zelle® Shine

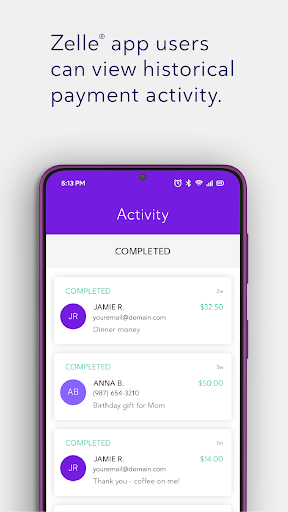

- Instant Transfers: Fund transfers typically settle within minutes, making bill splitting, gift-giving, or paying friends seamless.

- Bank-Level Security: Robust encryption and authentication protocols protect user data and transactions.

- Widespread Accessibility: Available through numerous banking apps and a standalone Zelle® app, broadening user reach.

- No Additional Fees: Most participating banks do not charge for Zelle® transactions, aligning with user expectations for free digital services.

Engaging the User: From Novice to Expert

Picture yourself at a bustling coffee shop—then imagine quickly splitting the bill with friends in a few taps, with no waiting or awkward cash exchanges. Zelle® transforms these everyday moments into swift, effortless actions. Its intuitive design and straightforward functionality make even first-time users feel at home in a matter of minutes, turning what used to be clunky transfers into a smooth dance. But what truly makes Zelle® stand out? Let's delve into its core strengths.

Streamlined Payment Experience and User Interface

Zelle® boasts a clean, minimalist interface that resembles a familiar messaging app—think of it as the "WhatsApp" of digital wallets. The main dashboard provides quick access to recent transactions, contacts, and options, reducing clutter and confusion. When initiating a transfer, the app guides users with clear prompts: select a recipient from contacts or enter an email/phone number, enter the amount, and hit send. The entire process feels as natural as sending a quick text, with minimal learning curve. Fast processing means there's rarely a lag, so users get instant confirmation that their money has moved—no more anxious waiting or doubts.

Security and Transaction Integrity: The Differentiation Edge

In a crowded landscape of finance apps, Zelle® sharply differentiates itself through its integrated security measures rooted in bank-grade protocols. Unlike standalone payment apps that store user funds or rely solely on intermediary servers, Zelle® directly links to your existing bank accounts, minimizing the risk associated with third-party custodial wallets. This means that your funds are as protected as when you use your bank's online services. Additionally, transaction authentication often involves multi-factor verification, ensuring that unauthorized transfers are prevented. Another standout authenticity is the ability to send money only to verified contacts, reducing the risk of fraud. Compared to other apps that may hold funds temporarily or require additional authentication steps, Zelle®'s direct bank connection provides an extra layer of security without complicating the user experience.

Recommendations and Use Cases

Overall, Zelle® is highly recommended for anyone looking for a fast, reliable, and secure way to handle small to medium-sized transactions with friends, family, or even small businesses. Its seamless integration with major banking institutions makes it a practical choice for daily personal finance needs. If you often split bills, gift money, or reimburse friends—Zelle® turns these tasks into mere seconds rather than minutes or hours. However, it's worth noting that Zelle® isn't designed for formal business transactions or large transfers; for such purposes, specialized platforms with escrow or escrow-like protections might be more appropriate.

Final Verdict: A Handy, Trustworthy Digital Wallet

If efficiency and security are priorities in your digital payment toolkit, Zelle® deserves a close look. Its strongest points—instantaneous transfer and bank-level security—place it ahead of several peer-to-peer options. Its user-friendly design diminishes the intimidation factor, making even technophobic seniors or busy professionals comfortable. For casual users who value speed and safety, Zelle® is a smart, reliable choice—like having a trusted assistant at your fingertips, ready to send or receive money in the blink of an eye.

--- Let me know if you'd like this tailored further or expanded!Pros

- Instant Peer-to-Peer Payments

- Wide Bank Network Integration

- No Additional Fees

- User-Friendly Interface

- Secure Transactions

Cons

- Limited Payment Recipients (impact: Medium)

- No Buyer Protection (impact: High)

- Potential for Scam Risks (impact: Medium)

- Limited Transaction History (impact: Low)

- Dependence on Bank Support (impact: Low)

Frequently Asked Questions

How do I get started with Zelle® if my bank supports it?

Open your banking app, find the Zelle® option, enroll by linking your debit card or bank account, and follow the prompts to activate the service.

Can I use Zelle® without a supporting bank or credit union?

Yes, download the standalone Zelle® app, sign up with your debit card, and follow instructions to start sending or receiving money.

How do I send money with Zelle®?

Open the app or your bank's digital platform, select a contact, enter the amount, confirm recipient details, and authorize the transfer.

What are the main features of Zelle®?

Zelle® allows instant peer-to-peer payments, integrates with your bank app, and enables quick, secure transfers directly between bank accounts.

How quickly are Zelle® transactions processed?

Most Zelle® transfers are completed within minutes, making it ideal for urgent payments or splitting bills quickly.

How do I receive money through Zelle®?

Share your email or phone number linked to Zelle®, and funds will be deposited directly into your bank account once the sender completes the transfer.

Are there any fees to use Zelle®?

Zelle® typically does not charge fees; check your bank's policies, but most services are free for sending and receiving money.

What should I do if a Zelle® payment is not received?

Verify the recipient's details, ensure the transfer was completed, and contact your bank's customer service if issues persist.

Can I cancel a Zelle® payment once it's sent?

No, Zelle® payments are instant; once confirmed, they cannot be canceled. Double-check recipient details before confirming.

Is Zelle® safe to use for online transactions?

Yes, Zelle® uses your bank's security measures, transfers funds directly between accounts, and minimizes fraud risk when used properly.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4